National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

170

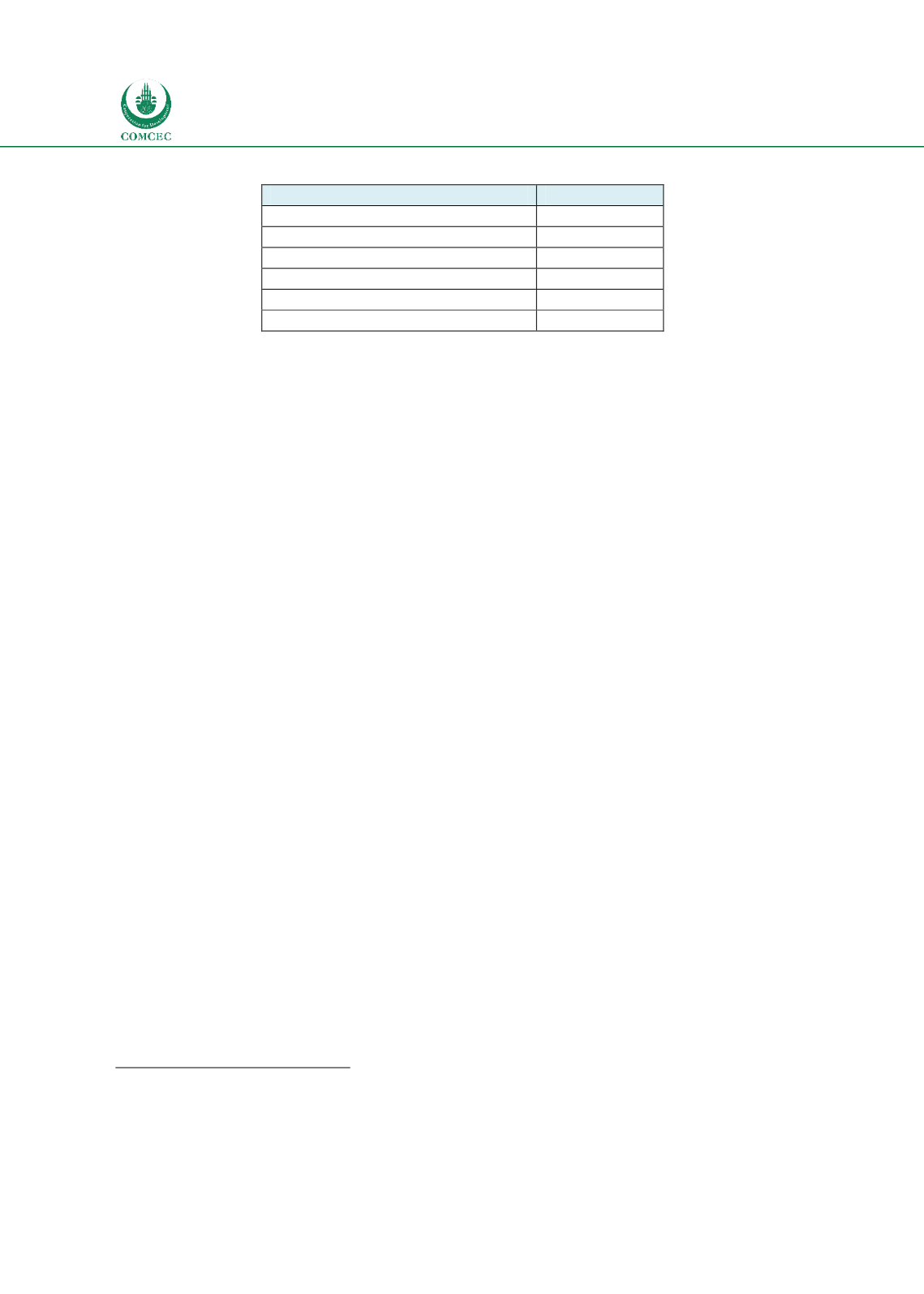

Table

5.4: Ranking of Global Financial Centers

Global Financial Centres

Ranking

London

1

Frankfurt

14

Munich

40

Luxembourg

19

Singapore

4

Hong Kong

3

Source: GFCI (2015)

The only remaining centres in the relevant countries quoted in the report were Glasgow (70)

and Edinburgh (71). The Index also assigns profiles to each centre, based on how well

connected a centre is, how broad its services are and how specialised it is. London, Frankfurt,

Singapore and Hong Kong are all placed in the “global leaders” category, having both breadth

and depth

45

and being globally connected. Luxembourg is classed as a “global specialist”,

lacking the breadth of these four, and Munich is classed as “transnational diversified”.

Putting these pieces of evidence together, the following picture emerges:

The UK

is, by any measure and on any criteria, a major global financial centre, with

international activity very much dominated by London. It is strong across the board, in

banking, capital markets and insurance, and has a strong professional services sector

46

. A

number of major financial institutions are domiciled there, and it is the principal European

base for others. Its stock exchange is the largest outside the USA by market capitalisation, and

all sectors of business have strong global presences.

For

Germany,

Frankfurt and Munich

taken together are also globally powerful but primarily in

banking and insurance; the capital markets activity, though very substantial in itself, has a less

international focus than in London. In the case of Germany, the international presence through

local operations of German-headquartered companies is at least as significant as the

international activity in that market.

Luxembourg

has a large financial sector in relation to its size but a modest one overall. It has

specialised in capital markets and, in particular, acts as a fund domicile, an activity in which it

has a major global position.

Singapore

and

Hong Kong

are both globally important centres with large financial sectors in

relation to their size. Hong Kong has much the more significant exchange; Singapore is a

somewhat more of a significant insurance centre and also the major currency trading centre of

Asia. Both are extremely strong as regional centres for global businesses and, in the case of

Hong Kong, for mainland Chinese companies seeking access to wider markets. Their financial

sectors thus tend to be dominated by companies domiciled elsewhere.

5.2.

Approaches to Islamic Finance

There are two different dimensions of an approach to Islamic finance which are relevant to this

analysis.

45

“Breadth” refers to the diversity of financial services sectors that flourish in a given sector; “depth” to the strength of the

investment management, banking, insurance, professional services and government and regulatory sectors. See page 11 of

GFCI (2015) for full definitions.

46

The GFCI (2015) also quotes ratings on professional services, but for the top centres in this category only.