Islamic Fund Management

97

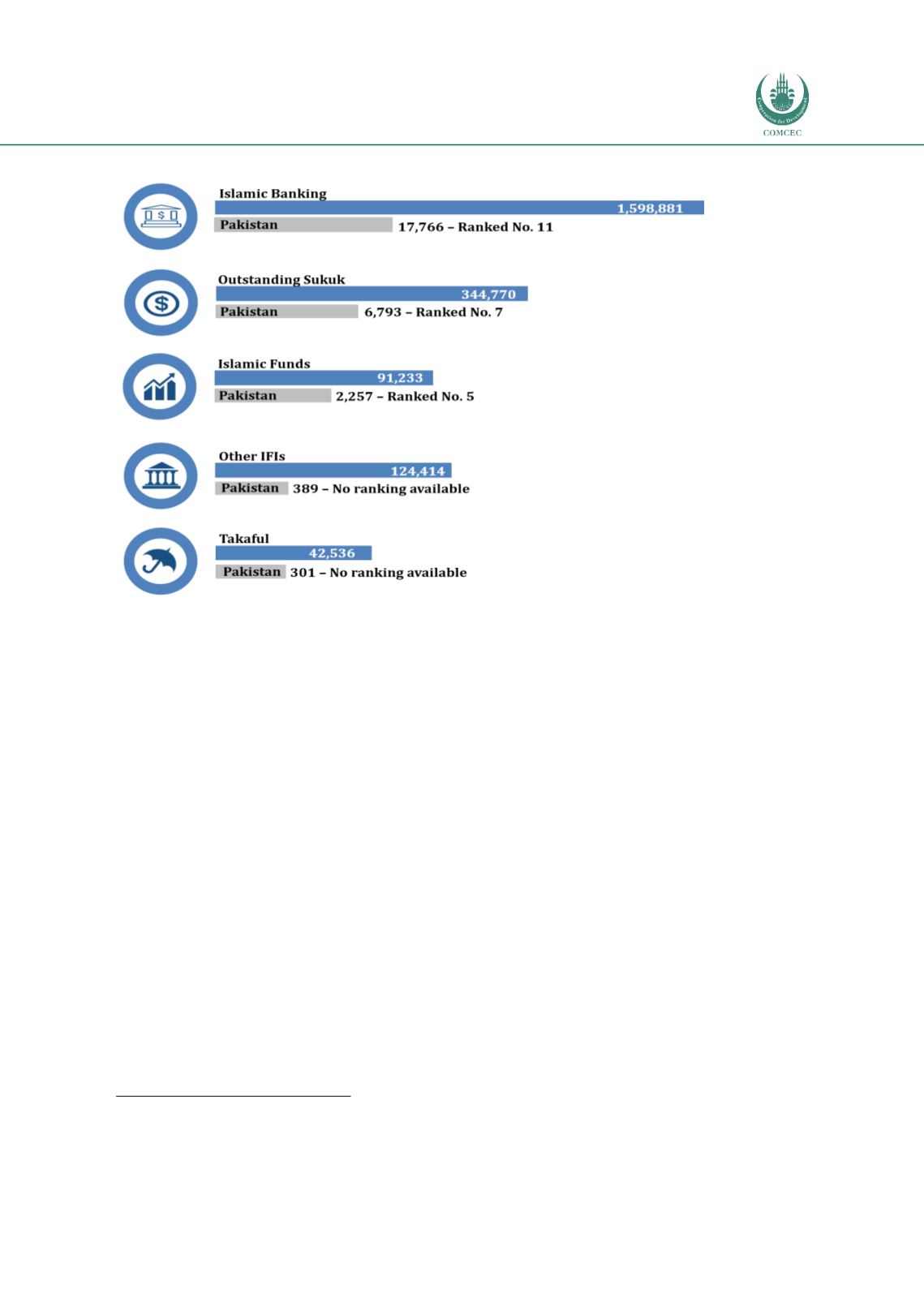

Chart 4.7: Global vs Pakistan’s Total Islamic Finance Assets in 2016 (USD million)

Sources: SBP (2017), SECP (2017), ICD-Thomson Reuters Report (2017)

Note: Only data on sukuk and Islamic funds are sourced from the ICD-Thomson Reuters Report 2017, to ensure

consistency with other case studies; data on Islamic banking assets are sourced from the SBP and the rest are

from the SECP.

Chart 4.8 ,on the other hand, presents Pakistan’s Islamic finance assets vis-à-vis the

conventional counterpart. As at end-2017, Pakistan’s Islamic banking assets summed up to

PKR2,272 billion (2016: PKR1,853 billion), representing 12.4% of its overall banking industry.

This figure is expected to be lifted 15% by end-2018. While total outstanding sukuk rose from

PKR1132.38 billion in 2016 to PKR1176.39 billion in 2017, Islamic funds’ AuM surged to

PKR296.24 billion in 2017 (2016: PKR196.41 billion), translating into 45% of the overall fund

management industry.

9

Other Islamic NBFC assets, i.e.

modarabas

’ assets also trended

upwards in 2017 with a total of PKR48.09 billion (2016: PKR40.6 billion). At the same time,

takaful

assets augmented from PKR31.46 billion to PKR44.25 billion over the same period.

9

This includes Islamic mutual funds, Islamic voluntary pension schemes and Islamic REITs, but exclude

discretionary and

non-discretionary portfolios

managed by AMCs.