Infrastructure Financing through Islamic

Finance in the Islamic Countries

80

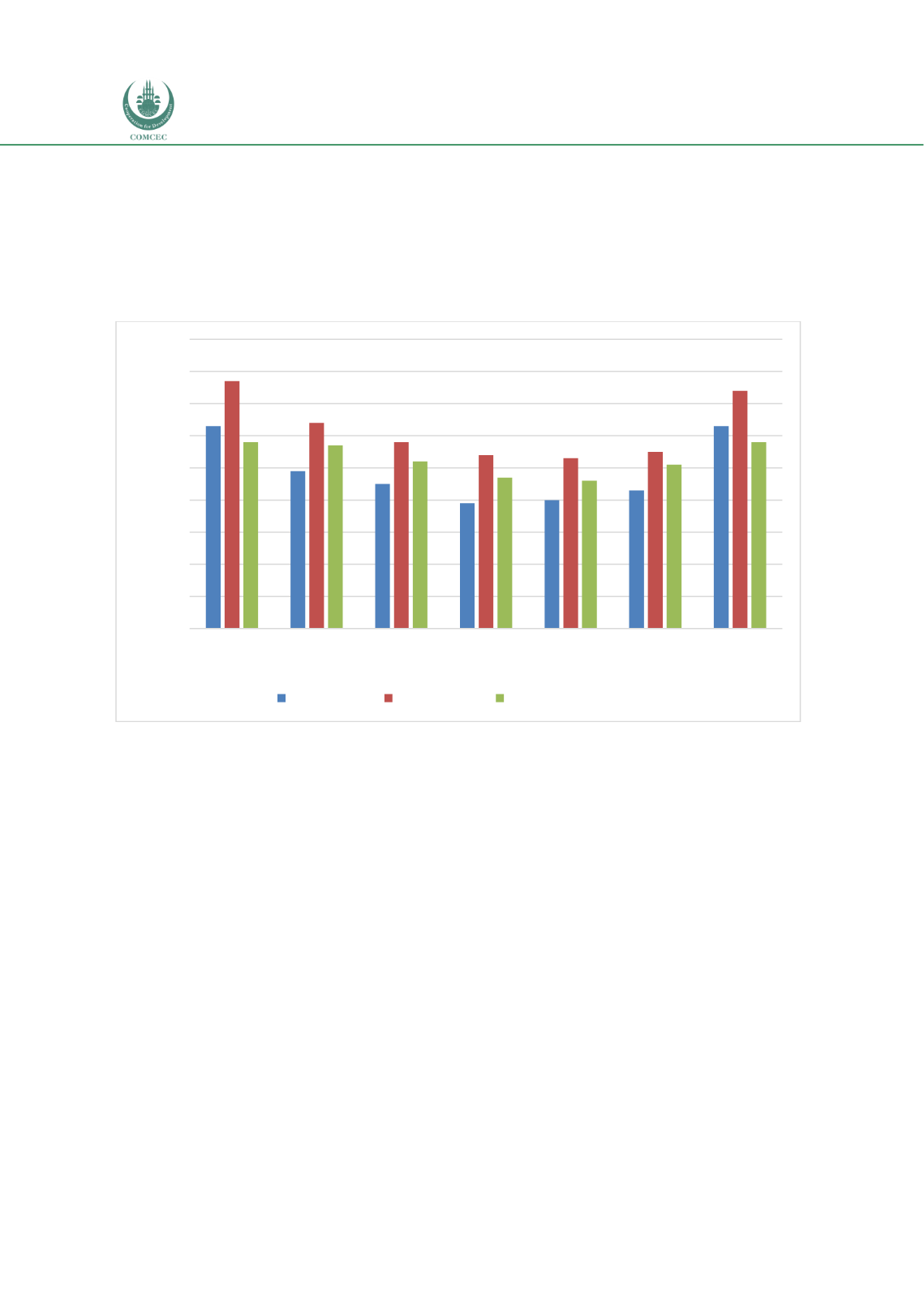

The statuses of the overall procurement regime identified in Chapter 2 for Indonesia relative to

the countries in different income groupings and the East Asia Pacific (EA&P) Region are shown

in Chart 4.1.6. The index shows that the current procurement regime for infrastructure

projects in Indonesia has improved and is significantly better than the average of the EA&P

region and similar to the averages of high-income countries. All the stages of Indonesia’s

procurement regime are better than the averages of OIC member countries.

Chart 4.1. 6: Procurement Regime of PPPs: Indonesia (0-100 Highest)

Source: World Bank (2018f)

IMF and World Bank (2017) identifies that the legal framework for special purpose vehicles

(SPV) that is used for issuing securities needs to be strengthened. Since in common law

countries trust can be used as a legal form for the SPV, Indonesia being a civil law country

needs to develop an appropriate legal framework for establishing SPVs.

4.1.4.1. Legal Environment for Islamic Finance

Banking Act Number 7, 1992 enabled the implementation of conventional and Islamic banking

systems by recognizing the special features of Islamic banking. Act Number 10, 1998 further

allowed conventional banks to establish Islamic banking units (UUS) and the conversion of

conventional banks to Islamic banks. The Islamic Banking Act Number 21, 2008 further

strengthened the legal framework of Islamic banking and provided a comprehensive legal

basis to promote the growth of Islamic banking. Insurance Act Number 40 2014 governs the

entire insurance industry in Indonesia and governs both the conventional insurance and

takaful

sectors.

Sukuk

Act Number 19, 2008 provides the legal foundations for issuing sukuk in

the country.

In order to increase the roles of Islamic finance in infrastructure financing, some policies have

been agreed to be pursued by three authorities, namely Bank Indonesia as the Islamic money

63

49

45

39

40

43

63

77

64

58

54

53

55

74

58

57

52

47

46

51

58

0

10

20

30

40

50

60

70

80

90

High income Upper-middle

income

Lower-middle

income

Low income East Asia &

Pacific

OIC Members

(40)

Indonesia

Index (0-100 Highest)

Preparation Procurement

Contract management