Islamic Fund Management

14

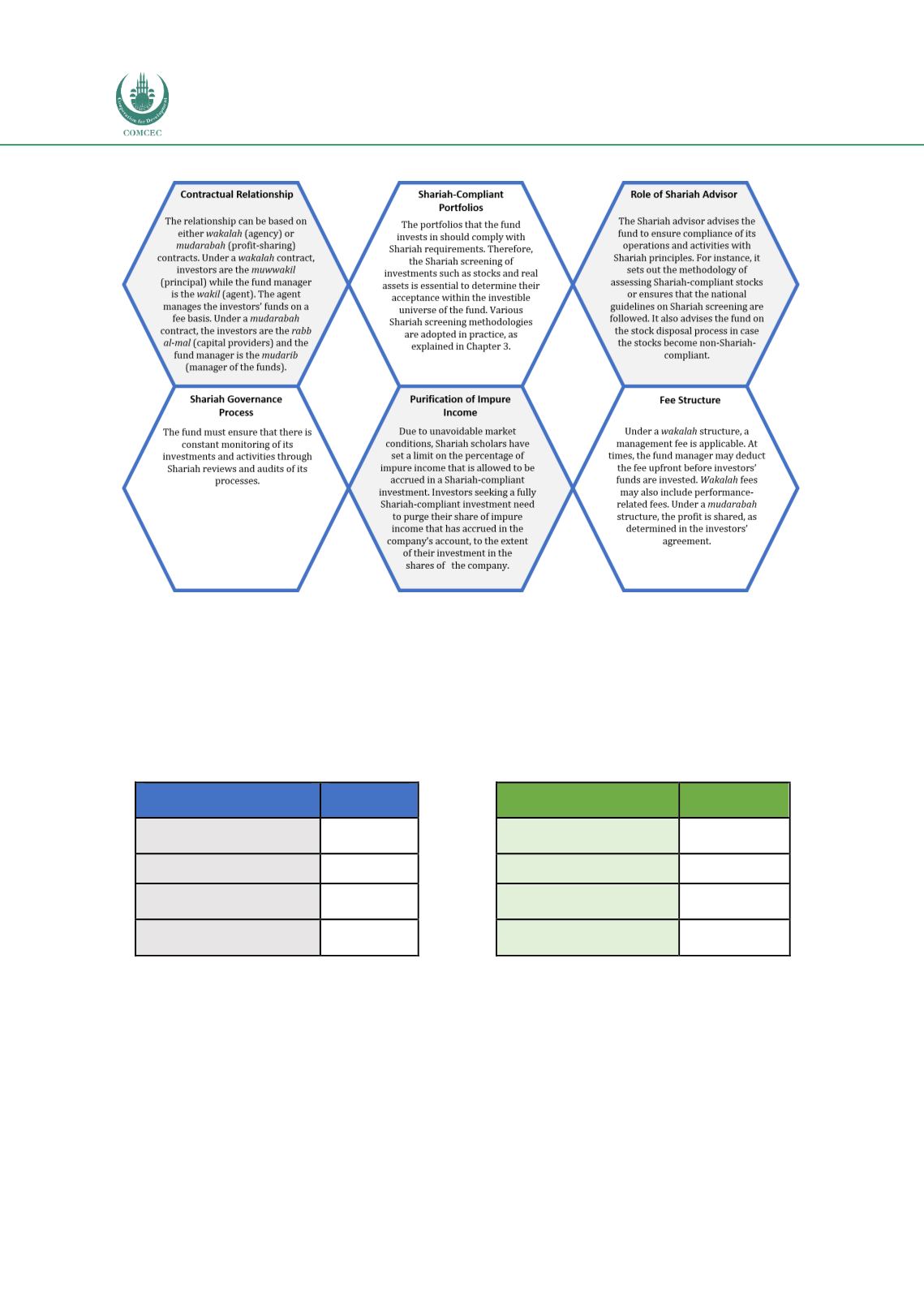

Figure 2.2: Differentiating the Criteria between Islamic and Conventional Funds

Source: Adapted from ISRA (2015)

It is also important to highlight that one of the key effects of Islamic asset management is in

security selection

. Table 2.1 ,for instance, depicts the difference in asset allocation between a

conventional and Islamic investor.

Table 2.1: Difference in Asset Allocation between Conventional and Islamic Investor

Conventional Investor

Islamic Investor

Asset Class

Allocation

Asset Class

Allocation

Money market funds

5%

Murabahah

and trade

finance funds

5%

Fixed income

40%

Sukuk

40%

Equities

40%

Shariah-compliant

equities

40%

Alternative Investments

15%

Shariah-compliant

alternatives

15%

Source: Sandwick (2016)

2.1.3

Role of Fund Management from Economic and Islamic Viewpoints

In many countries, the development of banking is often prioritised to the detriment of fund

management. This has a potentially negative impact on financial stability―as fractional reserve

banking is a more fragile model―and efficient capital mobilisation. Banks favour collateralised

capital lending to the

public/corporate sector

and personal (home and car) segment. This

leaves small and medium enterprises (SMEs) relatively underserved. Specialised VC and PE

funds are generally skilled at deploying capital, raising corporate capabilities and enhancing