Islamic Fund Management

17

the underlying assets of the fund determines its NAV, which is calculated at the close of

every trading day. Investors can buy and sell units from the fund at a price determined

by the NAV of the fund. Prices can thus rise and fall based on fluctuations in the NAV.

A close-ended fund issues a fixed number of shares via an initial public offering (IPO).

Once the IPO is over, it is closed to new investments (ISRA, 2015, p. 540). The fund is

listed on the stock exchange and its shares are traded on the exchange. Similar to stocks,

its share price is determined by market supply and demand; it is often trading at a

discount or premium to its NAV (Foster, 2014).

An ETF invests in securities that track an index such as the S&P 500 or the Dow Jones

(ISRA, 2015, p. 543). Its portfolio reflects the constituents of the index and hence

replicates the performance of the index. Ownership of the ETF is divided into shares;

unlike open-ended funds, its shares are traded like stocks on a stock exchange. Its share

price is determined by market supply and demand, similar to a close-ended fund.

However, this more closely tracks its NAV compared to close-ended funds as, unlike the

latter, ETF shares are continuously issued or redeemed by a financial institution (Foster,

2014).

Investment funds can also be categorised based on their investment portfolios, which in turn

reflect the asset class they invest in

. Table 2.2provides a list of different types of funds based

on their investment portfolios and assets.

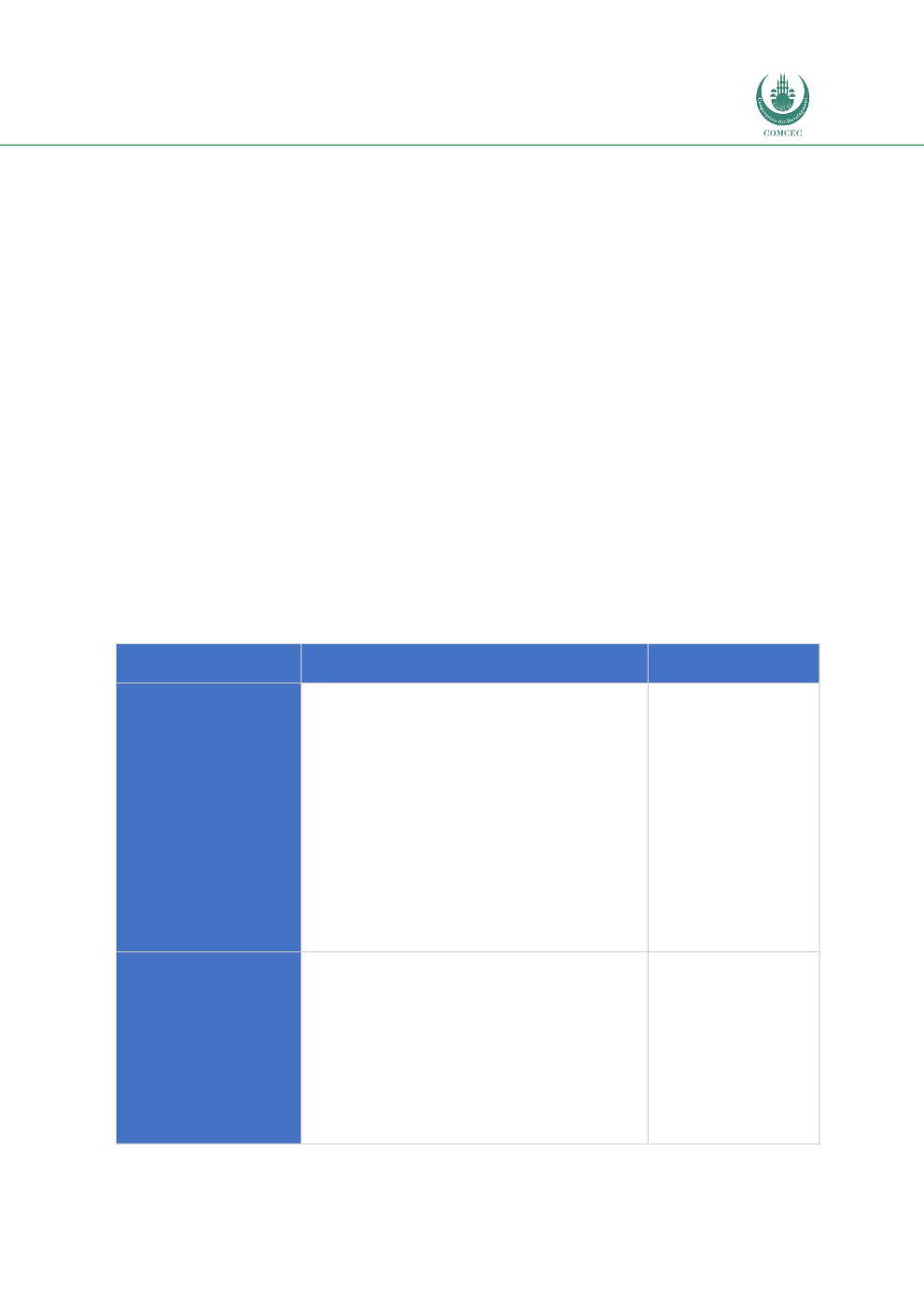

Table 2.2: Type of Funds by Investment Portfolio and Asset Class

Type of Fund by

Investment Portfolio

Description

Assets Invested In

Equity Fund

Principally invests in the stocks of listed

companies. Can be actively or passively

managed (tracks an index). Can be further sub-

categorised into:

Growth fund,

which invests in a

diversified portfolio of stocks that aims for

capital appreciation and pays little or no

dividend. Growth stocks are from

companies that are expected to grow more

rapidly than the overall stock market. They

can be from small- or large-cap companies.

Equity income fund,

which invests in

stocks that provide income to unit holders

in the form of dividends.

Company stocks.

Commodity Fund

Invests in commodities such as precious

metals (e.g. gold), energy resources (e.g. oil

and gas), agricultural goods (e.g. wheat),

livestock (e.g. animals). Besides direct holdings

of commodities, they can also invest in stocks

of companies involved in the commodity

markets (e.g. gold-mining companies) and

commodity options and futures. Generally, the

more a commodity is in demand, the higher the

price and profit for the investor.

Commodities,

commodities options

and futures.

Shariah-compliant

commodities for

Islamic commodity

funds.