Risk Management in

Islamic Financial Instruments

32

The above chart outlines the adaptations placed on the

takaful

model following the

implementation of

mudarabah

activity with regards to the investment profit. Hassan and

Lewis (2011) also state that, under a

mudaraba

contract, a profit is generated to be

distributed between the

rabb al-mal

and the

mudarib

(entrepreneur or

takaful

operator);

however, issues are borne out of the fact that, in the insurance arena, the profits from

investments are not the same as surplus. Essentially,

Shari’ah

scholars cite the profit-

sharing contract being applied in the model - the relationship between participants is one

of

tabaru

(donation) as defined in the contract and not of

mudaraba

(profit sharing

contract) - since it is impermissible for both the donation and

mudaraba

capital

(contributed by the capital provider ) in the arrangement to be the same monies (Hassan

and Lewis, 2011). Additionally, they state, “The requirement to provide a top up interest

free

qard hasan

(in case of a deficit) in a

mudaraba

contract is by definition against the

principle of

mudaraba

, which is a profit sharing contract, and in it the

mudarib

cannot be a

guarantor” (Hassan & Lewis, 2011). Similar to conventional insurance contracts, shared

underwriting may bring about an outcome as any ordinary business venture, not one of

mutual assistance.

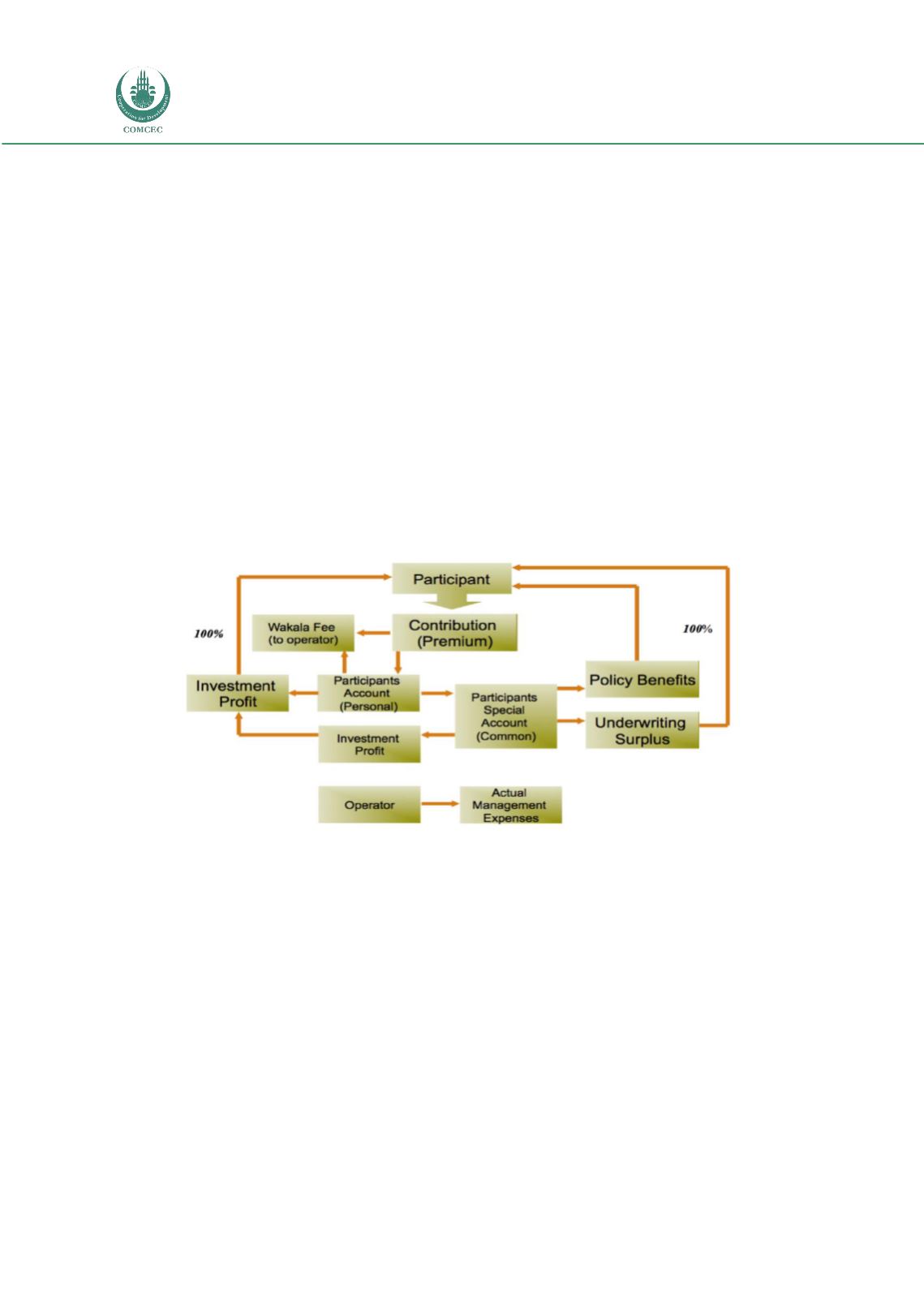

Figure 2.7: Takaful- Wakalah

Under a

wakala

contract, the operator would be receiving fixed fees for services rendered in

managing the

takaful

fund and the investment portfolio, but not in the form of a performance

fee geared to the surplus as an incentive for managing the

takaful

fund effectively. Basically,

the whole operation is based on agency fees, not encompassing any aspects of P/L. Hassan and

Lewis (2011) cite that there have been questions concerning whether or not

wakala

contracts

are adequate in a competitive market environment, since the

wakala

operator’s fee is a fixed

percentage of the total contributions, and so the fee is based on and recovered from the

takaful

fund. Being that a typical contract has a risk premium to which one may add expense margins

and profit margins for the operator, both the expense and profit margin would need to be

competitively priced on the volume of premiums for a single contract (Hassan and Lewis,

2011). In a conventional insurance contract, identification of these separately is not required,

as the expense surplus in addition to the underwriting risk surplus both belong to the

shareholders (Hassan and Lewis, 2011). Since, in

takaful

arrangements, the underwriting

surplus belongs to the participants, an adequate risk premium needs to be identified