Risk Management in

Islamic Financial Instruments

34

The modified

mudarabah

model is similar to the conventional framework seen above for

mudarabah takaful

models, but with a performance incentive for the fund’s operator, termed

in the chart above as “underwriting surplus”. In this model, this surplus is shared between the

operator and the participant, while the traditional model does not provide the operator with a

share to the surpluses of the underwriting, nor does it monetarily incentivize the operator to

produce such surpluses.

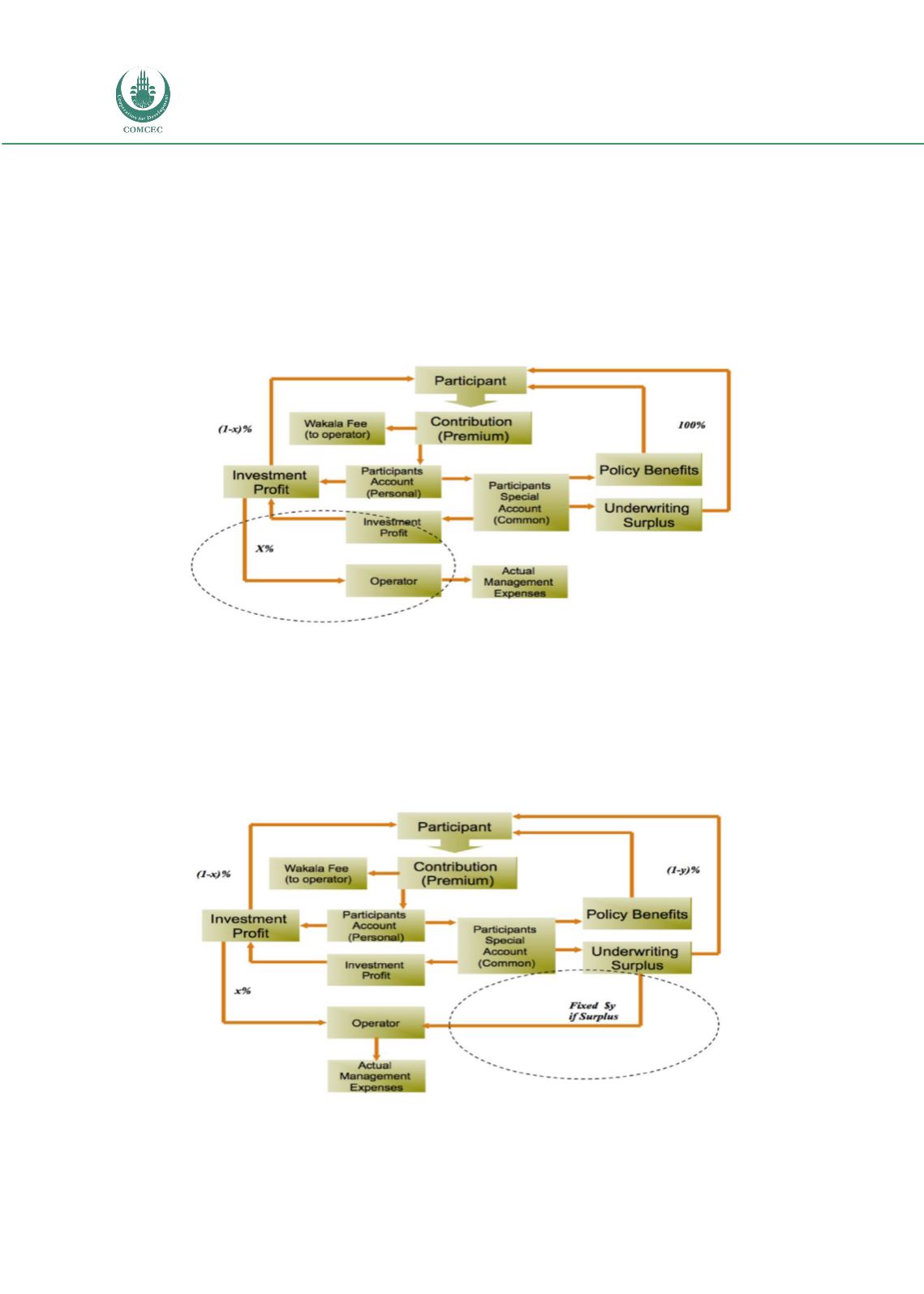

Figure 2.9: Takaful Model – Wakalah with Mudarabah on Investments

The above model provides an incentive to the operator to produce higher investment profits in

the form of a stake, “X%”, in the investment profits, though it does not allow for the operator to

share in underwriting surplus profits. This model, like the modified

wakalah

model, was

designed so that the operator has reason to attempt to maximize profits, not just meet base-

line expectations placed on them by the stipulations contained within their contract.

Figure 2.10: Takaful Model – Wakalah with Incentive Compensation

This model combines

mudarabah

components on the fund’s investments with an incentive for

operators should they generate underwriting surpluses, as noted in the figure above. Another