Risk Management in

Islamic Financial Instruments

30

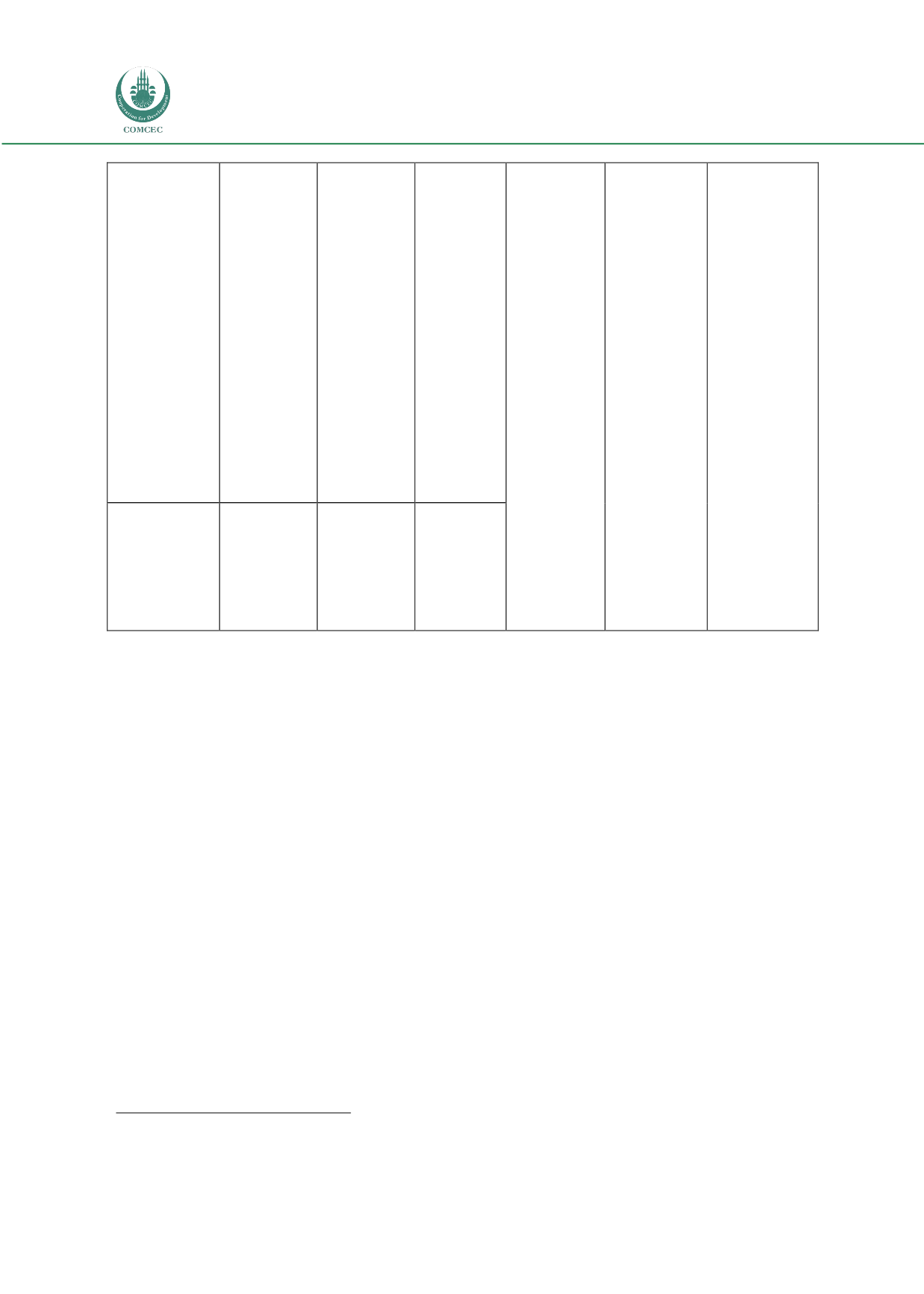

Musharakah

Term Finance

Sukuk (MTFS)

Medium

term

redeemable

musharakah

certificate

based on

diminishing

musharalah

- tradable as

well as

redeemable

Musharakah

has high

default risk

(see Khan

and Ahmed

2001),

however,

MTFS could

be based on

the strength

of the entire

balance

sheet

Similar to

the case of

the floating

rate. This is

however,

unique in

the sense

that the

rate is not

indexed

with a

benchmark

like LIBOR,

hence least

exposed to

this risk

contracts

these risks

can be

overcome.

Salam Sukuk

Securitized

salam, fixed-

rate and

non-

tradable

Salam has

unique

credit risk

(see Khan

and Ahmed

2001)

Very high

Auto fixed

rate

Source: International Conference on Islamic Banking: Risk Management, Regulation, and Supervision (2003)

From the inherent discrepancies concerning asset-based vs. asset-backed sukuk to the

objectives of the Shari’ah and the paradoxes existent in the current sukuk market, there are an

amalgam of different risks important to interested investors and researchers.

2.6 TAKAFUL MARKET RISKS

In our discussion of the risks associated with Islamic insurance mechanisms,

takaful,

it is

important for the reader to understand the transactional sequences as well as the different

entities involved in the two main

takaful

structures,

wakalah

and

mudarabah

-based models,

which are outlined in the following charts, as well as modified versions of those models on the

pages following. The nature and fast expansion of the takaful industry has left glaring

risk/Shari’ah gaps in the eyes of Islamic scholars, many of whom do not believe Islamic

insurance, particularly life insurance, is a viable Islamic financial structure. Experts have cited

many issues with both the

mudaraba

and

wakalah

models, namely issues pertaining to

corporate governance. It should be made plain that, when people contribute money, they

typically expect some sort of immediate or future remuneration. Thus, Hassan and Lewis posit

the question, “Is it really co-operative in nature,” since the number of operators using the co-

operative model is limited.

19

Only a fraction of those who purchase these policies are also

conscious that the premium is for mutual help, and though most

takaful

operators are actual

19

Hassan, Kabir, and Maryn K. Lewis. "Governance Issues in Islamic Insurance." FMA International, 2011. Web.