Risk Management in

Islamic Financial Instruments

29

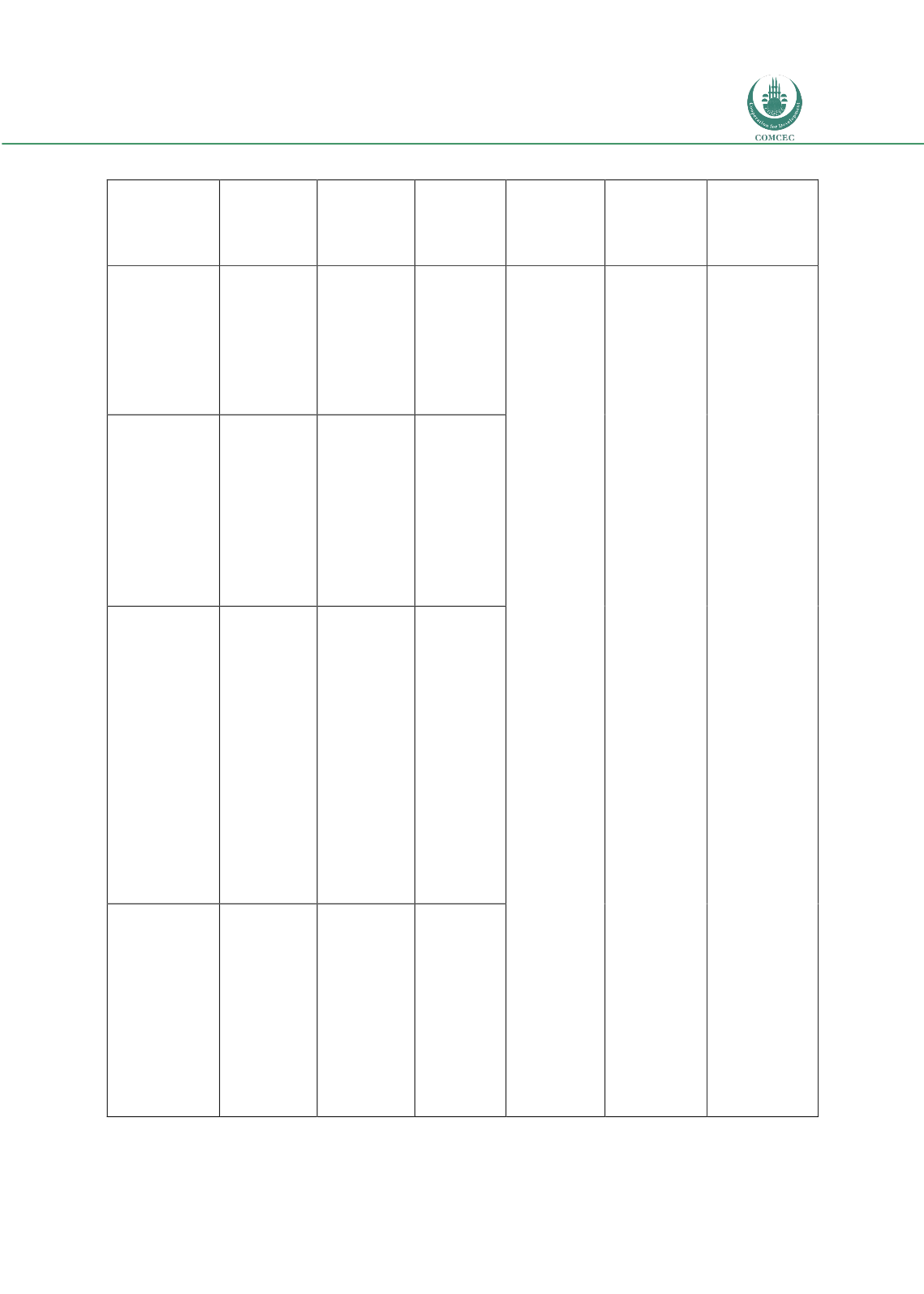

Figure 2.4: Types of sukuks and different risk metrics

Types of

Sukuk

Description

of Sukuk

structure

Credit Risk

Rate of

return

(Interest

rate risk)

FX risk

Price risk

Other risks

Zero coupon

Sukuk

Istisna',

Murabahah

debt

certificates -

non-

tradable

Unique

basis of

credit risks

exist, see,

Khan and

Ahmed

(2001)

Very high

due to fixed

rate.

remains for

the entire

maturity of

the issue

If all other

conditions

are similar,

FX risk will

be the same

for all cases

of Sukuk.

However,

those Sukuk

which are

liquid or

which are

relatively

short term

in nature

will be less

exposed.

The

composition

of assets in

the Pool will

also

contribute

to the FX

risk in

different

ways. Hence

this can be

very useful

tool to

overcome

the FX risk

by

diversifying

the

pool in

different

currencies.

Price risk

relates to the

prices of the

underlying

commodities

and assets in

relation to

the market

prices.

Ijara Sukuk

are most

exposed to

this as the

values of the

underlying

assets may

depreciate

faster as

compared to

market

prices.

Maintenance

of the assets

will play an

important

Part in this

process.

Liquidity of

the

Sukuk will

also play an

important

part in the

risk. Salam is

also exposed

to serious

price risks.

However,

through

parallel

Liquidity risk

is serious as

far as the non-

tradable

Sukuk are

concerned.

Business risk

of

the issuer is

an important

risk

underlying

Sukuk

as compared

to traditional

fixed incomes.

Shari'ah

compliance

risk

is another one

unique in caw

of Sukuk.

Infrastructure

rigidities, i.e..

non-existence

of efficient

institutional

support

increases the

rise of Sukuk

as compared

to traditional

fixed incomes,

see

Swndararajan,

& Luca (2002).

Fixed Rate

Ijara Sukuk

Securitized

Ijara,

certificate

holder owns

part of asset

or usufructs

and earns

fixed rent -

tradable

Default on

rent

payment,

fixed rate

makes

credit risk

more

serious

Very high

due to fixed

rate,

remains for

the entire

maturity of

the issue

Floating Rate

ljara Sukuk

Securitized

ljara,

certificate

holder owns

part of asset

or usufructs

and earns

floating rent

indexed to

market

benchmark

such as

LIBOR -

tradable

Default on

rent

payment,

floating rate

makes

default risk

lesser

serious - see

previous

case

Exists only

within the

time of the

floating

period

normally 6

months

Fixed rate

Hybrid/Pooled

Sukuk

Securitized

pool of

assets; debts

must not be

more than

49%,

floating rate

possibility

exists -

tradable

Credit risk

of debt part

of pool,

default on

rents, fixed

rate makes

credit risk

serious

Very high

due to fixed

rate,

remains for

the entire

maturity of

the issue