National and Global Islamic Financial Architecture:

Problems and Possible Solutions for the OIC Member Countries

166

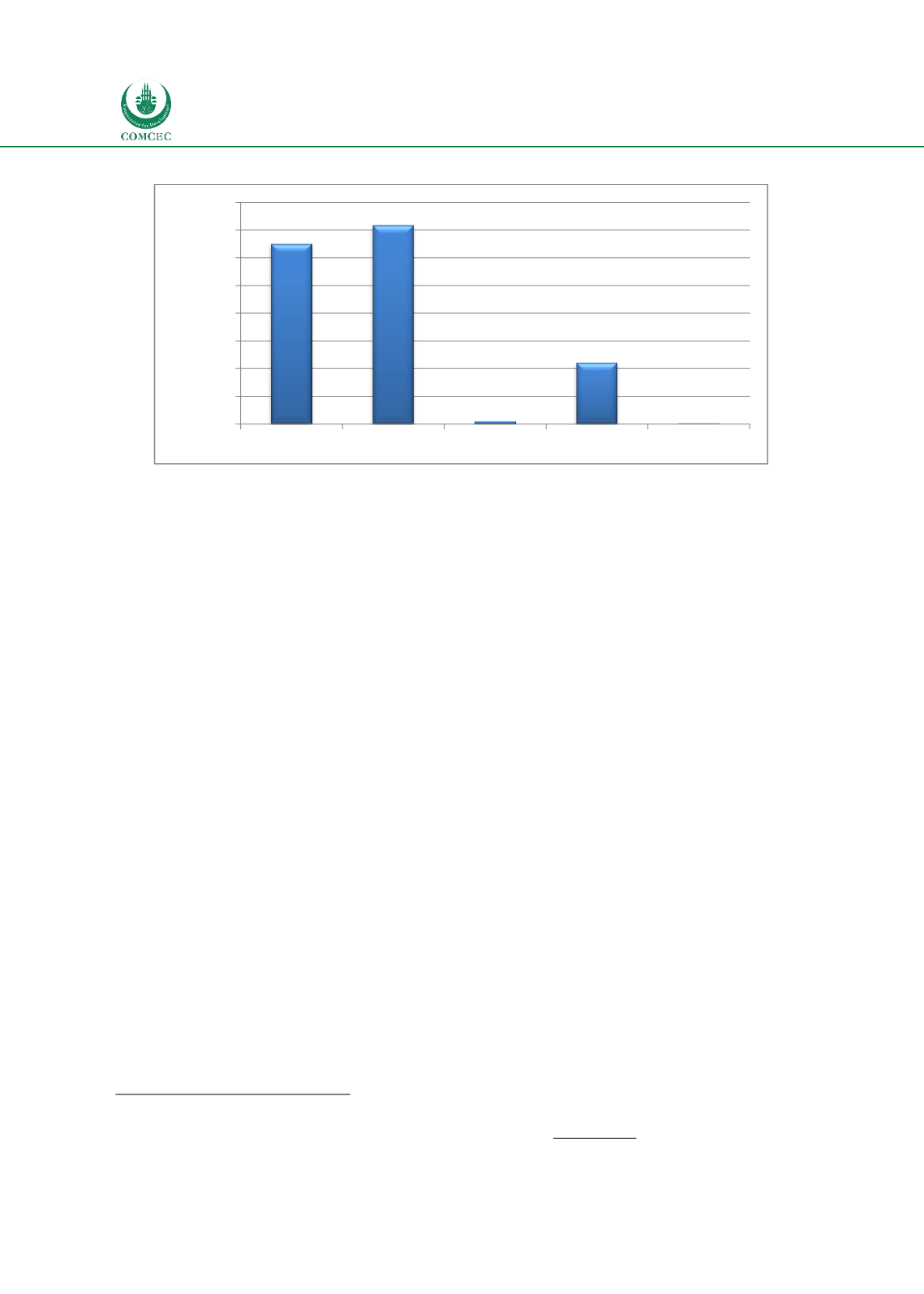

Chart

5.1: Estimated GDP of Muslims

Assessing the size and importance of the financial services industry in each centre is not

entirely straightforward. Comprehensive data is not available for all sectors, and is

particularly sparse for non-banking, non-insurance activities (e.g. discretionary asset

management). In addition, many data sets focus on where business is booked rather than

where the principal activities are carried out. Thus, for example, Emirates NBD’s funds, some

of which are Islamic, are registered in Jersey, but the key research functions are carried out in

the United Arab Emirates. Hence data based simply on the fund domicile does not necessarily

capture where the economically valuable functions are located.

For some of the centres, foreign exchange and commodities trading are an important part of

their business, as are derivatives of various kinds. Comprehensive data on these types of

business are difficult to find. These are, in general, less relevant to Islamic finance than the

sectors discussed, though of course some physical commodities may form the basis of

commodity Murabaha transactions. They are therefore not discussed further.

The BIS Locational Banking Statistics gives asset data for banks located in each jurisdiction

42

.

They show claims on the domestic sector and claims on the foreign sector separately. (This

basis is helpful for present purposes because it is more relevant to the role of each as a

financial centre than pure domestic data.) Banking claims for banks located in each of the

jurisdictions of interest are shown in Chart 5.2.

42

The alternative BIS data set, the consolidated statistics, which cover banks headquartered in each country, unfortunately

do not cover either Hong Kong or Luxembourg.

129,8

143,3

1,5

44,0

0,3

0

20

40

60

80

100

120

140

160

UK

Germany Luxembourg Singapore Hong Kong

USD (billions)