Risk Management in

Islamic Financial Instruments

72

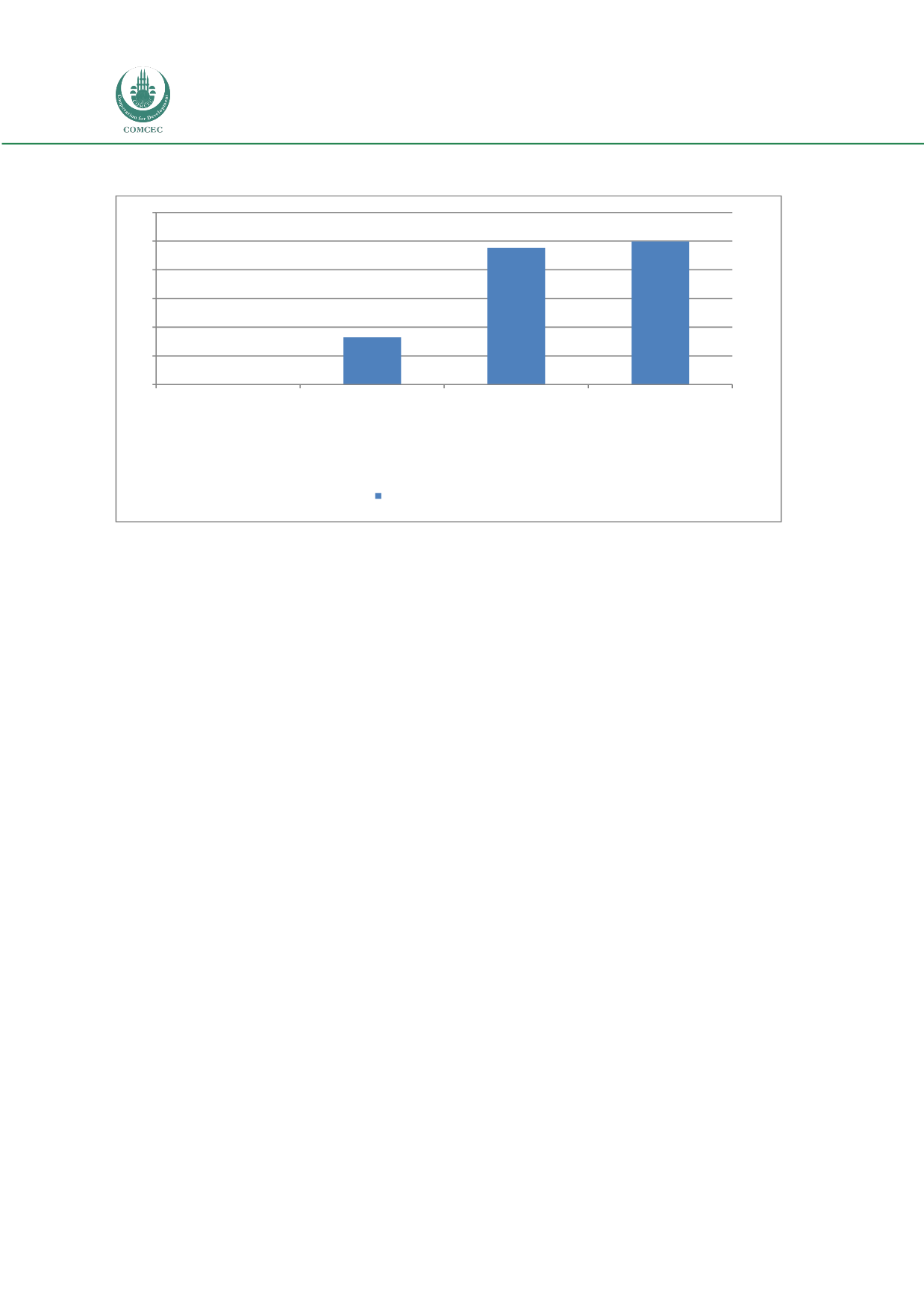

Chart 4.12: Liquidity Ratio for Sub-Saharan Africa Region

Source: BankScope Database 2013

4.4 ANALYSIS OF RISK MATRICES ACROSS FIVE MAJOR COUNTRY

JURISDICTIONS

This section presents a comparative analysis of the risk matrices for the Islamic and

conventional banks for five major Islamic financial markets: a) Malaysia, 2) Turkey, 3)

Kingdom of Saudi Arabia, 4) United Arab Emirates, and 5) Bangladesh.

4.4.1 Malaysia

4.4.1.1 Overview of Malaysian Islamic Finance Services Industries

Malaysia is the largest Islamic financial hub in the Asia-Pacific region, with total Islamic

financial assets worth USD272.5 billion as of the end of 2011. Malaysia is home to a wide range

of investment, wholesale, retail and structured products for a range of purposes and sectors.

Islamic financial institutions currently use a wide range of Shariah contracts and innovative

instruments, such as profit and FOREX rate swaps, which have been accepted globally. (GIFF

2012)

The country also provides an efficient regulatory environment that is conducive for the Islamic

financial services industries (IFSI). Under the existing legal framework, both conventional and

Islamic financial systems coexist and work together harmoniously in a competitive

environment.

16,46

47,72

49,88

0

10

20

30

40

50

60

Interbank Ratio

%

2011

Net Loans / Tot Assets

%

2011

Net Loans / Dep & ST

Funding

%

2011

Liquid Assets / Dep & ST

Funding

%

2011

SUB SAHARAN Islamic