Islamic Fund Management

20

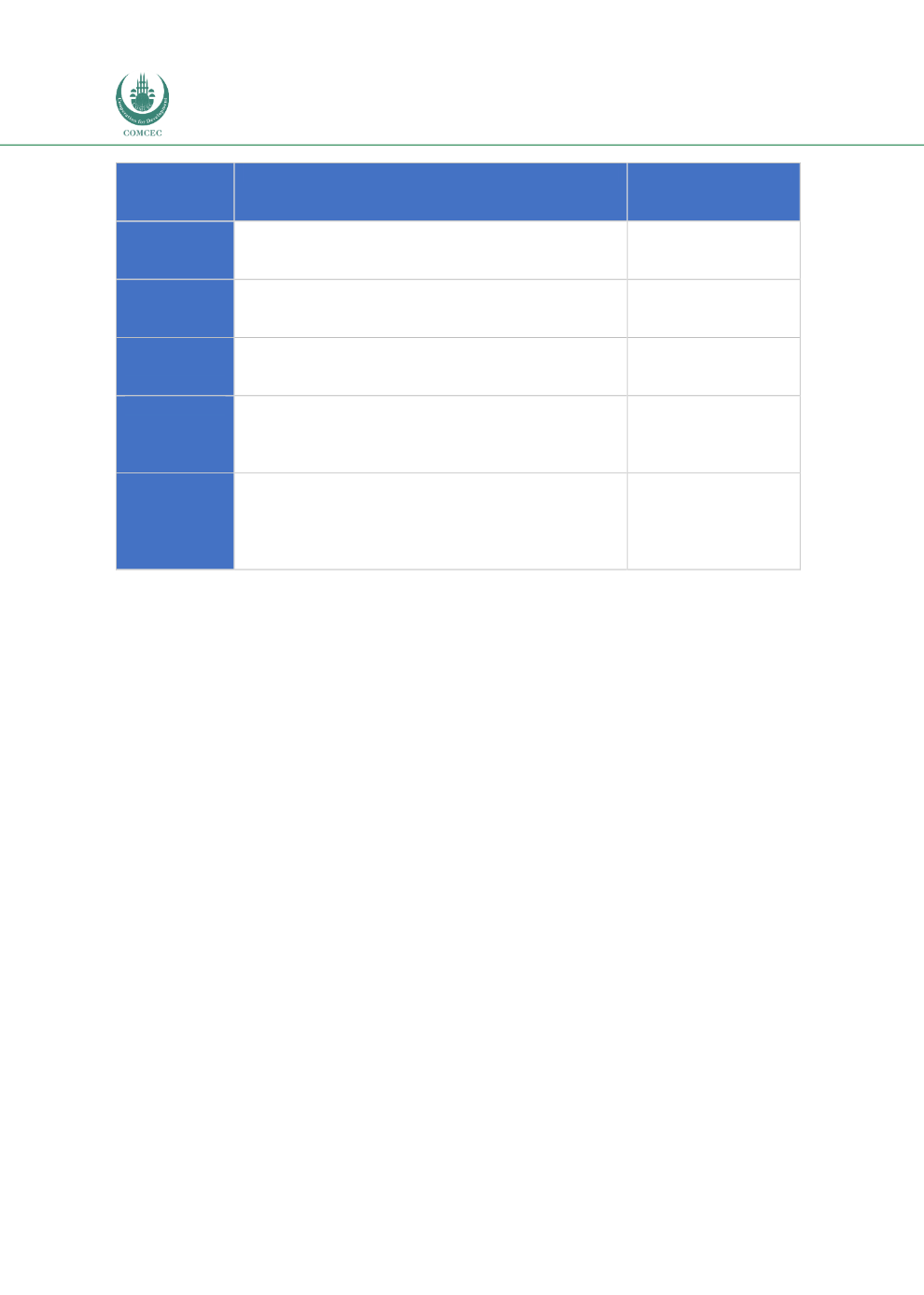

Alternative

and Islamic

Funds

Description

Assets Invested In

national objectives such as economic development,

capital maximisation and stabilisation (PWC,

Sovereign Investors 2020).

such as oil and gas,

private equities.

Ijarah

Fund

Invests in real assets, which are then leased and

generate rental payments to the unit holders. A REIT

is an example of an

ijarah

fund.

Leased assets.

Murabahah

Fund

Involves the purchase and sale of commodities or real

assets on deferred payment terms. An example is a

commodity

murabahah

fund.

Commodities, real

assets.

Hajj

Fund

Entails collecting, managing and investing the savings

of those wishing to go for their

hajj

(pilgrimage). An

example is Lembaga Tabung Haji―popularly known

as Tabung Haji (Pilgrimage Fund) in Malaysia.

Shariah-compliant

investments, e.g.

Islamic securities,

commodities, assets.

Waqf

Fund

Involves the management of

waqf

properties, and

investing the returns in Shariah-compliant assets.

Properties,

investments with

social objectives (e.g.

healthcare, education,

poverty reduction).

Sources: ISRA (2015), ISRA

2.1.5

General Principles of Fund Set-Up, Historical Evolution, Key Global Trends

The basic principles of fund set-up, as briefly noted in

Figure 2.4 ,are applicable to both

conventional and Islamic funds. Setting up a fund involves considering key aspects such as

determining the domicile country that offers the right level of a regulatory framework to

establish the fund, accounting for the target investors and their needs, determining the

investment objectives and strategies of the fund, and selection of securities. These are

considered during the different stages of the fund’s setting up.