National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

169

Looking at the broader category of asset management which would include, for example, the

management of discretionary portfolios, global data is not readily available, but, within Europe,

the European Fund and Asset Management Association gives some data for assets under

management (AuM) across Europe. Table 5.2 shows the data for AuM as a percentage of GDP

are interesting as an indication of the significance of the asset management sector in the

economy.

Unfortunately, Luxembourg is not identified separately in the table but from the figures

already quoted it must account for the lion’s share of the “Rest of Europe” figure with the

further implication that discretionary portfolios (which in the European totals account for

slightly more than investment funds) are a relatively small part of the picture in Luxembourg

and Germany but a very large one in London.

Insurance is a somewhat different business, because for historic regulatory reasons it is

common for major international insurance groups to set up locally-domiciled subsidiaries as

separate legal entities to undertake their primary insurance business in any jurisdiction. (So,

for example, the Allianz Group is headquartered in Munich, but much of the group’s business

will be booked in its 70 or so operating subsidiaries around the world.) Reinsurance, however,

is an international business, as to a lesser extent are certain types of large commercial risk. The

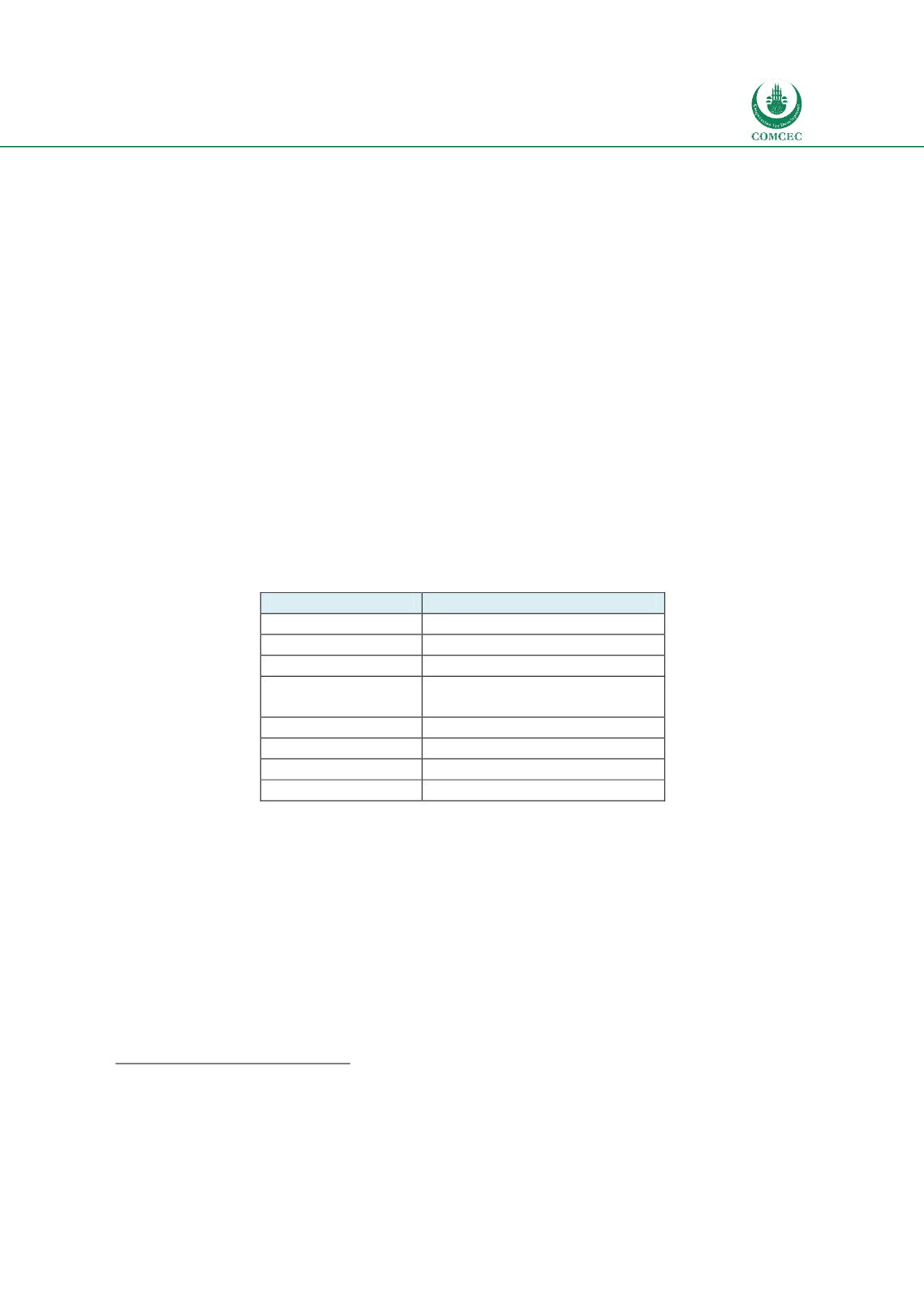

USFIO (2014) quotes the following figures for reinsurance premiums written in 2013 by

domicile of the ultimate parent; the dominance of Germany is particularly obvious.

Table

5.3: Reinsurance premiums 2013 by domicile of parent

Location

Percentage of Total (%)

UK

43

8.6

Germany

27.3

Switzerland

15.6

Other

European

10.2

Americas

15.6

Bermuda

11.3

Asia-Pacific

11.3

Other

0.3

Source: US Federal Insurance Office (2014)

Another approach to understanding the significance of the five centres as international

financial centres is taken by the GFCI (2015), produced by Long Finance. The Index is based on

both so-called “instrumental” factors and the opinions of financial services professionals.

Partly as a result, it has some methodological problems which lead to volatility in the outcomes

and indeed to some possibilities to “game” them

44

. But it does provide a different perspective.

The rankings of centres located in the relevant countries ranked among the top 50 centres

internationally are shown in Table 5.4.

43

This figure is in fact quoted as “London”, but since there is no material reinsurer headquartered in the UK outside London,

the two may be regarded as the same.

44

It is, for example, hard to find objective reasons why Riyadh should fall from 14

th

place to 57

th

in 6 months, or why Osaka

should rise from 31

st

to 20

th

over the same period.