Infrastructure Financing through Islamic

Finance in the Islamic Countries

83

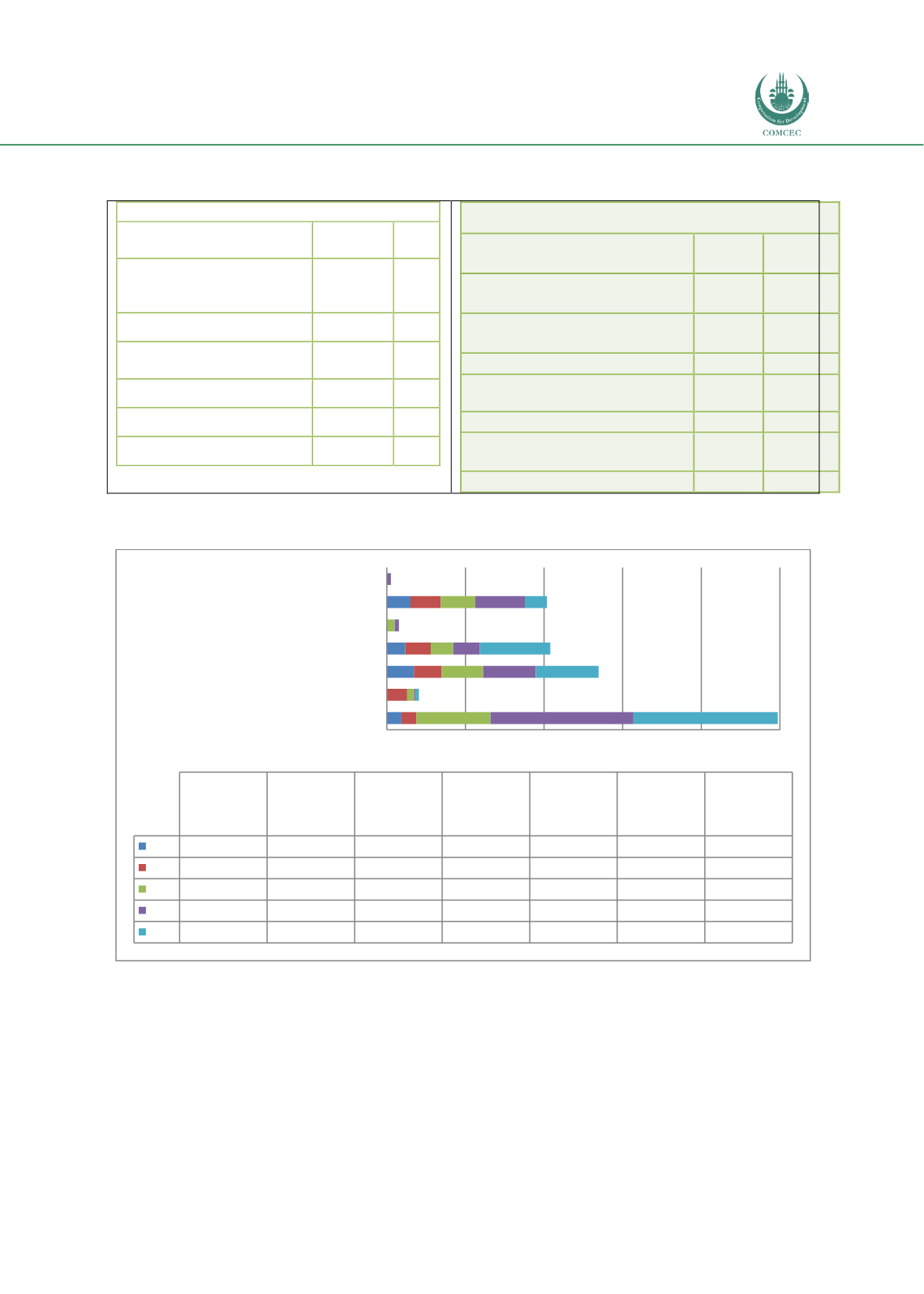

Table 4.1. 7: Islamic Banks Assets Composition and Financing of Infrastructure Sector

(2018: Q1) (IDR billion)

Total Islamic Banking Assets

Asset Composition

IDR

(Billion)

% of

total

Total Shariah-compliant

financing (excluding interbank

financing)

190,063.6 64.6%

Sukūk holdings

26,452.6

9.0%

Other Sharī`ah-compliant

securities

3,879.4

1.3%

Interbank financing

5,784.7

2.0%

All other assets

68,087.1

23.1%

Total assets

294,267.4

100%

Infrastructure Financing by Islamic Banks

Financing going to infrastructure

IDR

(Billion)

% of

total

Electricity, gas, steam and air-

conditioning supply

8,162.5

2.8%

Water supply, sewerage, and

waste management

439.9

0.1%

Transportation and storage

7,372.2

2.5%

Information and

communication

1,045.0

0.4%

Education

4,069.8

1.4%

Human health and social work

activities

3,574.4

1.2%

Total

24,663.8

8.4%

Source: IFSB PSIFI.

Chart 4.1. 8: Types and Annual Issuance Values of SBSN (IDR trillion)

Source: Ministry of Finance Monthly report 2018

As indicated in Chart 4.1.5, the total financial needs for infrastructure financing over the 2015-

2019 period is USD 342.57 billion, out of which the government plans to finance around 41%,

SEOs are estimated to finance 22%, and the remaining 37% is projected to be raised by the

private sector. The government finances a significant part of the projects by issuing

government securities, both bonds and sukuk. Government bonds dominate at IDR 1701

trillion (USD 121.5 billion) and this is followed by government sukuk (commonly called SBSN)

with IDR 277 trillion (USD19.78 billion) which is 14% of the total government securities.

0

50

100

150

200

250

Project Based Sukuk (PBS)

Hajj (Pligrimage) Fund Sukuk (SDHI)

Indonesian National Sukuk (SNI)

Sovereign treasury Notes Sukuk (SPNS)

Non-tradeable Sovereign treasury Notes Sukuk…

Retail Sukuk (SR)

Saving Sukuk (ST)

Project Based

Sukuk (PBS)

Hajj

(Pligrimage)

Fund Sukuk

(SDHI)

Indonesian

National Sukuk

(SNI)

Sovereign

treasury Notes

Sukuk (SPNS)

Non-tradeable

Sovereign

treasury Notes

Sukuk (SPNSNT)

Retail Sukuk

(SR)

Saving Sukuk

(ST)

2013

9.3

0

17.2

11.7

0

15

0

2014

9.4

12.9

17.7

16.2

0

19.3

0

2015

47.2

4.5

26.4

14.3

5.1

22

0

2016

90.9

1

33.4

17

2.5

31.5

2.6

2017

91.8

2

40

44.7

0

14

0