Infrastructure Financing through Islamic

Finance in the Islamic Countries

82

sector under PPP arrangements. The government, SOE, and the private sector have the

opportunity to raise funds from Islamic finance for investing in infrastructure.

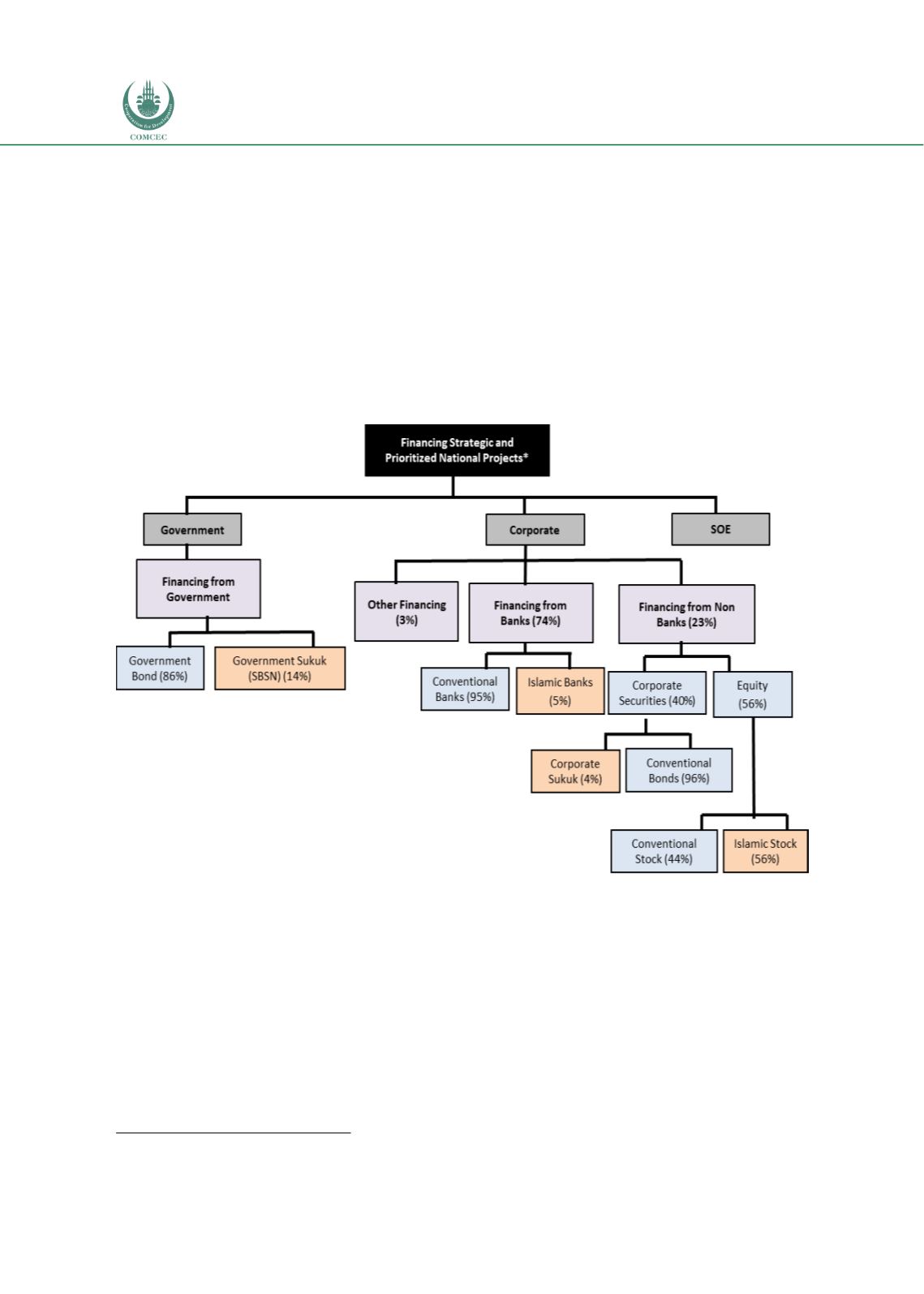

Chart 4.1.7 shows the percentage of the financing that comes from different segments of the

government and the private corporate sectors for the financing of infrastructure projects.

Banks cover 74% (IDR 1296 trillion or USD 92.6 billion) of the total corporate financing,

followed by nonbanks with 23% (IDR 403 trillion or USD 28.78 billion) and other types of

financing with 3% (IDR 52.56 trillion or USD3.75 billion).

30

Corporate Sukuk takes an even

smaller share which is only 4% of the total corporate securities. This is partly due to a limited

understanding of sukuk among corporations, no tax incentive for issuing corporate sukuk, and

the overall less developed sukuk market compared to its conventional counterpart.

Chart 4.1. 7: Composition of Financing in the National Infrastructure Finance

Source: Bank Indonesia, Ministry of Finance and OJK (2018)

The financing of Islamic banks to different infrastructure sectors is shown in Table 4.1.7. The

overall contribution of Islamic banks in infrastructure sector is 8.4% with 2.8% going to the

electricity sector and 2.5% going to the transportation sector.

30

Exchange rate on 31 March was USD1=DR 13730.