Risk Management in

Islamic Financial Instruments

33

separately, so sometimes a discount may be given to be competitive (Hassan and Lewis, 2011).

Consequently, when charging the fee to the fund, the fixed percentage fee being removed may

result in the fund’s having diminished monies, which are needed to pay claims in relation to

the risk being undertaken.

Another key issue of the model is that

tabaru

(donation) remains the property of the

participants (unless consumed), since they hold the right to any surplus. As such, it becomes a

conditional gift, bringing to question issues such as inheritance (not possible to measure the

share of surplus in the pool at time of death) and

zakat

(in the case of the death of the person),

as the donation is a conditional gift (Hassan and Lewis, 2011). Secondly, the relationship, being

between the participants and the operator, as well as the participants (exchange of gift for a

gift) leaves doubt about the contract becoming a contract of compensation (Hassan and Lewis,

2011).

As found in Hassan and Lewis (2011), "contingency reserves may not be equitable between

generations as the operator is likely to hold higher proportionate reserves in the early years

for future contingencies. Since the participants keep changing on a continuous basis, it leads to

an intergenerational equity issue. In a pure pooling arrangement, one should be able to call on

members to actually contribute more in the case of a deficit on a pro-rata basis. This is not

seen as practical in retail commercial insurance, and, therefore, alternative solutions may need

to be explored for

takaful.”

Also, an obligation on future generations, however, will be different

from those which may have given rise to the deficit (over the course of time, as membership of

the pool of participants changes over), leaving another potential issue encompassed by this

model. A solution to the last three issues has been sought in terms of the

wakalah

with

waqf

fund approach in Pakistan. Interested readers should reference Wahab, Lewis and Hassan,

2007, and Alhabshi and Razak, 2008, for further information on this.

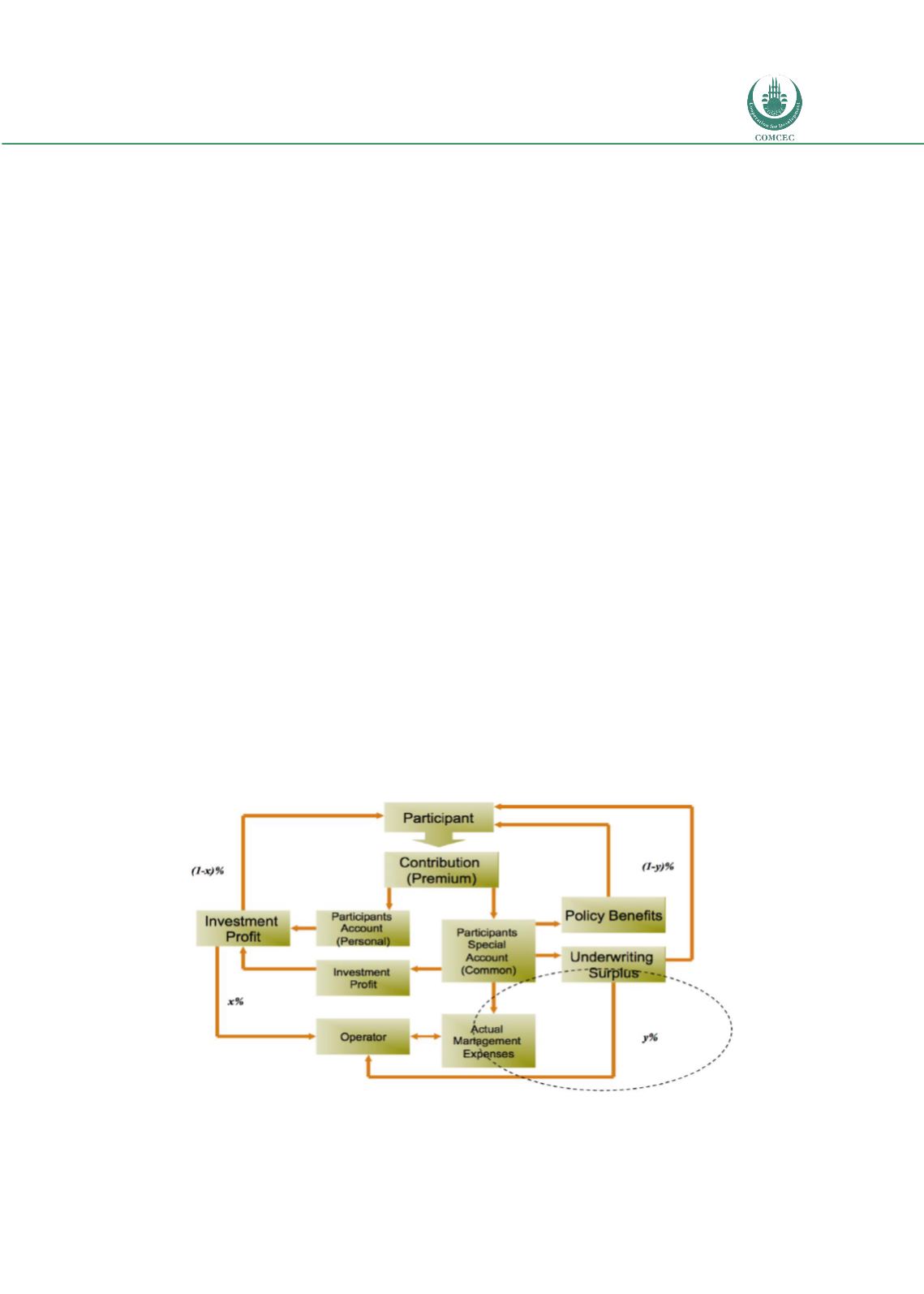

Figure 2.8: Takaful- Modified Wakalah