Risk Management in

Islamic Financial Instruments

88

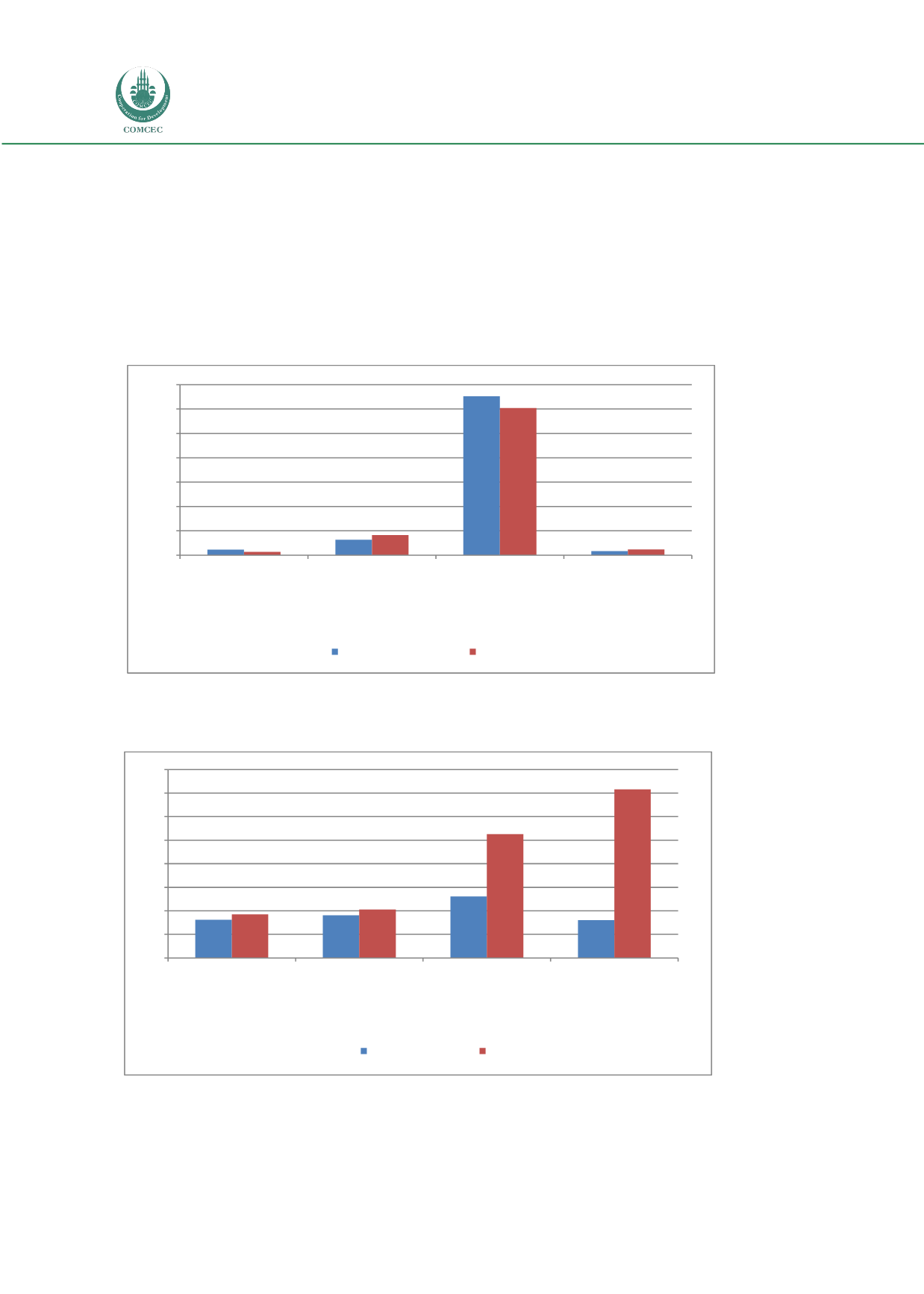

Liquidity Ratios

An Interbank Ratio of greater than 100 indicates the bank is net lender, rather than a net

borrower and resembles higher liquidity. Both the Islamic banks (175.29%) and conventional

banks (185.63%) maintain higher interbank ratios, which means that both types of banks are

lenders to the interbank market. A higher ratio for Net Loans / Cust & ST Funding maintained

by the Islamic banks (61.75%) represents lower liquidity, compared to conventional banks

(53.73%). (See Chart 4.38)

Chart 4.35 : Asset Quality Ratios for Kingdom of Saudi Arabia (K.S.A.)

Source: BankScope Database 2013

Chart 4.36: Capital Adequacy Ratio for Kingdom of Saudi Arabia (K.S.A.)

Source: BankScope Database 2013

4,67

12,66

130,55

3,45

2,73

16,51

120,84

4,80

0

20

40

60

80

100

120

140

Loan Loss Res / Gross

Loans

%

2011

Loan Loss Prov / Net Int

Rev

%

2011

Loan Loss Res / Impaired

Loans

%

2011

NCO / Net Inc Bef Ln Lss

Prov

%

2011

KSA Conventional

KSA Islamic

16,24

18,10

26,11

16,12

18,54

20,62

52,54

71,54

0

10

20

30

40

50

60

70

80

Tier 1 Ratio

%

2011

Total Capital Ratio

%

2011

Equity / Net Loans

%

2011

Equity / Liabilities

%

2011

KSA Conventional

KSA Islamic