Risk Management in

Islamic Financial Instruments

31

“treasurers” of the fund. Purchasers often view them as the fund’s actual owners.

20

One distinct

feature of

takaful

, as mentioned above, is that the participant and the operator of the fund are

clearly segregated, with the operator’s reward being contingent upon which kind of

takaful

model is used.

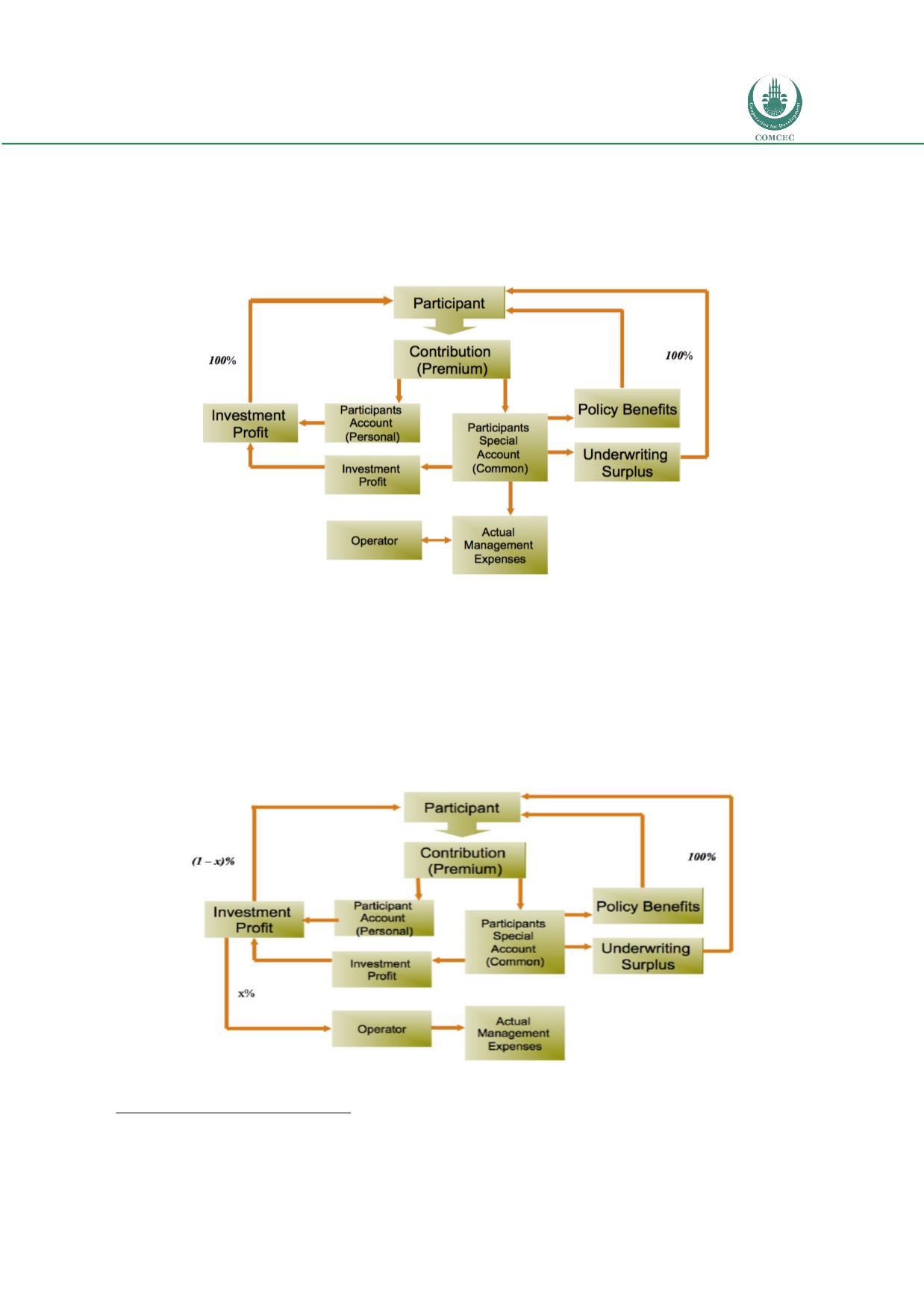

Figure 2.5: Takaful – Cooperative Model

Generally, the theoretical model, seen above, is, at its core, based on a mutually beneficial and

cooperative framework. Historically, the main conflict that has arisen in the context of

conversations concerning

takaful

models is that contributors may demand financial

remuneration in exchange for their participation in the fund. Hassan (2014) states that this has

allowed for the development of the two main

takafu

l models,

wakalah

and

mudarabah.

Figure 2.6: Takaful- Mudarabah on Investments

20

Al-Qyardawi (1989) quoted in Hassan, Kabir, and Maryn K. Lewis. "Governance Issues in Islamic Insurance." FMA International, 2011. Web.