National and Global Islamic Financial Architecture:

Prolems and Possible Solutions for the OIC Member Countries

165

5. Global Financial Centres and Islamic Finance

This chapter examines the standing of Islamic finance in five global financial centres. It looks

at their global status in conventional as well as Islamic markets, their strategic and practical

approaches to Islamic finance, their legal and regulatory frameworks, their strengths and

weaknesses in the context of Islamic finance, and lessons that can be drawn from them. It

covers all three major sectors of financial services (banking, insurance and capital markets),

though the significance of each of these varies from centre to centre.

The centres chosen are three European jurisdictions and two Asian ones: the United Kingdom

(UK), which has global significance in all three sectors. Germany is also globally significant in

all three sectors. Luxembourg is specialised in certain capital markets sectors and has done so

on the basis of a very small domestic population. Singapore is significant in all three sectors

with a limited domestic population and Hong Kong is significant in banking and capital

markets, though less so in insurance, again with a limited domestic population.

The last three financial centres identified above are essentially city states. In the case of the UK,

although London is the dominant financial centre, there is some business outside, particularly

aimed at the domestic market. In the case of Germany, while Frankfurt is the principal centre

for banking and capital markets, Munich is more important for insurance and there are some

significant businesses, for example the large reinsurer Hannover Re, located elsewhere.

The three European centres are all members of the European Union (EU). Their financial

services regulatory frameworks therefore must follow EU law, and there is thus very little

difference between those frameworks, though there is a little more in their practical

operations. In particular, for the banking sector, Germany and Luxembourg are both within the

Single Supervisory Mechanism, which means that the practical operation, as well as the legal

provisions of their regulation will be closely aligned.

5.1.

Basic Data and Status of Financial Services

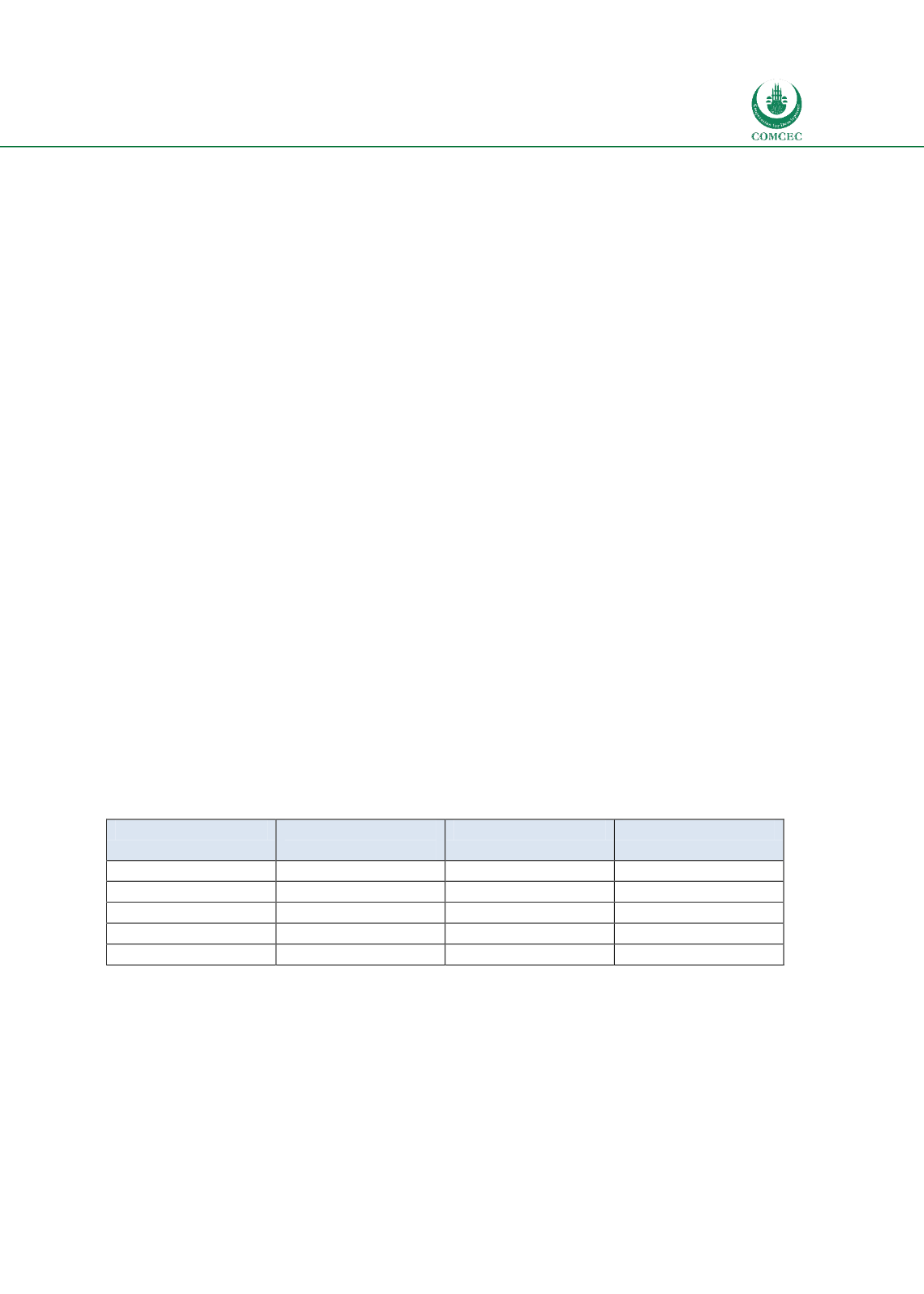

Table 5.1 sets out basic demographic and Gross Domestic Product (GDP) data for the countries

concerned.

Table

5.1: Demographic and GDP Data

Country

Population

(millions)

Muslims (%)

GDP (USD bn)

UK

64.1

4.4

2,950

Germany

80.9

3.7

3,874

Luxembourg

0.6

2.3*

66

Singapore

5.7

14.3

308

Hong Kong

7.1

0.1*

291

Source: Except where otherwise stated, all figures from CIA World Factbook; latest estimates as at January

2016. Figures marked * are from Pew Research Forum 2009.

As a crude indication of the income that might be available to Muslims in those countries, one

can multiply the GDP by the percentage of the population that is Muslim. The estimated income

of Muslim population in different countries is shown in Chart 5.1.