Infrastructure Financing through Islamic

Finance in the Islamic Countries

76

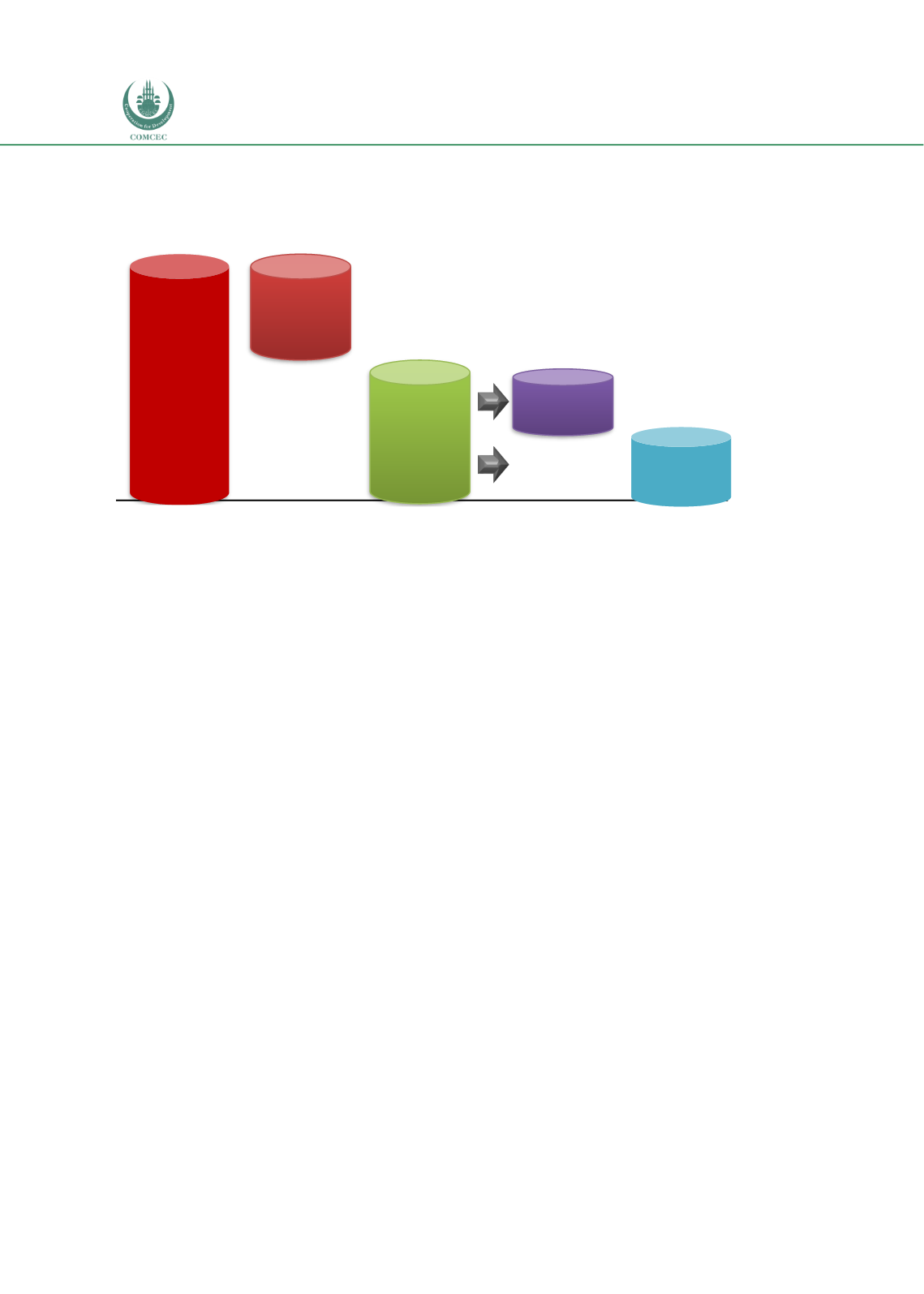

Chart 4.1. 5: Composition of Projected Sources Infrastructure Financing (IDR trillion)

Source: Bank Indonesia, Ministry of Finance and OJK (2018)

4.1.3.

National Level Policies and Framework for Infrastructure Development

As shown in Chart 4.1.1 the infrastructure of Indonesia has lagged behind other countries in

the South-east Asian region. For example, during the period 2008-2012, the Infrastructure

investments in Indonesia were around 1.5% of the GDP compared to the 9% of GDP in

Malaysia and 7% of GDP in Thailand (ADB undated). Recognizing that infrastructure

investments are insufficient and also to enhance the role of the private sector in the sector, the

government has taken some specific steps to improve the overall legal and institutional

environment for facilitating public-private partnerships.

Infrastructure investments are guided by the medium term national development planning

(RPJMN) 2005-2025 adopted by the government of Indonesia. The broad targets of RPJMN

include increasing the national per capita income to the level of upper middle-income

countries in 2025; reducing the unemployment rate to less than 5%, and bringing the poverty

rate to below 5% of the total population. RPJMN was divided into four periods that had their

own targets. The key overall targets for each period are shown in Table 4.1.4.

To achieve the broad goals of each period, specific projects are identified for implementation.

For example, for RPJMN 2015-2019 a total of 1600 national infrastructure projects have been

identified. However, a sub-group of projects under RPJMN are classified as National Strategic

Projects (PSN) and, within this group, some are identified as Priority Projects. Under

Presidential Decree Number 58 year 2017, the government classified 245 projects (out of 1600

projects) as National Strategic Projects and 30 projects out of these are considered Priority

Projects.

1,751.6

SOE

Private

2,817.8

1,066.2

Demand for

Financing

Government

Budget

Financing

Opportunity

4,796.2

1,978.4

41.3%

58.7%

22.2%

36.5%

100%