Islamic Fund Management

43

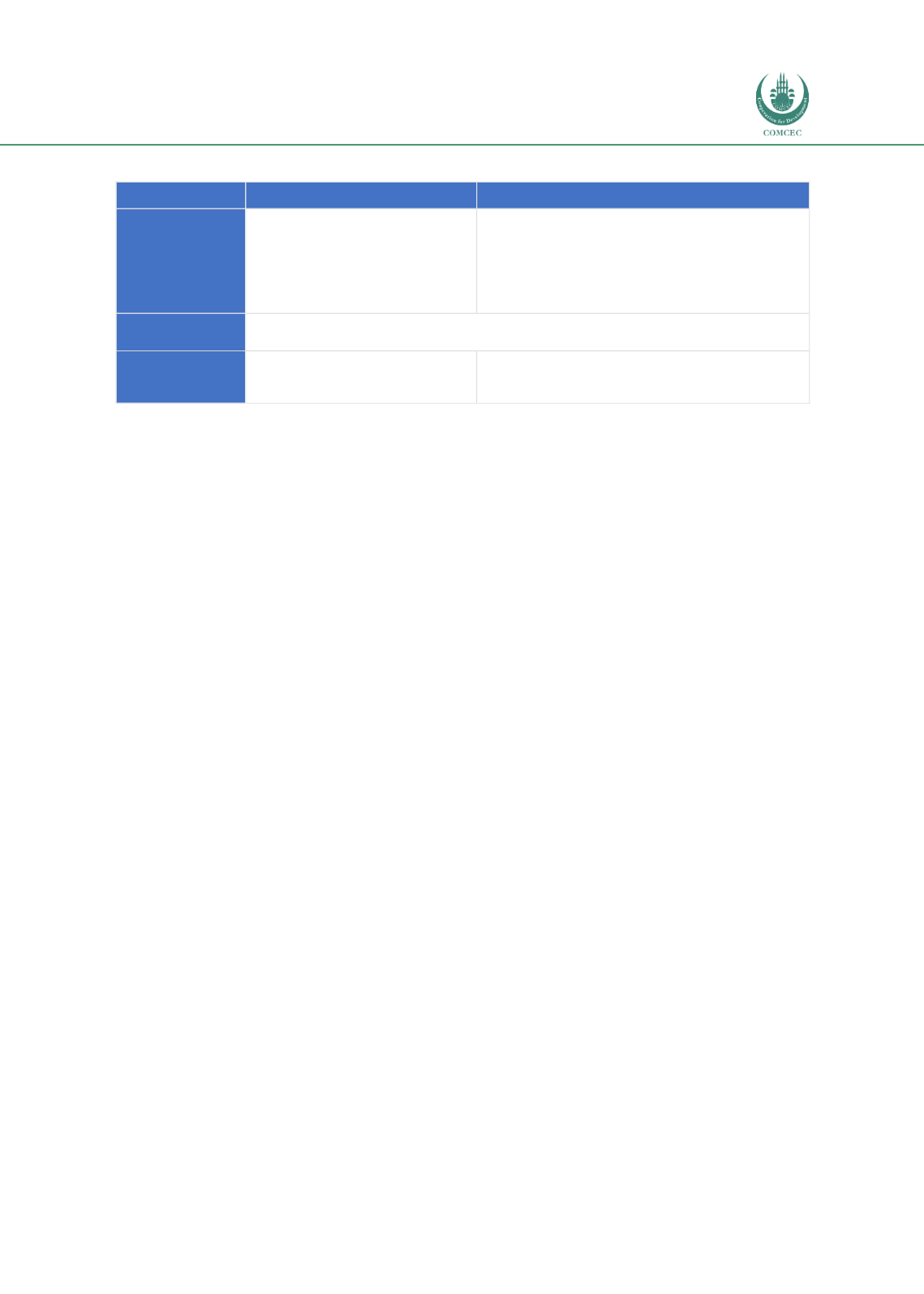

Table 3.1: Comparison between Conventional Unit Trust and Islamic Unit Trust

Type

Conventional Unit Trust

Islamic Unit Trust

Feature

A pooled investment plan, where

the capital contributions of

investors are combined into a

legally formed trust fund.

Depending on the type of Shariah contract

adopted, e.g. under a

mudarabah

structure,

investors are known as

rabb al-mal

and the fund

manager as

mudarib

. Investors participate in the

equal sharing of a collective investment scheme,

and share the profits and losses

Asset Manager

Invested and managed by professional fund managers, acting on behalf of the investors

in a portfolio of marketable securities.

Type of Stocks

All types of equities.

Restricted to Shariah-compliant stocks that are

screened based on Shariah screening

methodologies, e.g. AAOIFI, Dow Jones, MSCI, SC.

Source: RAM

Furthermore, an Islamic fund must establish a Shariah audit function, either by hiring an

external party or internally engaging a Shariah specialist, whose responsibility is to oversee

the Shariah compliance of the fund in consonance with the relevant regulations and Shariah

resolutions.

Shariah Stock Screening

For an investment fund to be Shariah-compliant, the stock of the company in question must be

screened to ensure that the potential investment is suitable under Islam. Under Shariah law,

ownership of shares in a company is considered a structured proportionate share of that

company's business and assets, with the result that Islamic investors cannot own a company

involved in any

haram

activity. Investors will seek guidance from the fund's Shariah board on

the permissibility of an investment or business venture.

To enhance Islamic investors’ access to the financial markets, a group of leading Shariah

scholars has developed a series of screening criteria aimed at identifying the Shariah non-

compliant elements of a company; they will devise means to avoid or deal with them in a

manner consistent with Shariah principles. Through this screening process, Shariah-compliant

investors can, therefore, invest in companies which fulfil such screening criteria. The screening

criteria is applied at the time of the investment decision and during the subsequent ongoing

monitoring process by the Shariah board, to ensure that the company remains Shariah-

compliant during the investment period.

There has been much debate on the interpretation and application of the screening criteria,

which will often vary on a case-by-case basis. However, there are two basic screening

processes which are applied to companies with the potential of forming part of an Islamic

investment portfolio.

Firstly, the

business screen

examines the underlying business of the company and aims to

eliminate any

haram

businesses that are contrary to the principles of Shariah. Such businesses

include conventional banking, insurance, alcohol, pork-related products, non-compliant food

products, gambling, certain tobacco products, pornography and weapons manufacturing. It is

not sufficient for the holding company alone to comply with the industry screen, all its

subsidiaries must also adhere to the same.