Infrastructure Financing through Islamic

Finance in the Islamic Countries

85

4.1.6.2. Case Studies

Case Study: Cash Waqf Linked Sukuk (CWLS)

CWLS is a recent development of Sukuk initiated by the National Waqf Body (BWI), Ministry of

Finance (MoF), Ministry of Religion (MoR) and Bank Indonesia (BI) in collaboration with the

Productive Waqf Forum (FWP), Islamic banks, and social institutions (Ministry of Finance,

Bank Indonesia, Financial Service Authority, 2018). CWLS was officially launched during the

IMF/World Bank Annual Meeting 2018 in Bali as a unique instrument since it combines the

Islamic social instrument (waqf) with the sukuk market (SBSN) to take part in government

public projects such as government schools, public hospitals, mosques, etc.

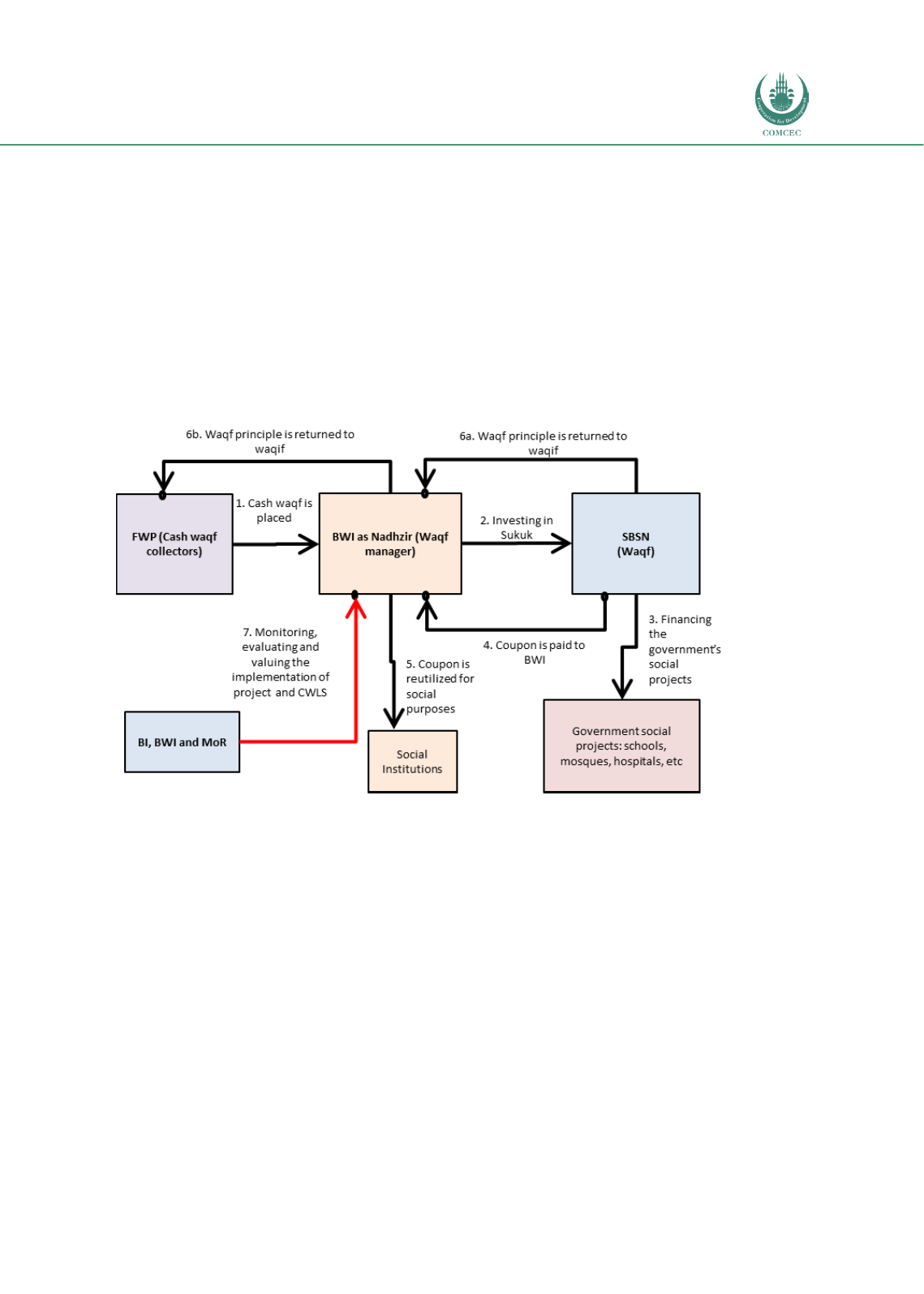

Chart 4.1. 9: The Structure of Cash Waqf Linked Sukuk (CWLS)

Source: Cash Wakaf Linked Sukuk Feasibility Study 2018

Technically, the CWLS model involves the FWP, BWI, Ministry of Finance (MoF), Ministry of

Religion, social institutions and Islamic Banks as in the following:

1.

FWP collects cash waqf (temporary) fromWaqif (social investors) and extends it to the

National Waqf Body (BWI) via Islamic banks.

2.

BWI (as Nadhzir or Waqf manager) places the cash waqf in SBSN (waqf contract) with

a private placement mechanism for a temporary period (5 years).

3.

The government (Ministry of Finance) uses the cash waqf funds to finance government

social projects such as schools, hospitals, etc.

4.

The government (for an appreciation) pays regular coupon to BWI via Islamic banks.

5.

The Coupon (return from waqf investment and treated as another waqf fund) is to be

used by social institutions for other social purposes.

6.

In the maturity date (6a), the MoF returns the principal of SBSN (waqf contract) to

BWI and then it is extended to FWP (6b).

7.

Bank Indonesia, BWI and the Ministry of Religion (MoR) monitor, evaluate and value

the implementation of projects and CWLS.