National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

168

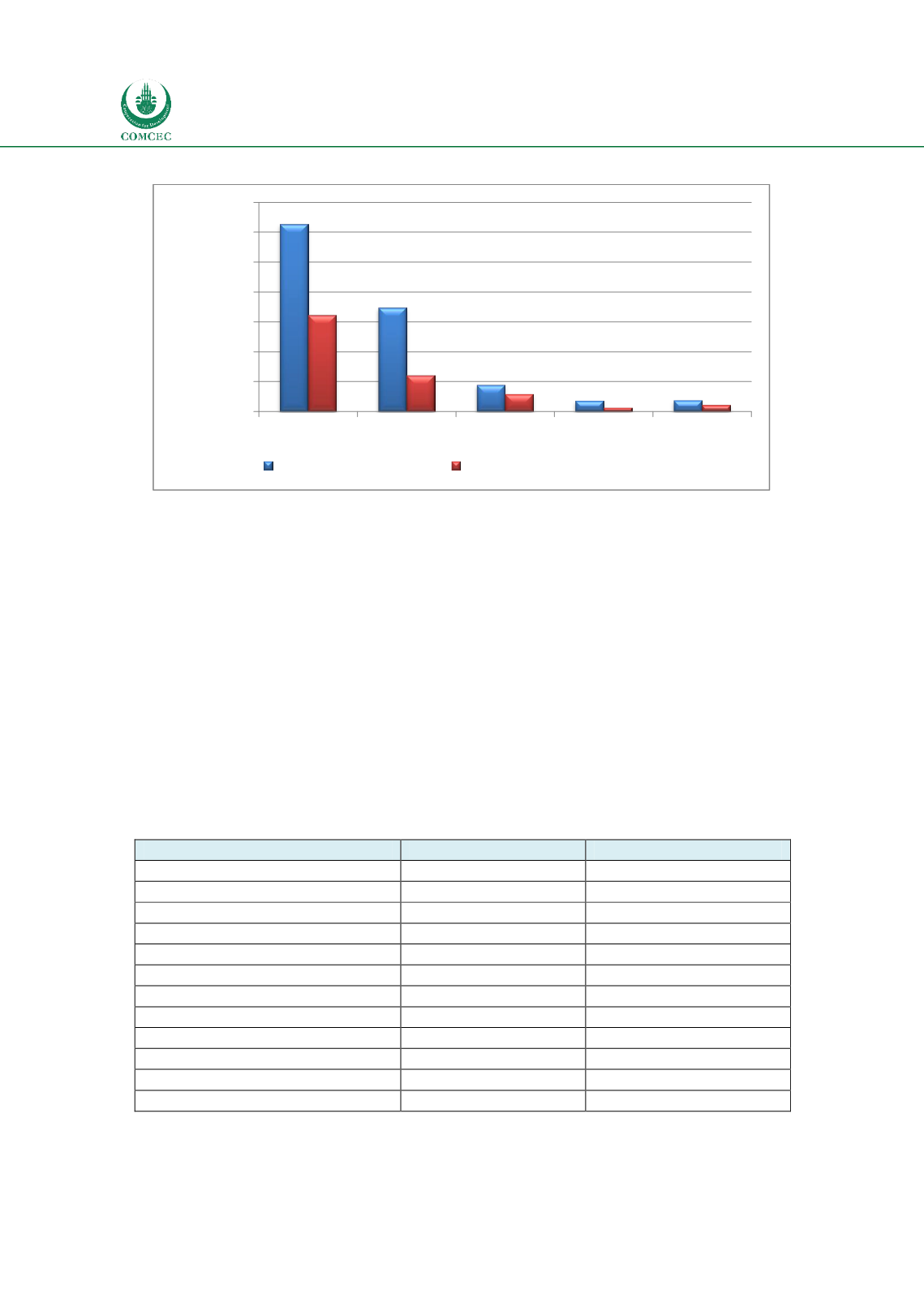

Chart

5.4: Debt Securities Issued

Source: BIS Statistics Explorer, end Q2 2015

Many of the debt securities included in these figures will not be listed on any regulated market,

so cannot be compared directly with the previous set of figures, but they are nevertheless

significant as an indicator of each jurisdiction’s importance in debt markets and of the balance

between domestic and international business.

However, Luxembourg has established a special position as a funds domicile. The most useful

comparative data in this area comes from the International Investment Funds Association Q3

2015. However, they cover regulated open-ended funds only, and so they are not absolutely

comprehensive, but they give an indication at least of the significance of fund domiciles. They

show the following values: UK USD1544 bn, Germany USD1794 bn, Luxembourg USD3526 bn.

Unfortunately they do not cover Hong Kong and Singapore, but the Hong Kong Securities and

Futures Commission on its website shows a value for regulated funds of USD1322 bn at the

end of 2014. Statistics for Singapore are harder to come by, partly reflecting the fact that many

funds on offer in that country are packaged as insurance products.

Table

5.2: Assets under management (AuM) in Europe

Countries

AuM (Euro bn)

AuM/GDP (%)

UK

6101

302

France

3258

154

Germany

1612

57

Italy

881

54

Netherlands

469

73

Belgium

229

58

Austria

85

26

Portugal

74

43

Hungary

25

25

Turkey

18

3

Greece

9

5

Rest of Europe

3694

107

Source: European Fund and Asset Management Association Annual Review, April 2015. Data as at end 2013.

“Rest of Europe” excludes Bulgaria and Romania. Data for Austria cover investment fund assets only.

6.263

3.469

880

353

367

3.219

1.201

575

118

208

-

1.000

2.000

3.000

4.000

5.000

6.000

7.000

UK

Germany Luxembourg Singapore Hong Kong

USD (Billions)

Total Debt Securities

International Debt Securities