Infrastructure Financing through Islamic

Finance in the Islamic Countries

91

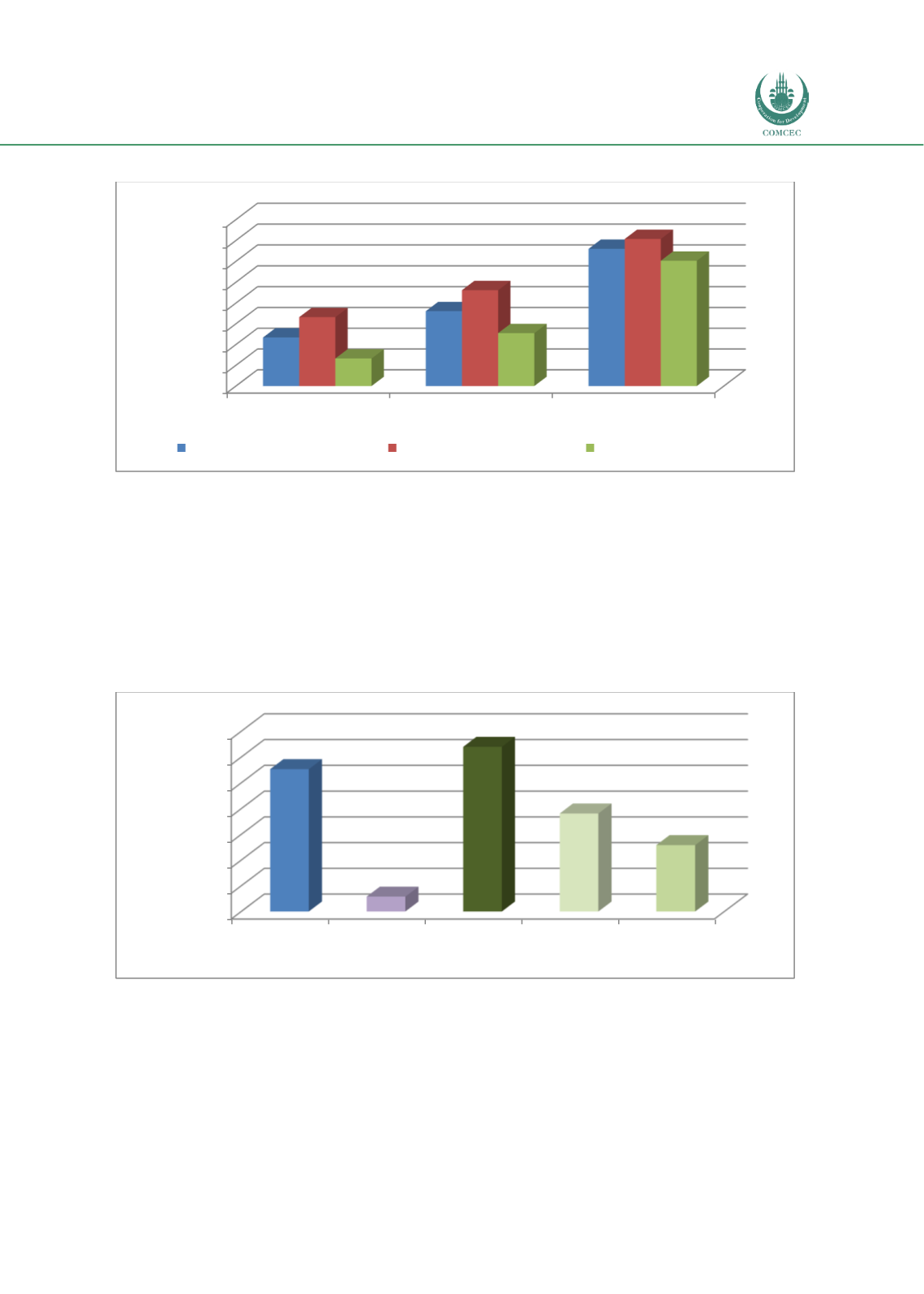

Chart 4.2. 1: Relative Financial Sector Development in Malaysia (2016) (0-1 Highest)

Source: IMF Financial Sector Development Database,

http://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B&sId=1481126573525

Chart 4.2.2 shows the composition of the Malaysian financial industry according to broad

categories of banking, insurance and capital markets. The capital markets sector that includes

the stock market and the bonds/sukuk market is the largest with a total value of RM 3.199

trillion followed by the banking sector with assets valued at RM 2.766 trillion and the

insurance/takaful sectors with assets worth RM 290 billion. The components of the capital

market show a larger stock market segment with a market capitalisation at RM 1.906 trillion

and bonds and sukuk market valued at RM 1.291 trillion.

Chart 4.2. 2: Composition of the Financial Sector: Malaysia 2017 (RM billion)

Source: Estimated from BNM (2017) and SCM (2017)

The financial institutions in Malaysia are diverse and include commercial banks, investment

banks, development financial institutions (DFIs) and other nonbank financial institutions such

as cooperatives, building societies, leasing and factoring companies and other DFIs (BNM

2017). While six DFIs are established under the Development Financial Institutions Act 2002

and are regulated by BNM, seven other DFIs are not under the purview of the Act or BNM. The

former DFIs include specialised banks such as SME Bank, EXIM Bank and Agro Bank and the

latter group includes the Malaysian Industrial Development Bank, Credit Guarantee

0.00

0.10

0.20

0.30

0.40

0.50

0.60

0.70

0.80

OIC Average

Asia & Pacific Average

Malaysia

0.23

0.36

0.66

0.33

0.46

0.71

0.13

0.26

0.60

Index Value (0-1 Highest)

Financial Development Index

Financial Institutions Index

Financial Markets Index

0

500

1,000

1,500

2,000

2,500

3,000

3,500

Banking Assets Insurance &

Takaful Assets

Capital Markets

Value

Stock Market

Capitalization

Bonds & Sukuk

Markets

2,766.1

290.0

3,199.0

1,906.9

1,291.9

RM Billion