Retail Payment Systems

In the OIC Member Countries

112

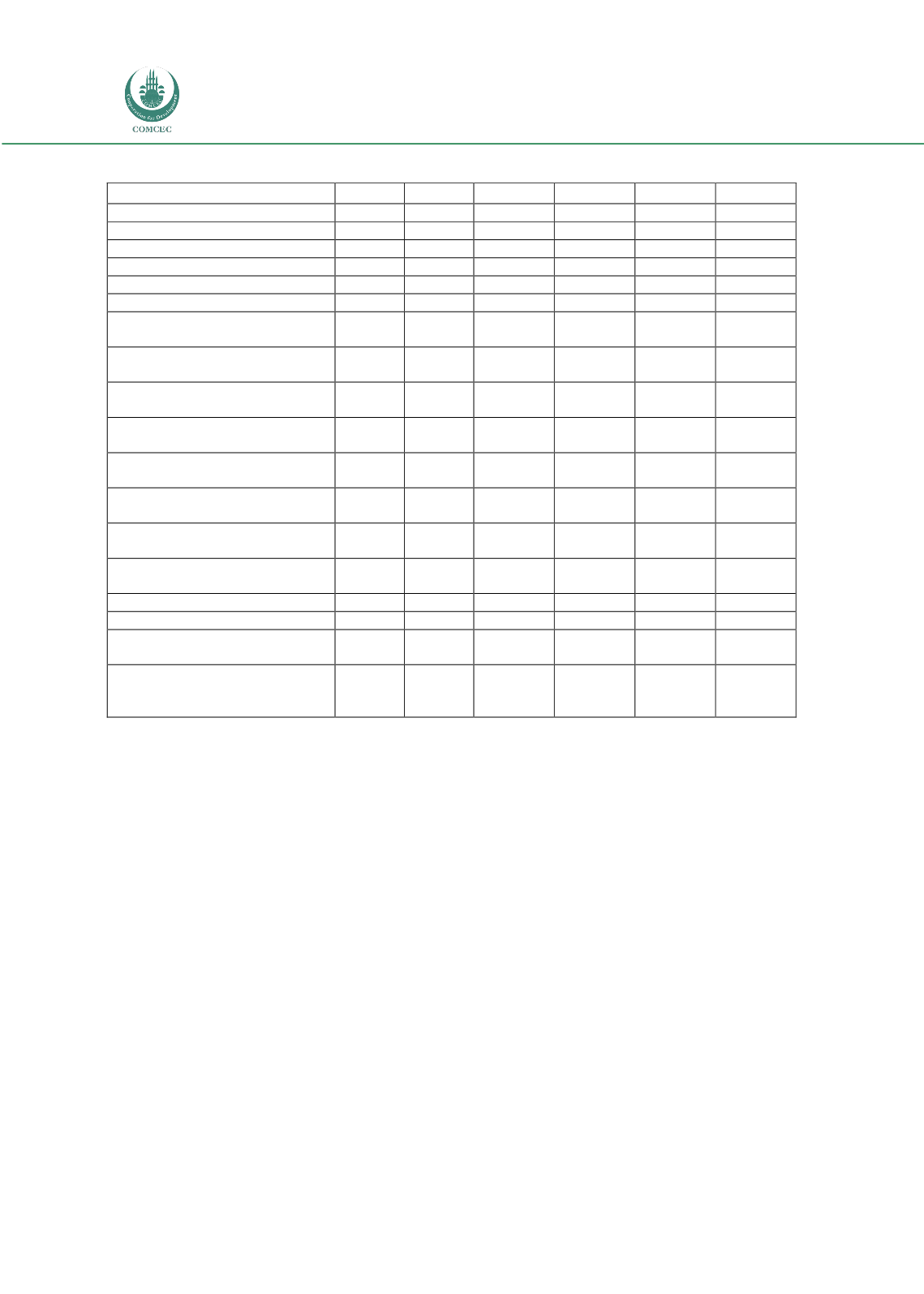

Table A4. Nigeria: Market Data and Indicators

2000

2005

2010

2011

2012

2015

Financial cards in circulation

- ATM cards (mn cards)

0.5

0.6

0.9

1.0

1.1

1.3

- Debit cards (mn cards)

0.4

0.5

0.7

0.7

0.8

0.9

- Credit cards (mn cards)

-

0.1

0.2

0.2

0.2

0.3

- Charge cards (mn cards)

0.2

0.3

0.3

0.3

0.3

0.4

Financial cards' transactions

- ATM cards (US$ mn,

at constant prices)

2,832

4,240

5,254

5,151

5,570

6,483

- Debit cards (US$ mn, at

constant prices)

47

1,168

7,261

7,278

7,967

10,689

- Credit cards (US$ mn, at

constant prices)

1,174

3,031

2,886

3,015

3,364

4,674

- Charge cards (US$ mn, at

constant prices)

1,178

1,834

1,733

1,821

2,020

2,799

Cash transactions (US$ mn, at

constant prices)

25,593

35,898

40,603

42,141

46,223

57,163

Other paper transactions (US$

mn, at constant prices)

1,125

1,410

1,362

1,292

1,330

1,316

Annual savings (NGN mn, at

constant prices)

621,114

942,672

1,224,618

1,127,106

1,141,905

1,280,497

Savings ratio (% of disposable

income)

5.7

4.1

4.2

4.3

4.4

4.5

Annual lending rate (%)

21.3

17.9

17.6

16.0

16.8

-

Consumer lending

- Consumer credit (outstanding

balance) (US$ mn)

7,246

12,105

15,443

16,050

17,601

23,368

-

Mortgages/housing (outstanding

balance) (US$ mn)

15,270

29,860

50,217

51,414

53,226

61,849

Source: National statistics, Euromonitor International