Islamic Fund Management

19

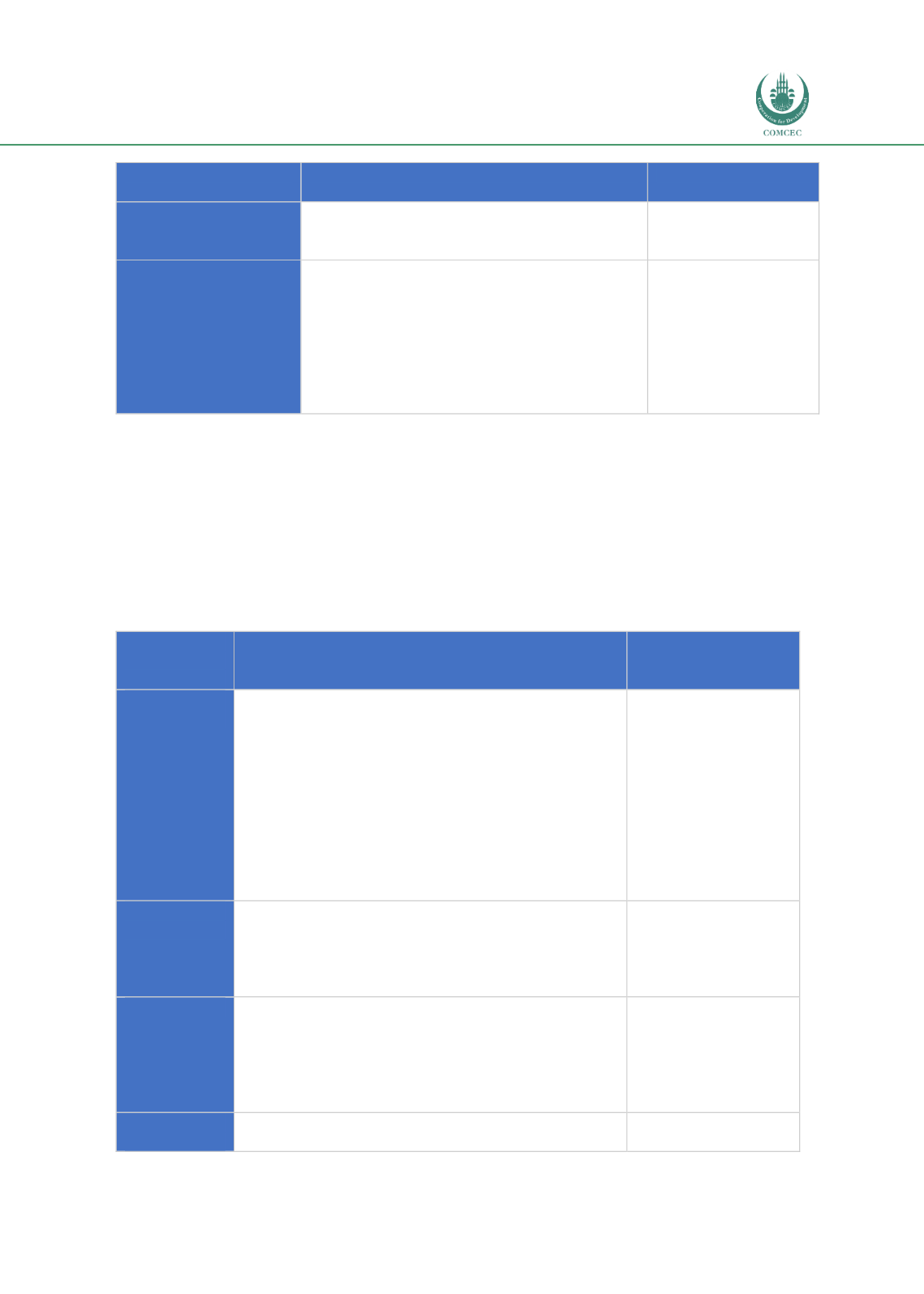

Type of Fund by

Investment Portfolio

Description

Assets Invested In

funds from other countries or in different

sectors and asset classes, with various risk

exposures.

REIT

Invests in a diversified pool of properties, e.g.

commercial

buildings,

student

accommodations, retirement homes, shopping

malls,

housing

complexes,

land

and

plantations. Returns take the form of rental

payments. REITs usually have to distribute

most of their gains as dividends to their unit

holders.

Real estate.

For Islamic REITs,

tenants must be

involved in Shariah-

compliant activities.

Sources: ISRA (2015), PWC (2016), ISRA

While the abovementioned funds can have their Islamic equivalents, there are also some―such

as PE and VC funds, hedge funds and other specialist funds―that are commonly classified as

alternative funds. PE and VC funds, for instance, do not actively invest in the capital markets.

Others such as pension funds and sovereign wealth funds are often loosely referred to as

funds, even though they are institutions with multiple ‘funds’. These are classified in

Table 2.3

below as alternative types of funds. Within this category, certain types of Islamic funds, such as

ijarah

,

murabahah

,

hajj

and

waqf f

unds, are described in more detail.

Table 2.3: Alternative Funds and Some Specific Types of Islamic Funds

Alternative

and Islamic

Funds

Description

Assets Invested In

PE and VC

Funds

These refer to investments in PE and VC firms, with

the aim of improving the performance of the

companies and disposing of these investments at a

higher rate of return. PE involves investment in more

mature businesses while VC refers to investment in

riskier start-up businesses. Investors of these funds

are mostly institutional and high-net-worth clients,

which typically hold them for more than 10 years

plus a number of extensions. PE/VC funds are high-

risk investments; they are expected to provide higher

returns, outperforming traditional asset classes.

Riskier start-up

companies (VC) and

mature businesses

(PE).

Pension

Fund

Collects the pension contributions of employers and

employees, and invests in a diversified portfolio of

assets. Generally has large amounts of money to

invest and stand among the major stakeholders of

listed and private companies.

Invests the pension

contributions of

employees and

employers.

Hedge Fund

Distinct from mutual fund/unit trust as it pools funds

from sophisticated and institutional investors and

invests in a variety of assets, with complex portfolio

construction and risk-management strategies. Islamic

hedge funds have attracted much controversy while

others allow Shariah-compliant hedge funds.

Equities, fixed-income

securities, options,

futures, swaps.

Sovereign

Wealth Fund

Refers to an investment fund owned and managed

directly or indirectly by a government to achieve

Infrastructure, real

estate, commodities