Islamic Fund Management

48

3.1.2

Review and Analysis of Various Funds by Investment Portfolio

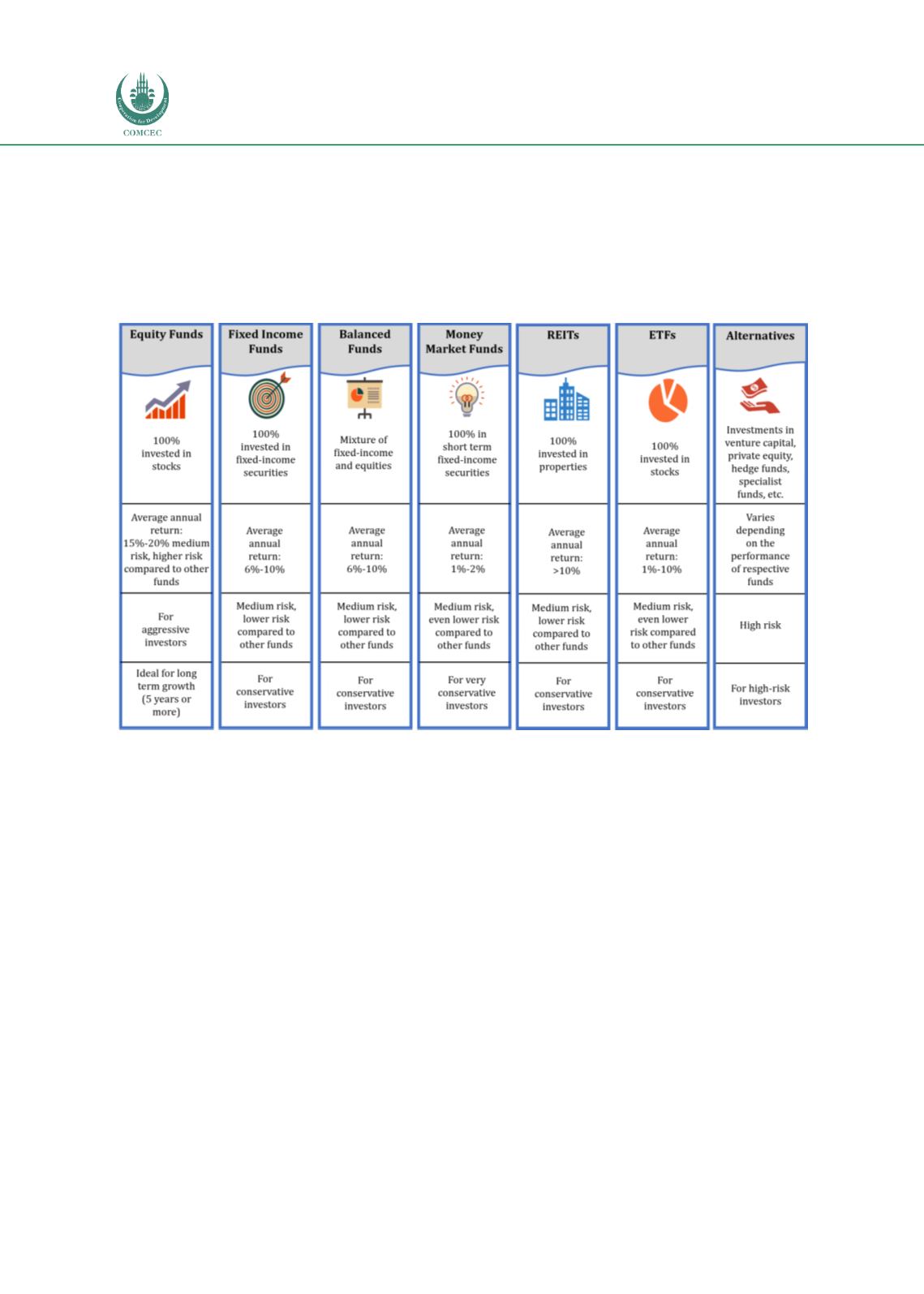

Different types of funds―based on their investment portfolios―carry different risk profiles, as

delineated i

n Figure 3.3 .Equity funds, for instance, entail high risks and represent long-term

investments, which are more suitable for aggressive investors.

Figure 3.3: Analysis of the Various Types of Funds by Investment Portfolio

Sources: Compilation from various funds’ prospectus, RAM

1.

Equity Funds

Equity funds invest in a portfolio of stocks and equity-related instruments. Instead of investing

directly in a company, the investor shares the risk of the market performance of a portfolio of

stocks in various sectors with the fund’s other unit holders. The strategies of diversified equity

funds are detailed below:

a)

Large-cap equity funds

invest in stocks of large and liquid blue-chip companies with

stable performance returns.

b)

Mid-cap funds

invest in mid-cap companies that have the potential for greater growth

and returns.

c)

Small-cap funds

invest in companies with small market capitalisations, with the

intention of benefitting from greater gains in the form of the stocks’ price performance

as smaller companies may benefit from newer business opportunities.

d)

Sector funds

invest in companies that belong to a particular sector, e.g. technology or

banking. The risks of sector funds are high as they are not diversified. Declines in the

stocks of one sector can lead to a significant fall in investment value.

e)

Thematic funds

invest in the stocks of companies which may be defined by a unifying

underlying theme. For example, infrastructure funds invest in stocks in the