Islamic Fund Management

44

Once this initial screen is passed, the

financial screen

is then used to determine the extent of a

company's Shariah non-compliant financial behaviour. This presents a significant challenge, as

very few companies are completely Shariah-compliant in the current global market. As a result,

many Islamic scholars agree to use certain financial ratios to determine whether a company is

financially Shariah-compliant. While these ratios vary based on a specific Shariah board's

discretion, a commonly used standard developed by the AAOIFI (2015) can be employed, as

follows:

Total conventional loans (long-term and short-term debts) must be less than 30% of the

total market capitalisation of the company.

Total interest-bearing deposits must be less than 30% of the total market capitalisation

of the company.

Total interest and Shariah non-compliant income must be less than 5% of the total

revenue of the company.

By utilising its total market capitalisation, the entire value of the company (including

intangible assets) can be considered, thus enabling more companies to be Shariah-compliant.

Any of the company's income derived from Shariah non-compliant activities should be purified

by the investor, by donating the

haram

portion of the income to charity.

Table 3.2provides a list of different Shariah screening methodologies adopted by a regulator

(i.e. the SAC of the SC) and various index providers.

Figure 3.2 presents an example of the

Islamic equity fund screening process in Malaysia.

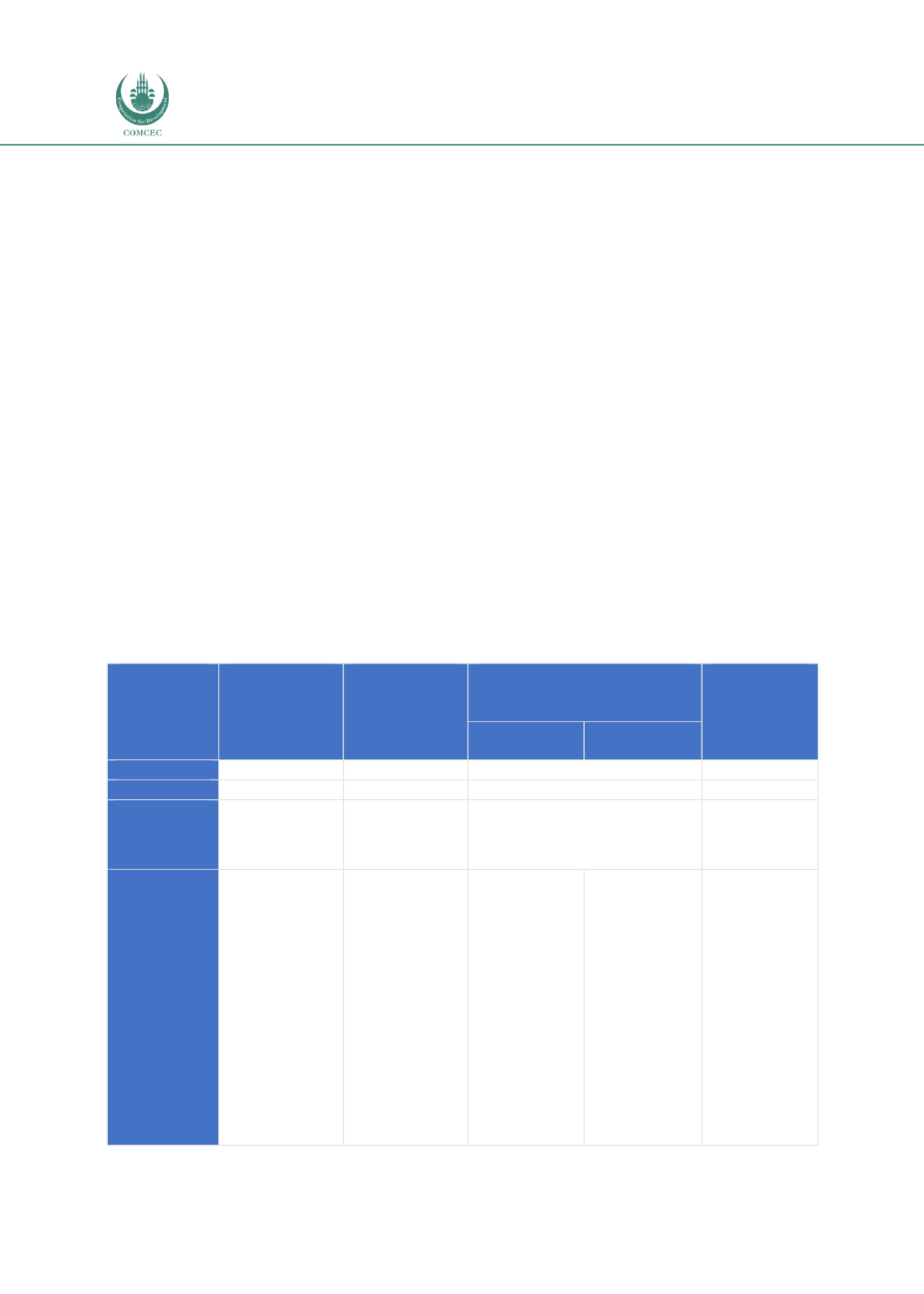

Table 3.2: Comparison of Different Shariah Screening Methodologies

SAC of SC

(Malaysia)

S&P Dow

Jones Shariah

Indices

MSCI Islamic Index

FTSE

Shariah

Global

Equity Index

Series

Series

M-Series

Scope

Malaysian stocks

Global stocks

Global stocks

Global stocks

Screener

Regulator

Index provider

Index provider

Index provider

Focus

Business activity

and financial

ratio

benchmarks

Sector-based

and accounting-

based screens

Business activity and financial

screening

Business sector

and financial

screening

Financial

Ratio

Total debts/

Total assets

= < 33%

Cash/Total

assets

= < 33%

Total debts/

Market

capitalisation

= < 33%

Accounts

receivables/

Market

capitalisation

= < 49%

Cash +

Interest-

bearing

securities/

Market

Total debts/

Total assets

= < 33.33%

Cash +

Interest-

bearing

securities/

Total assets

= < 33.33%

Accounts

receivables +

Cash/Total

assets

= < 33.33%

Total debts/

Average

market

capitalisation

= < 33.33%

Cash +

Interest-

bearing

securities/

Average

market

capitalisation

= < 33.33%

Accounts

Total

debts/Total

assets

= < 33.333%

Accounts

receivables +

Cash/Total

assets

= < 50%

Cash +

Interest-

bearing

securities/

Total assets