Infrastructure Financing through Islamic

Finance in the Islamic Countries

89

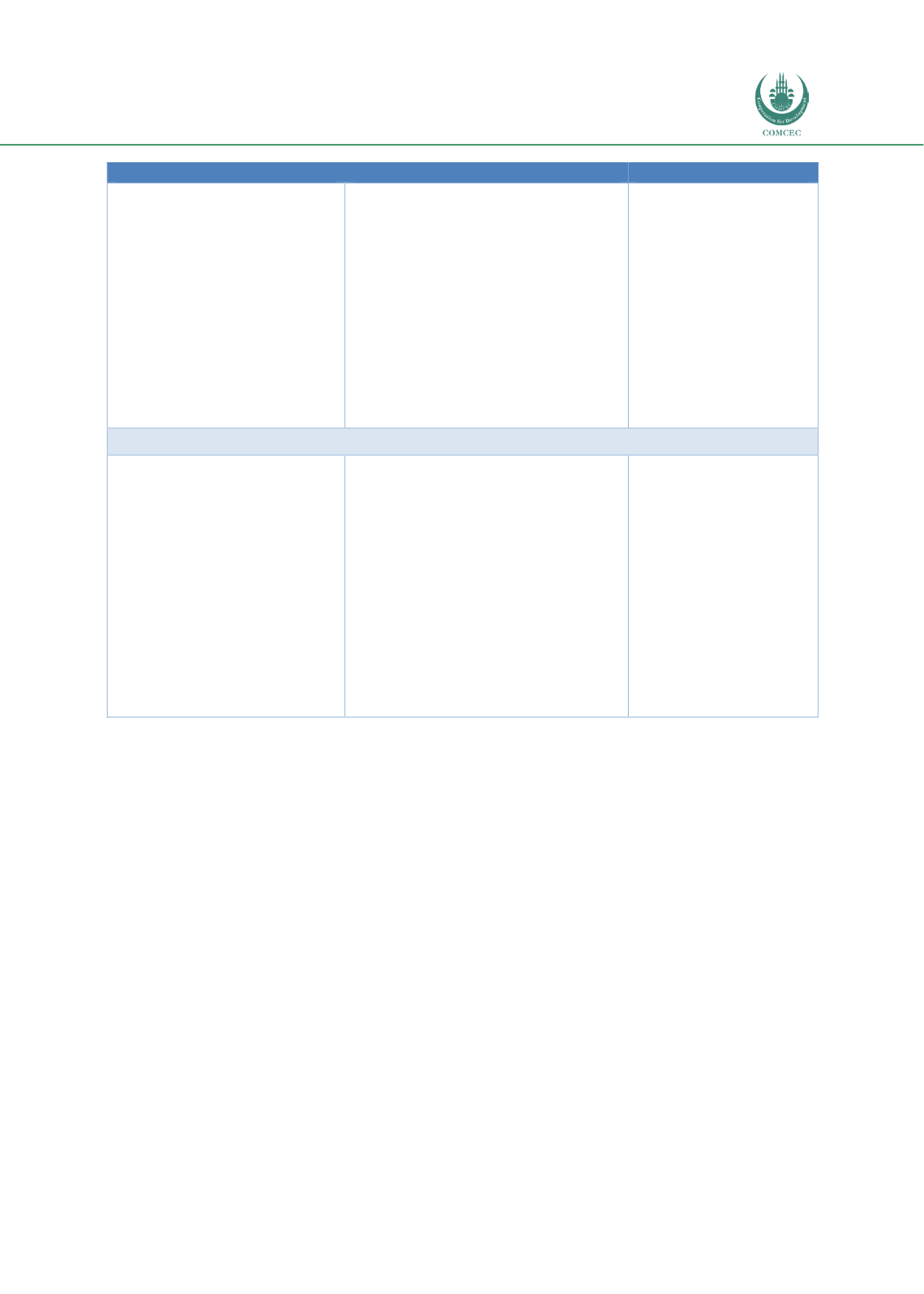

Issues

Recommendations

Implemented by

due to investments in long-term

projects) can be mitigated is to

develop a well-functioning

Islamic money market through

which Islamic banks can access

liquidity when needed.

The balance sheet structure of

life insurance and pension funds

supports investment in long-

term investments. However, the

Islamic nonbank financial

institutions sector in Indonesia

are relatively small.

incentives for Islamic banks to invest in

long-term illiquid assets.

Increase the shares of family takaful and

Islamic pension funds to increase the

role of Islamic finance in the

infrastructure sector.

Establish specialized Islamic funds and

platforms to increase investments in

infrastructure projects.

Islamic financial

institutions

Relevant ministries to

create the right legal and

regulatory framework

Market players

Islamic Capital Markets

Although Indonesia has used

sukuk to raise funds for the

infrastructure sector, there is

potential to expand it further.

Sukuk structures are complex

and new for many stakeholders.

Indonesia has issued retail sukuk

to tap into alternative sources of

funds which can be further

increased.

Develop market and infrastructure for

Islamic capital market/sukuk.

Issue more project sukuk.

Establish an institution that can advise

on the issuance of sukuk and develop

templates for the issuance of sukuk for

infrastructure projects.

Increase literacy of Islamic finance and

introduce efficient mechanisms for the

delivery and redemption of sukuk issues

to further encourage retail investors to

invest in infrastructure sector

Capital markets authority

Issuers (sovereign and

corporates)

The government linked

financial institution PT

SMI that also has a

Shariah unit

Capital markets authority

Issuers (sovereign and

corporate)

Financial institutions