Islamic Fund Management

98

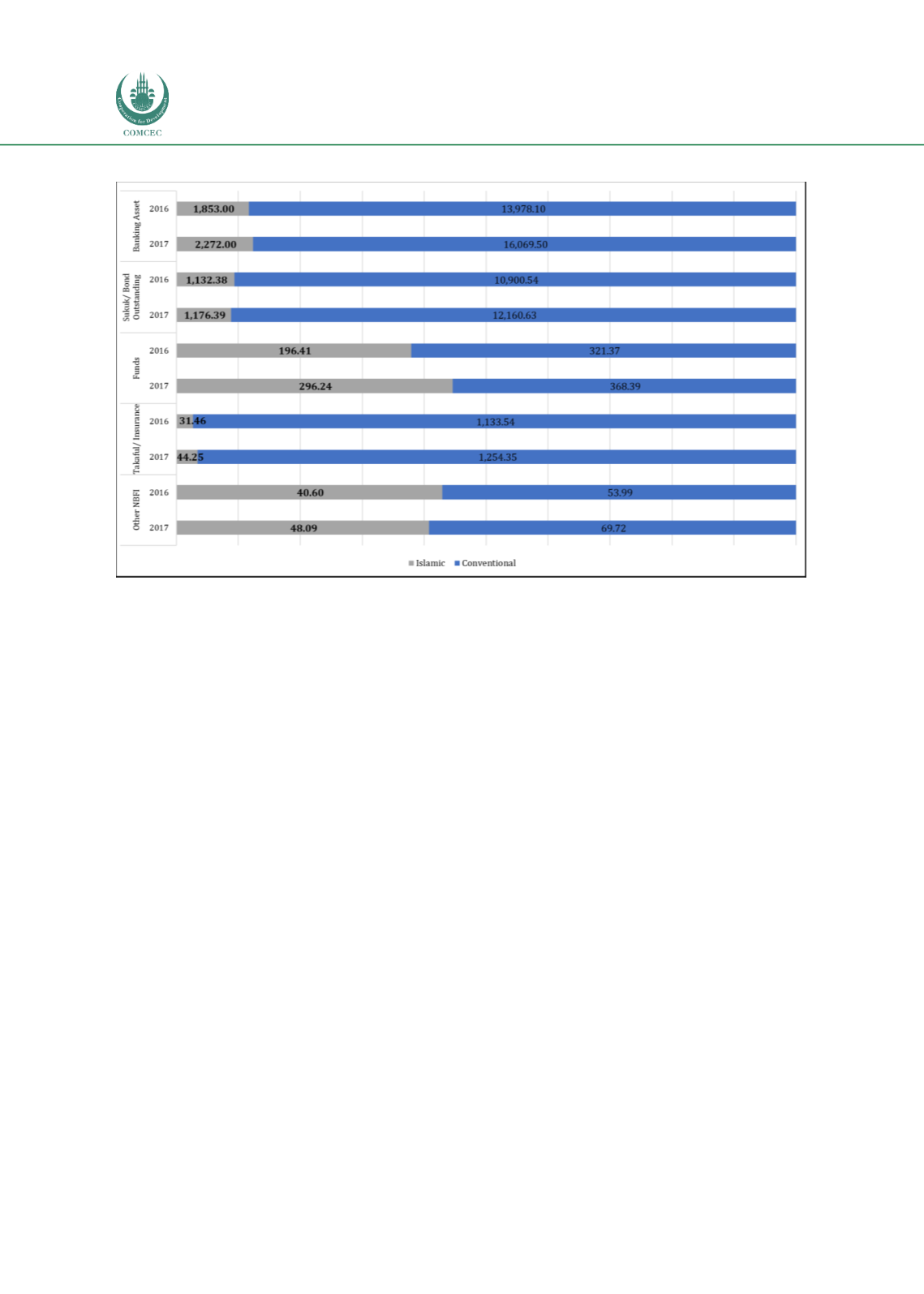

Chart 4.8: Pakistan’s Total Finance Assets – Islamic vs Conventional (PKR billion)

Sources: SBP (2017), MUFAP (2017), SECP (July, 2016), SECP (2017, June), SECP, SBP

Note: The total assets of the Islamic fund management industry, as shown in this chart, include Islamic mutual

funds, Islamic voluntary pension funds managed by AMCs and Islamic REITs only, and exclude Islamic

discretionary and non-discretionary portfolios managed by AMCs due to unavailability of sufficient data.

All numbers are as at end-2016 and end-2017 except for funds (as at June-2016 and June-2017).

Share of Domestic Islamic Funds against Total Funds Managed

The size of the fund management industry in Pakistan is relatively small compared to other

matured markets. However, the size of Islamic mutual funds has been growing positively.

Chart 4.9shows that Islamic AuM climbed up from 19% (PKR69,299 million) in 2013 to 45%

(PKR296,241 million) of Pakistan’s total fund management industry (PKR664,632 million) in

2017.

Chart 4.10depicts the number of Islamic funds vis-à-vis conventional funds between

2013 and 2017. The former indicates steady growth and outnumbered its conventional

counterpart by 50.64% (118 of 233 funds) in 2017.