Islamic Fund Management

24

US accounted for a respective 55% and 26% of global AuM in 2016. They are followed by the

Asia-Pacific region, with 14% of AuM (PWC, 2017b)

. Chart 2.1indicates the number of Islamic

funds by domicile as at end-2017. Meanwhile

, Chart 2.3shows global AuM by region for the

same period.

Table 2.4: Estimated Global AuM 2004-2020 (USD trillion)

Clients

2004

2007

2012

2013

2014

2015

2020

Mass

Affluent

42.1

55.8

59.5

64.2

67.2

62.5

96.3

HNWIs

37.9

50.1

52.4

59.2

69.6

67.8

83.5

Pension

Funds

21.3

29.4

33.9

35.8

38.7

38.2

55.8

Insurance

Companies

17.7

21.2

24.1

26.1

26.2

27.1

38.8

SWFs

1.9

3.3

5.3

6.1

6.3

6.7

10.0

Total Clients’

Assets

120.9

159.8

175.2

191.4

208.0

202.3

284.4

Global AuM

37.3

59.4

63.9

71.9

78.0

78.7

112.0

Penetration

Rate

30.9%

37.2%

36.5%

37.6%

37.5%

38.9%

39.4%

Source: PWC (2017, p. 5)

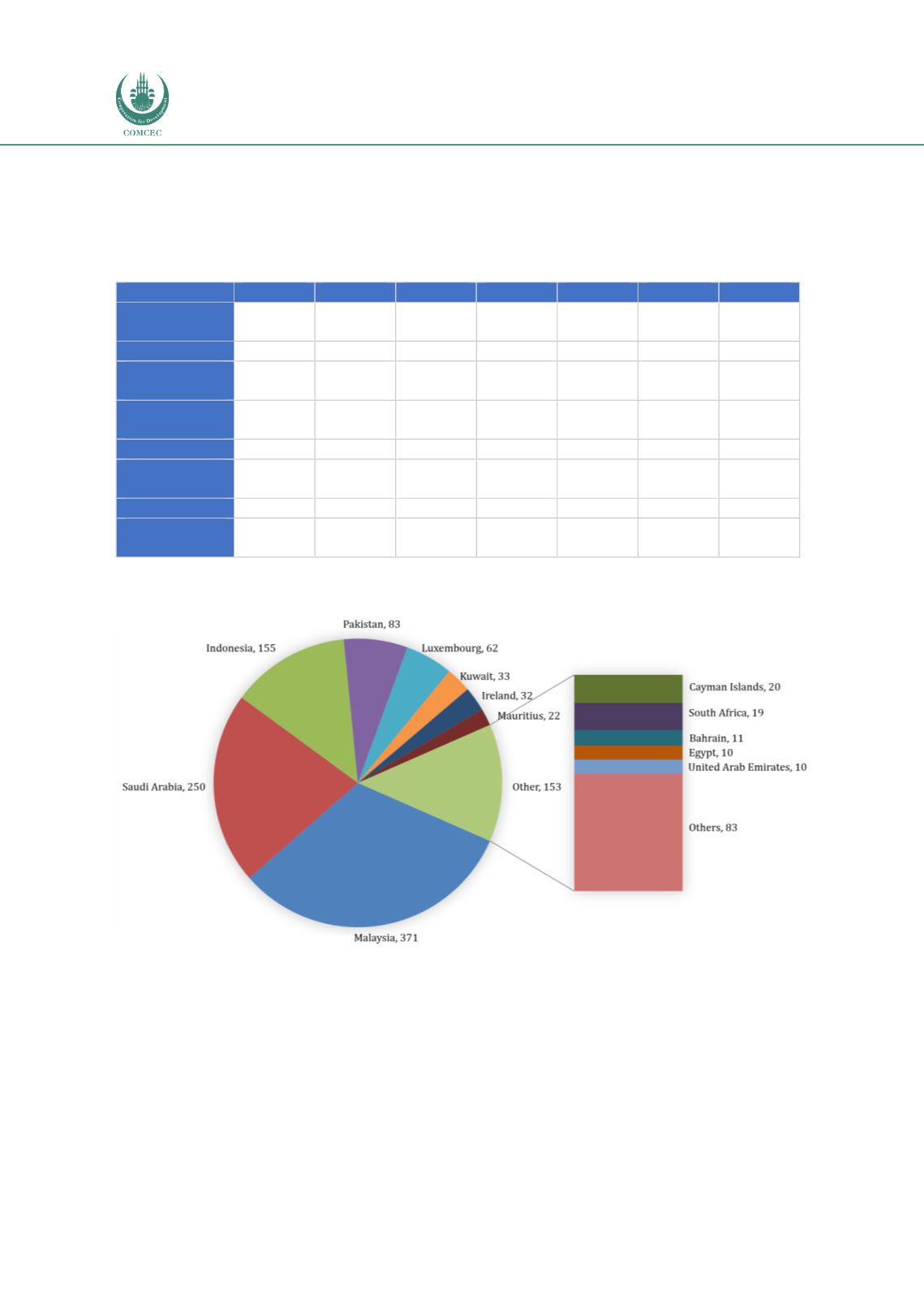

Chart 2.1: Number of Islamic Funds by Domicile (2017)

Sources: IFSB (2018), Bloomberg

The Islamic asset management industry has been posting significant growth since the late

1980s, both in terms of the number of funds and AuM. Reports indicate that the industry

expanded from about 800 Islamic funds in 2008 (IFSB, 2017) to 1,161 as at end-2017,

accounting for some USD66.7 billion of AuM as at end-2017 (IFSB, 2018). Nonetheless, this

sector represents only a small percentage (about 3%) of the total Islamic finance assets of

USD2.05 trillion as at the same date―with the Islamic finance industry being mostly dominated

by the Islamic banking sector (representing 76% or USD1.6 trillion of total assets) and sukuk

(19.5% or USD399.9 billion of total assets).

Chart 2.2 illustrates the breakdown of Islamic