Islamic Fund Management

107

Islamic REITs

As part of the government’s efforts to boost the fund management industry, the SECP issued

REIT Regulations in 2008. Nonetheless, the industry only witnessed the launch of the first

REIT in Pakistan and South Asia on 26 June 2015, i.e. Dolmen City REIT issued by Arif Habib

Dolmen REIT Management Limited―a joint venture between Arif Habib Group and Dolmen

Group, following the issuance of revised REIT Regulations 2015 by the SECP. The pioneer REIT

was listed on the Karachi Stock Exchange (KSE) and the Lahore Stock Exchange (LSE) as a

close-ended Shariah-compliant rental REIT, allowing investors to become the unit holders of

two components of the Dolmen City project, i.e. Dolmen Mall Clifton and Harbor Front.

There are three types of REITs in Pakistan:

1.

Rental REITs:

Investments in commercial or residential real estate with the objective of

generating rental income. In a rental REIT, the RMC buys a completed/constructed

property and leases it out. Revenue from the rental is distributed to the unit holders.

2.

Developmental REITs:

Investment in real estate to develop it for industrial,

commercial and residential purposes via construction or refurbishment. The property is

subsequently sold or rented and the proceeds are distributed to the unit holders.

3.

Hybrid REITs:

An investment in a portfolio of buildings for rental and property for

development.

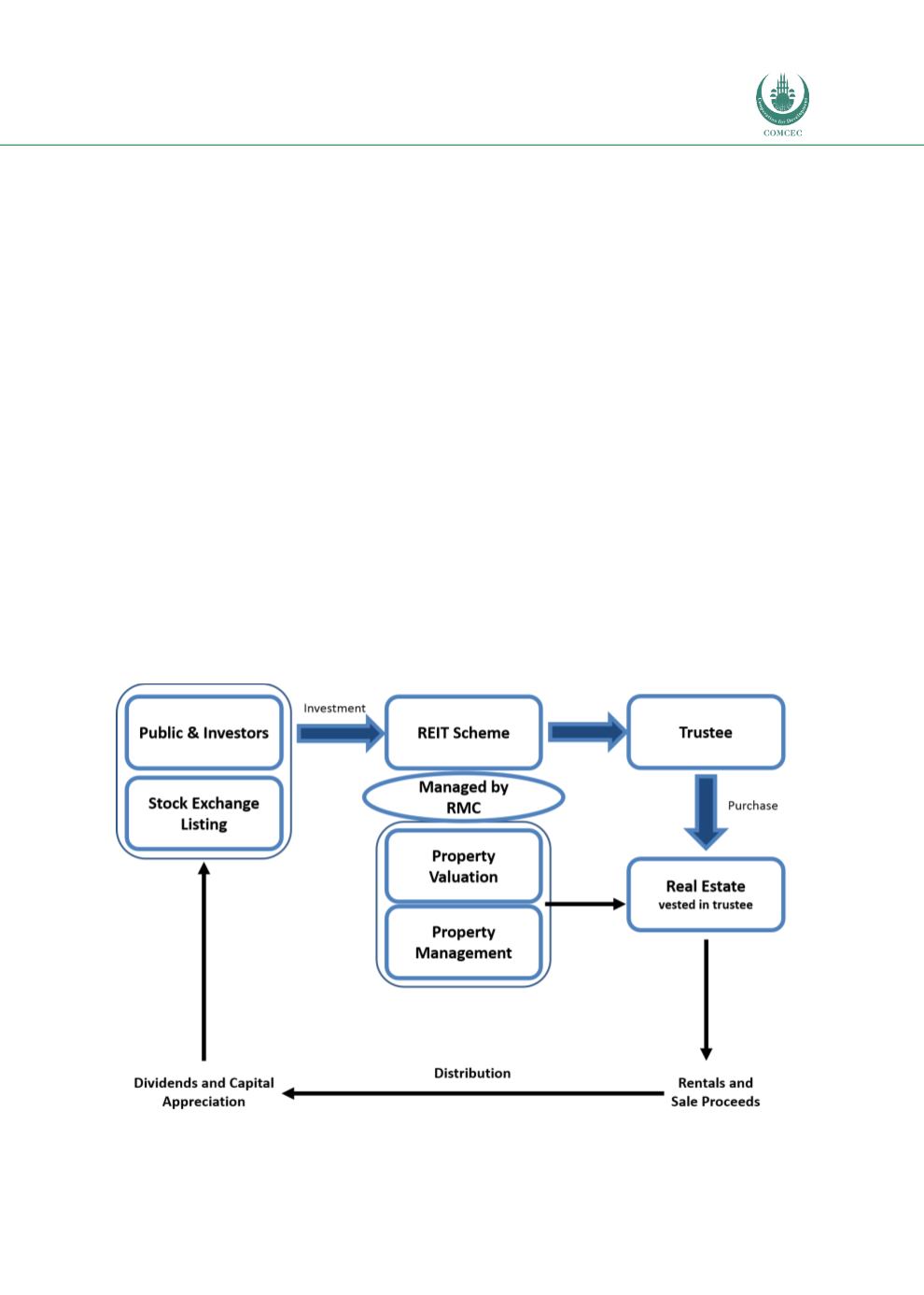

The mechanics of Islamic REITs in Pakistan are explained i

n Figure 4.11 .Figure 4.11: Structure of Islamic REITs in Pakistan

Source: Arif Habib Dolmen (n.d)