Risk Management in

Islamic Financial Instruments

71

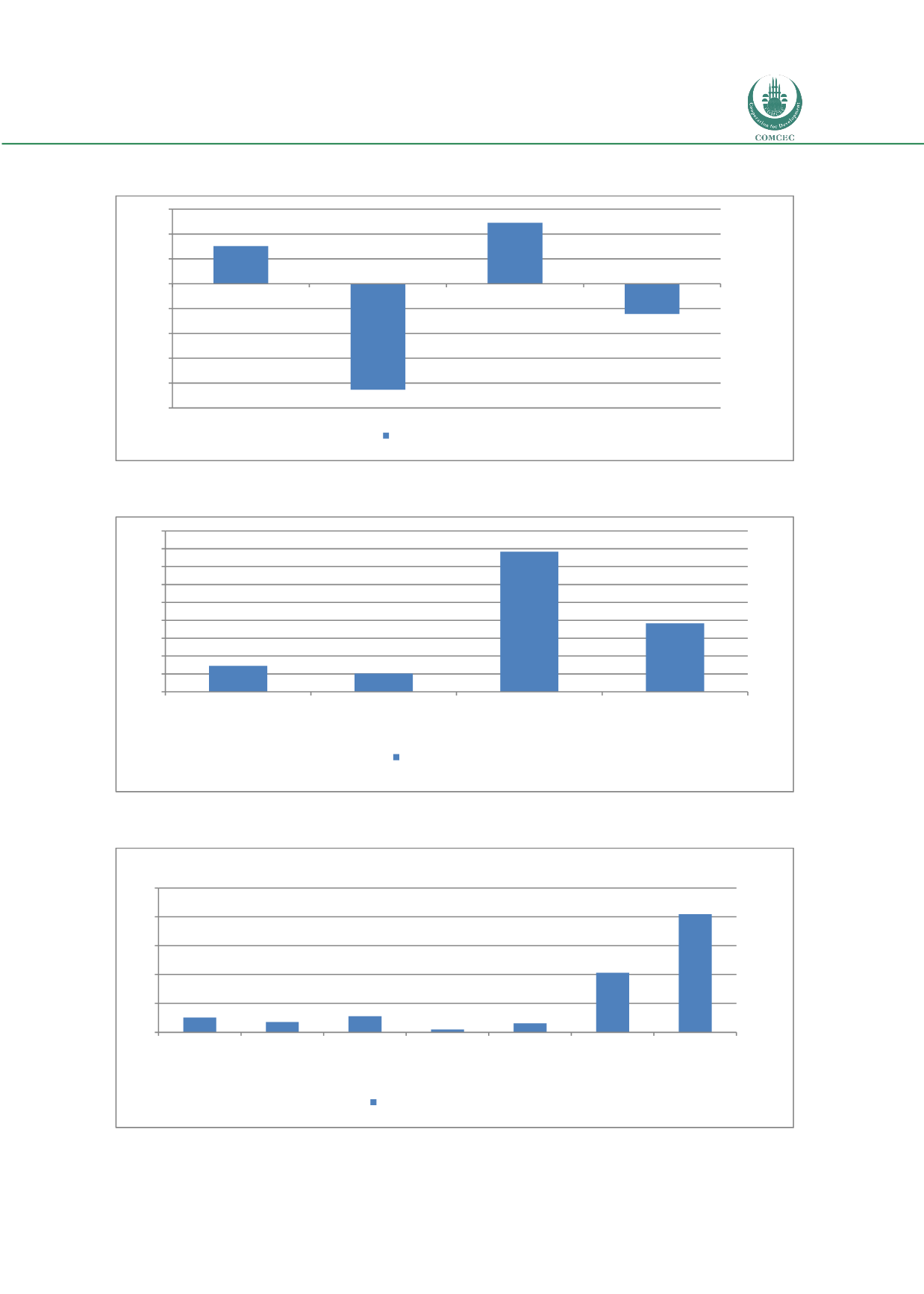

Chart 4.9: Asset Quality Ratios for Sub-Saharan Africa Region

Source: BankScope Database 2013

Chart 4.10: Capital Adequacy Ratio for Sub-Saharan Africa Region

Source: BankScope Database 2013

Chart 4.11: Operational Efficiency Ratios for Sub-Saharan Africa Region

Source: BankScope Database 2013

3,02

-8,55

4,92

-2,45

-10

-8

-6

-4

-2

0

2

4

6

Loan Loss Res / Gross

Loans

%

2011

Loan Loss Prov / Net Int

Rev

%

2011

Loan Loss Res / Impaired

Loans

%

2011

NCO / Net Inc Bef Ln Lss

Prov

%

2011

SUB SAHARAN Islamic

7,31

5,08

39,18

19,17

0

5

10

15

20

25

30

35

40

45

Tier 1 Ratio

%

2011

Total Capital Ratio

%

2011

Equity / Net Loans

%

2011

Equity / Liabilities

%

2011

SUB SAHARAN Islamic

2,57

1,80

2,77

0,48

1,55

10,33

20,43

0

5

10

15

20

25

Net Interest

Margin

%

2011

Net Int Rev /

Avg Assets

%

2011

Non Int Exp /

Avg Assets

%

2011

Pre-Tax Op Inc /

Avg Assets

%

2011

Return On Avg

Assets (ROAA)

%

2011

Return On Avg

Equity (ROAE)

%

2011

Dividend Pay-

Out

%

2011

SUB SAHARAN Islamic

SUB SAHARAN Islamic