National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

164

4.12.8 Summary and Conclusions

Even though the UAE has one of the biggest Islamic financial industries, the infrastructure

supporting the industry is relatively underdeveloped. While the financial laws recognize

Islamic finance as a legitimate business, the regulators have come up with regulatory

guidelines for different Islamic financial sectors. The banking law stipulates that Islamic banks

should have Shariah boards but details of their governance are lacking. Though the banking

law mentions a central Shariah board, by default

it does not exist. There is one liquidity

instrument that the central bank uses to manage the liquidity of Islamic banks and the central

bank uses this instrument to provide funds to Islamic banks. There is no specific information

infrastructure or consumer protection framework for Islamic finance. Some universities and

the private sector have taken initiatives to provide education and training in Islamic finance in

the country.

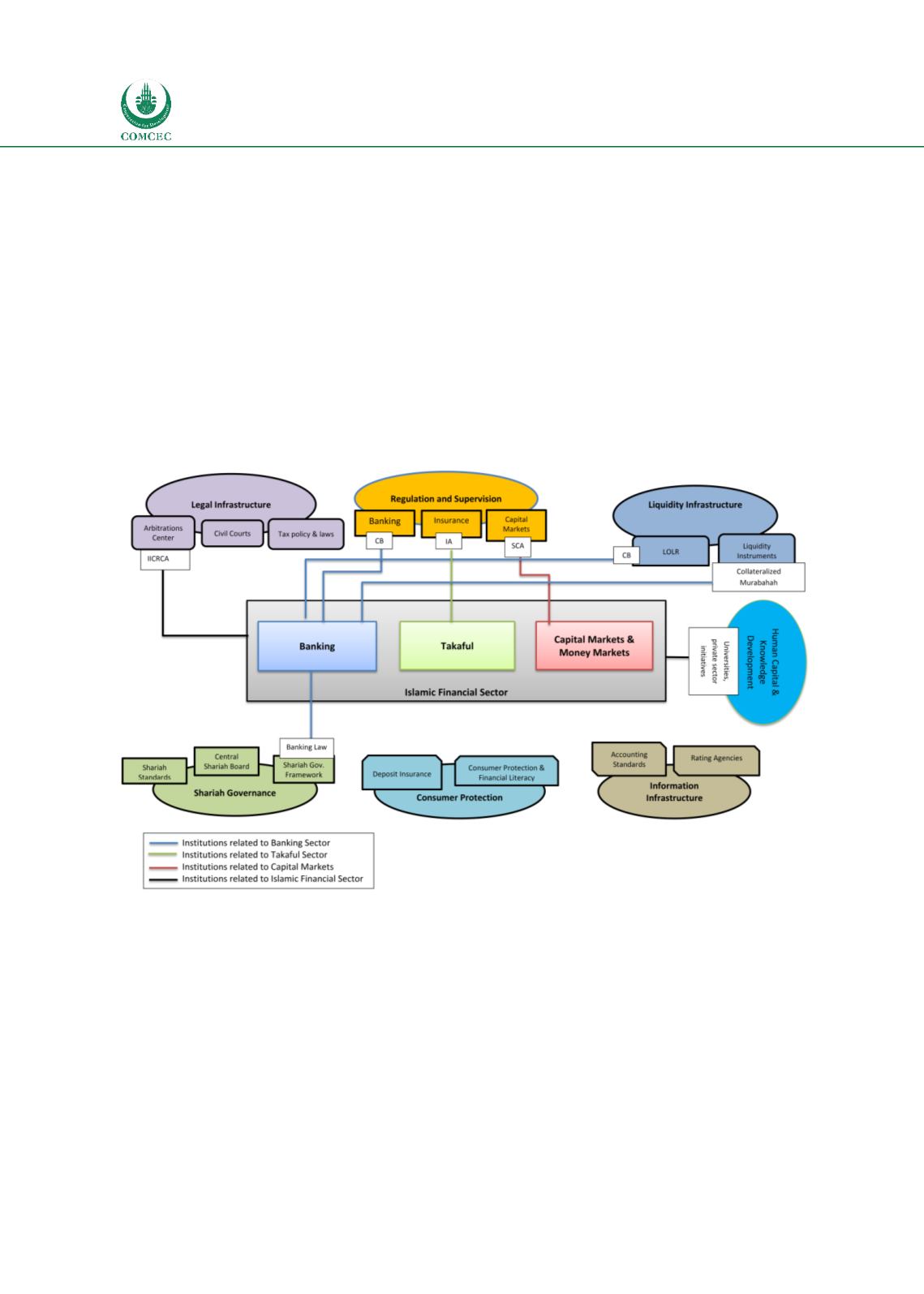

Chart

4.12: Islamic Financial Architecture Institutions—UAE