Islamic Fund Management

109

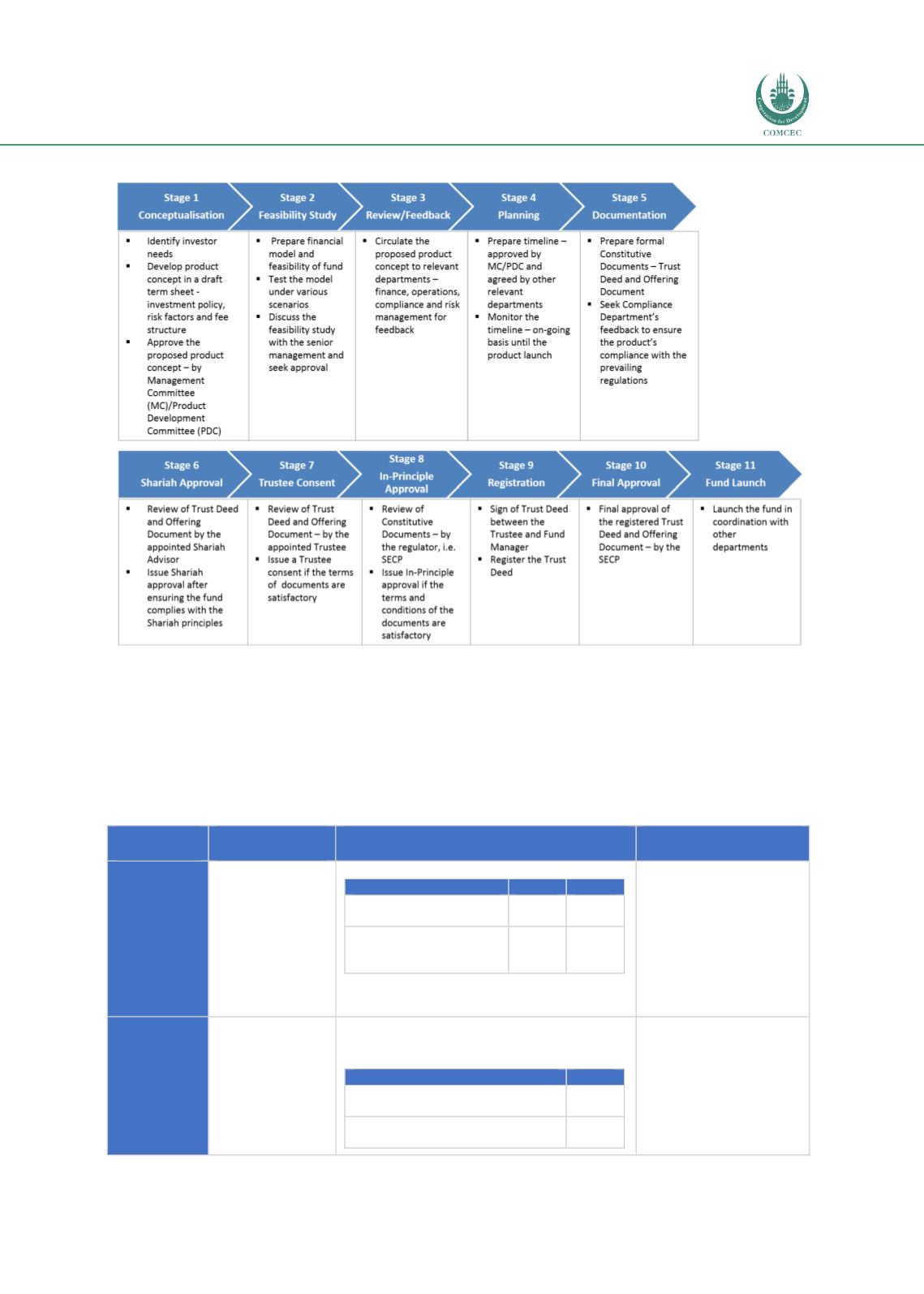

Figure 4.12: Process Flow of Fund Development in Pakistan

Source: Al Meezan Investment

As at end-2017, there are 11 categories of Islamic funds offered in Pakistan―as approved by

the SECP. Investment in these funds is driven by individual investment objectives and risk

appetites

. Table 4.14highlights some key investment strategies, authorised asset allocation or

investment avenue, and product suitability that AMCs in Pakistan consider when

recommending a certain type of Shariah-compliant fund.

Table 4.14: Investment Strategies of Different Types of Islamic Funds in Pakistan

Type of

Fund

Investment

Strategy

Asset Allocation/ Authorised Investment

Product Suitability

Shariah-

Compliant

Equity Fund

To

provide

potential for high

growth

and

returns with a

relatively

high

level of risk.

Asset allocation

Min

Max

Shariah-compliant listed

securities

70%

100%

Islamic bank deposits

(excluding term-deposit

receipts (TDRs))

0%

30%

Investors who seek:

High risks with high

returns

on

their

investments.

Long-term

wealth

creation.

A diversified equity

fund that aims for

capital appreciation.

Shariah-

Compliant

Index

Tracker

Fund

To

provide

returns that are

in line with the

performance of

benchmark

indices such as

the KMI-30.

Strive to invest 100% according to the stated

index. Otherwise, the fund should invest in:

Asset allocation

Max

Shariah-compliant

securities

covered by the index

85%

Cash in Islamic banks/Islamic

banking windows (excluding TDRs)

15%

Investors who seek:

High risk with high

returns

on

their

investments.

Cost-efficient way to

invest

in

specific

benchmark indices.

A passive investment