Infrastructure Financing through Islamic

Finance in the Islamic Countries

88

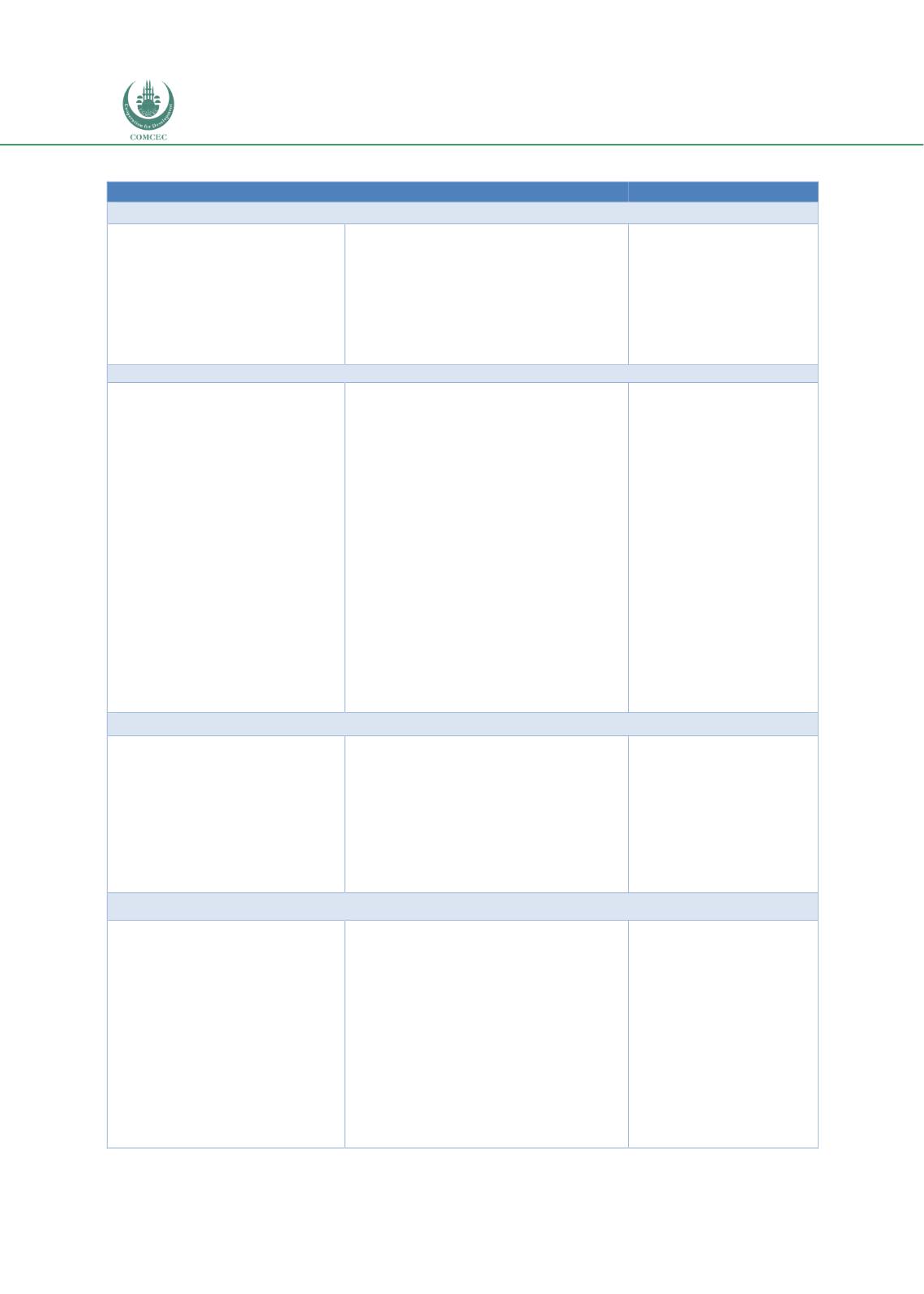

Table 4.1. 8: Issues and Policy Recommendations: Indonesia

Issues

Recommendations

Implemented by

Infrastructure Related Strategies and Policies

PPP projects and contracts are

novel and complex.

Indonesia is one of the few

countries that has guarantees

for implementation of PPP

contracts.

Developing Shariah-compliant contract

templates that can be used for different

types of PPP projects.

Expand the scope of guarantees and

insurances to cover other risks such as

political risks and partial credit risks in

a Shariah-compliant manner.

Relevant ministry in

coordination with IDBG

Relevant public bodies

Private sector

insurance/takaful

companies

Legal and Regulatory Regimes

While Indonesia has Islamic

banking and capital

markets/sukuk law, the takaful

industry operates under single

insurance law.

The regulatory framework for

capital requirements

discourages banks from

investing in long-term projects

as these would require higher

capital charges.

Since Islamic banks are relatively

small, their contribution to

infrastructure development can

be enhanced by jointly funding

the projects with other banks

through syndicated financing.

Introduce specific takaful law to help

promote the industry further.

Balance between financial stability

objectives and lowering the capital

requirements for investments in long-

term projects to encourage more

involvement of Islamic banks in

infrastructure financing.

Develop a sound legal framework and

contracts for syndication to increase the

participation of Islamic banks in

infrastructure projects along with other

banks

Relevant government

ministry

Banking regulatory

bodies (OJK and Bank

Indonesia)

Relevant government

ministry

Government and Public Bodies

Government-linked financial

institution PT SMI provides

financing for infrastructure

projects

Strengthen PT SMI to further encourage

pooling of funds from different sources

for investments in infrastructure

projects in a Shariah-compliant manner.

PT SMI can also provide information

and advisory services on Islamic project

financing and the potential

infrastructure projects that other

financial institutions can invest in.

Board and Senior

management of PT SMI

Islamic Financial Institutions

One key factor that limits the

involvement of Islamic banks in

long-term infrastructure projects

is liquidity risks arising from

their short-term and liquid

liabilities.

One way in which liquidity risk

of Islamic banks (that can arise

Separate deposits and (restricted)

investment accounts in Islamic banks.

Since the investors in the latter are

expected to have long-term perspectives

and also bear the risks of the

investments, Islamic banks would be

able to use these funds for investment in

the infrastructure sector and will not be

required to hold much capital for

investment.

Improve the efficiency and depth of

Islamic money markets to create

Relevant ministry and

regulators

Islamic banks

Central bank

Other stakeholders such