Islamic Fund Management

16

From an Islamic perspective, fund management addresses the following issues faced by an

individual investor seeking Shariah-compliant investment avenues:

Search cost in selecting Shariah-compliant investments.

Screening requires a considerable amount of information (e.g. company annual reports,

accounts) to be scrutinised, perhaps over a period of several years, to discern trends and

know if the investee company has kept to its stated objectives. The fund manager either

adopts its own screening methodologies or tracks an Islamic index.

Skills are required to analyse financial ratios.

Conflicting advice is often given by Shariah scholars, financial advisers and other

consultants. This raises the issue of interpretation and coordination at the level of the

individual investor.

Shariah governance in the form of investment reviews and audits.

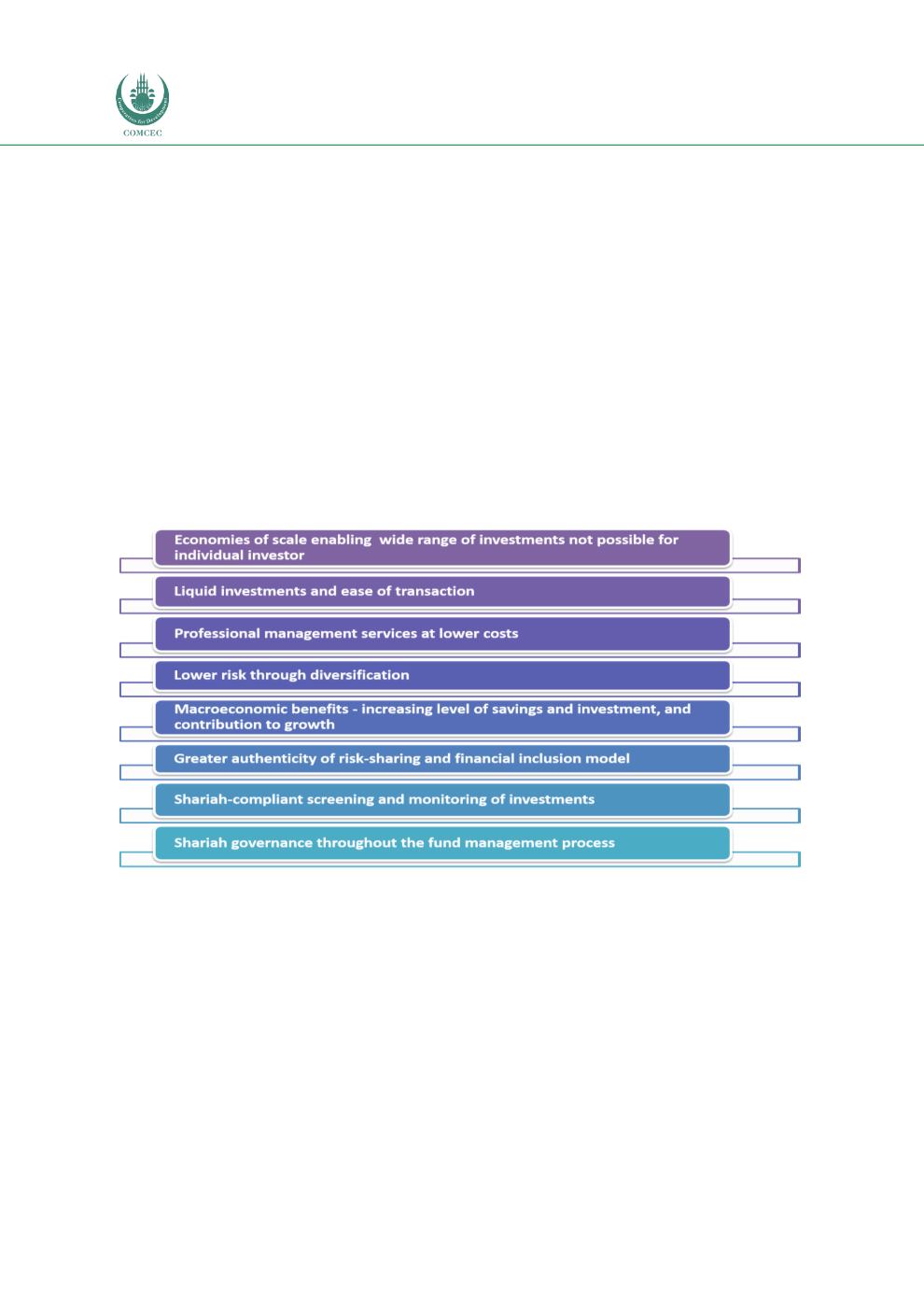

Figure 2.3summarises the roles and advantages offered by Islamic fund management from

both the economic and Islamic perspectives.

Figure 2.3: Roles and Advantages of Islamic Fund Management

Source: ISRA

2.1.4

Different Types of Islamic and Conventional Funds

There are three general types of funds: open-ended, close-ended and exchange-traded. Each of

these offers investors an easy and low-cost opportunity to invest in a diversified pool of

investment with specified investment objectives (Foster, 2014). Specifically, these funds differ

in the following aspects:

An open-ended fund has no limit on the number of units/shares that it can issue. An

investor can purchase/sell units directly from the fund or through authorised agents.

The fund creates more units to meet demand from investors and the money collected is

invested in securities that form the portfolio of the investment fund. The performance of