Islamic Fund Management

95

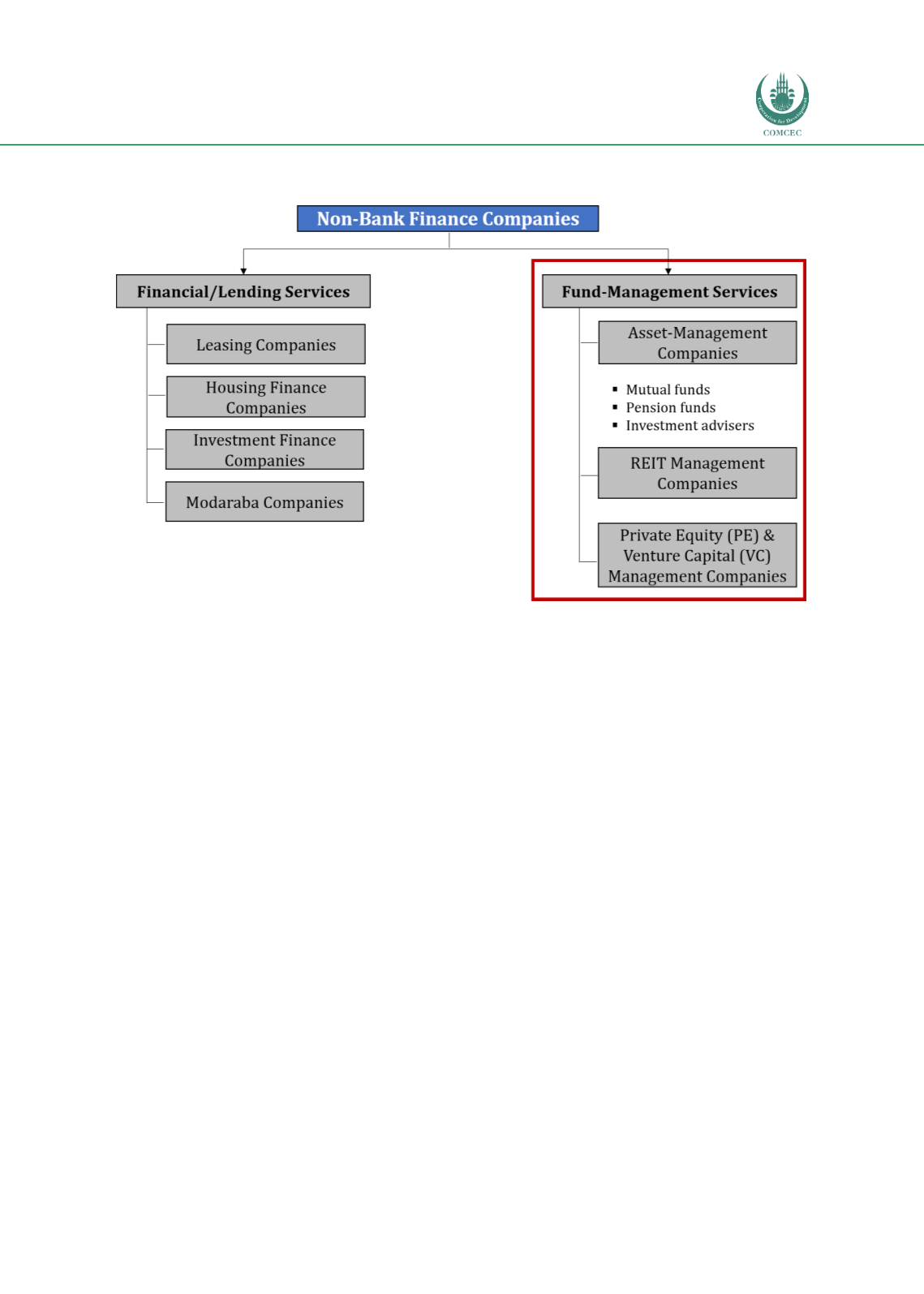

Figure 4.9: Broad Categories of NBFCs in Pakistan

Source: Adapted from Pakistan Islamic Finance Report (2016)

The overall development of the Islamic finance industry in Pakistan lags far behind the

conventional finance market and requires strong regulatory support. This is especially so for

NBFIs/NBFCs that have been dwarfed by commercial banks, which offer similar financial

services at lower costs due to their extensive outreach and economies of scale (Pakistan

Islamic Finance Report, 2016).

As part of the government’s initiatives to spur the growth of Islamic finance in the country, the

SBP issued a Strategic Plan for the Islamic Banking Industry (2014-2018). The SBP targets

Islamic banking assets to account for 15% of the total market by end-2018. The SECP

established the Islamic Finance Department (IFD) in 2015. Its main responsibilities are to

regulate and supervise the Islamic capital market, and to ensure that Shariah-compliant

companies adhere to the principles of Shariah in conducting their business operations. Among

commendable initiatives undertaken by the IFD is the incorporation of provisions pertaining

to Shariah-compliant companies and securities under the Companies Act 2017 (Section 451),

the release of Shariah Advisor Regulations 2017, and the issuance of the Draft Shariah

Governance Regulations 2018 and several Shariah standards of the AAOIFI for adoption and

consultation. In addition, the SECP has also issued the Capital Market Development Plan

(CMDP) (2016-2018), which provides a short-term roadmap for the initiatives envisaged by

the SECP in developing the country’s capital markets within three years.

Box 4.3gives an

overview of the CMDP.