Islamic Fund Management

11

2.

REVIEW OF GLOBAL ISLAMIC FUND MANAGEMENT INDUSTRY

The Islamic equity market has evolved through the years, from the development of Shariah-

compliant screening methodologies that have led to the development of Shariah-compliant

stocks and Islamic indices, to the development of more innovative structured investment

products and different types of funds. Besides products and services, the Islamic equity market

has also expanded in terms of market players, geographical coverage, infrastructure

development, financial technology, sustainable strategies, and other areas. This chapter sheds

light on the development trends in the global fund management industry, particularly Islamic

funds. It explains the principles, roles, functions, mechanisms, evolution and future trends in

Islamic fund management.

2.1

Development of Global Fund Management Industry

2.1.1

Definition of Fund Management

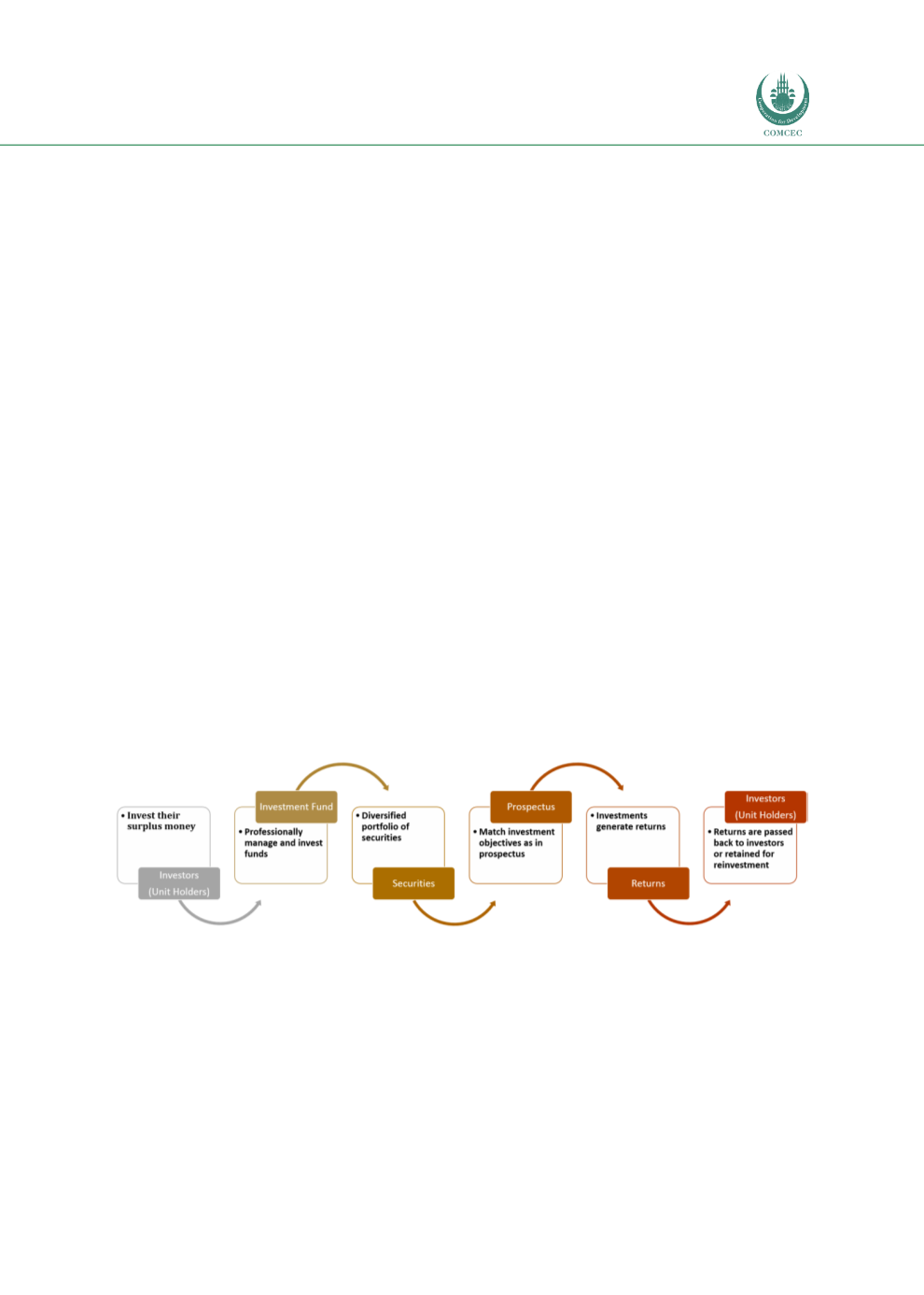

Fund management involves a group of investors channeling their surplus money to a legal

entity known as a ‘fund’, which pools the collected funds and invests it in a diversified portfolio

of securities and other assets to achieve specific financial goals (ISRA, 2015, p. 524). Investors,

usually known as shareholders or unit holders, can be individuals or institutions. The legal

entity that professionally manages the funds and undertakes the investment on behalf of the

investors is known as a fund manager or fund management company. The fund manager

handles the clients’ investments, establishing a portfolio of assets constituting securities such

as stocks, bonds, money market instruments, a combination of these or even other funds. The

fund’s portfolio of investments is structured and maintained to match its investment

objectives, as stated in its prospectus. The flow chart of the fund management process is

depicted i

n Figure 2.1 .Figure 2.1: Flow Chart of the Fund Management Process

Source: ISRA

The fund sells shares or units to investors and redeems shares from those who wish to have

their money back, at a price determined by the current net asset value (NAV) of the fund

(Gerber, 2008, p. 3). The NAV is the price of one share in the fund at the end of the trading day.

To get an initial unit value of a share at the time the fund is created, the monetary value of its