Islamic Fund Management

18

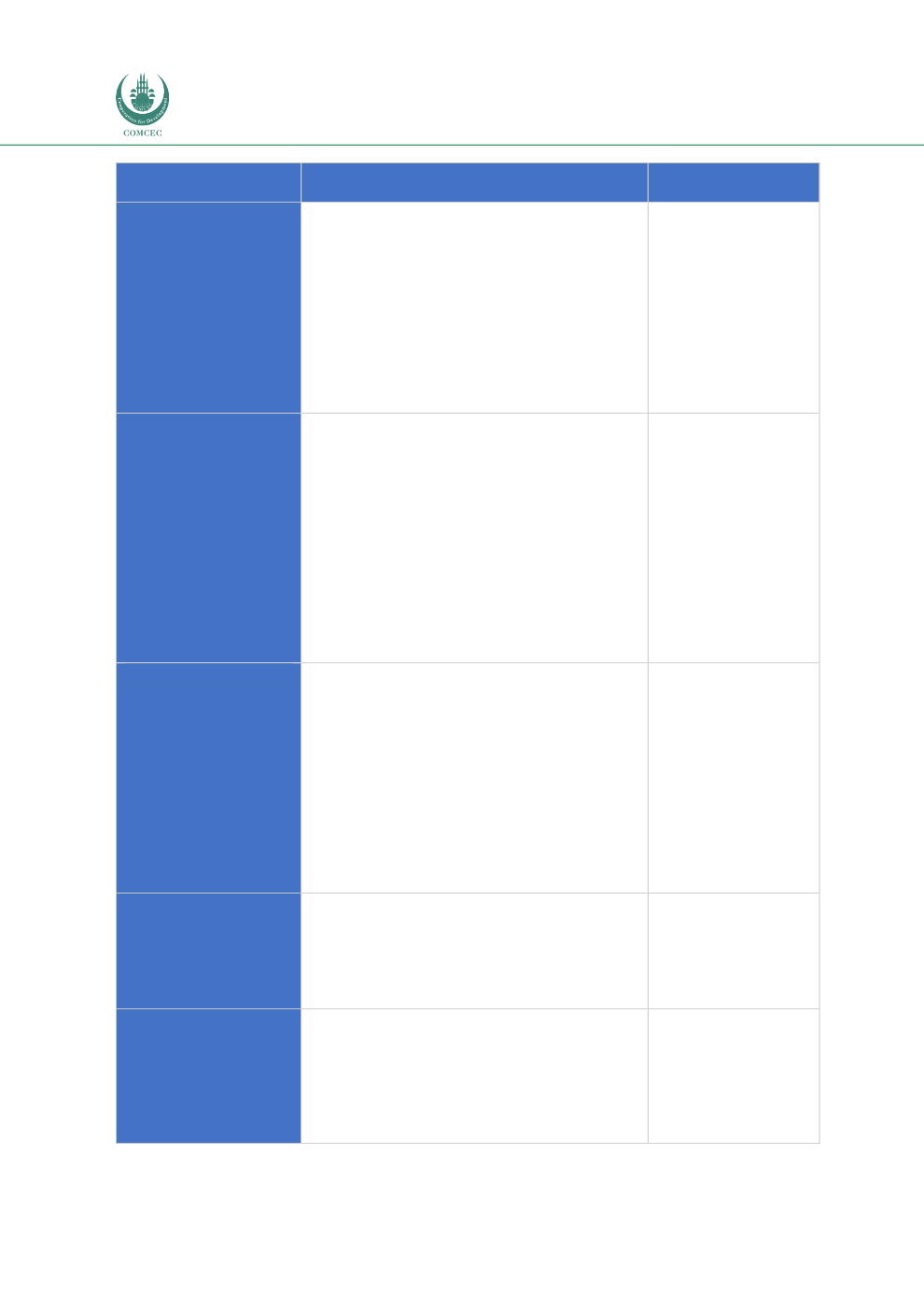

Type of Fund by

Investment Portfolio

Description

Assets Invested In

Money Market Fund

Invests in short-term money market securities

(one year or less) and aims mainly to preserve

its principal capital and generate a modest

income for the unit holders. Commonly

deemed as safe as bank deposits, but with a

higher yield. Extremely liquid; investors can

withdraw their money at any time, with almost

no risk of loss of principal.

Islamic money market funds invest in short-

term sukuk and other investment instruments.

Short-term treasury

bills, debentures,

commercial papers.

Short-term sukuk for

Islamic money

market funds.

Fixed-Income Fund

Its main objective is to generate a flow of fixed

income.

The government,

municipal and

corporate debt

obligations

, preferred stocks, money market

instruments, and

dividend-paying

stocks.

Sukuk and dividend-

paying stocks for

Islamic fixed-income

funds.

Balanced or Mixed

Fund

Its investment objective is to attain a mix of

safety,

income

and

capital

appreciation/growth while avoiding excessive

risk. Investment in each asset class usually

must remain within the minimum and

maximum ratios.

Mix of stocks (for

growth), bonds,

money market

instruments or other

fixed-income

instruments (for

income).

Shariah-compliant

stocks and sukuk for

Islamic balanced

funds.

Index Fund

The investment portfolio is constructed to

match or track the components of a market

index. It, therefore, aims to replicate the

performance of a benchmark index, regardless

of market conditions. This type of fund falls

within the category of passive investing.

Invest in all the

constituents of the

market index or

representative

securities of the

market index.

Fund of Funds

Invests in units/shares of other investment

funds instead of investing directly in stocks,

bonds or other securities. This investment

strategy is also known as a multi-manager

investment, where investments in a variety of

funds are all bundled into a single fund.

Diversification can be achieved by investing in

Units of other funds.