The Role of Sukuk in Islamic Capital Markets

68

3.5.3

AFRICAN REGION

In terms of financial market development, African countries liberalized their financial sectors

in the late 1980s and 1990s, as part of the structural adjustment programmes promoted by the

IMF and the World Bank. The reforms included the removal of credit ceilings, the liberalization

of interest rates, the restructuring and privatization of state-owned banks, and the

introduction of a variety of measures to promote the development of private banking systems

and financial markets (Review of Development Finance, 2015). These measures had been

accompanied by bank supervisory and regulatory schemes, including the introduction of

deposit insurance in certain countries (Cull et al, 2005). South Africa’s financial market seems

to be the most advanced compared to its peers, as depicted by an increase in its outstanding

bonds and market capitalization as a percentage of GDP. Overall, despite the growth of Africa’s

financial system, it remains relatively underdeveloped compared to other up-and-coming

emerging markets. Table 3.18 shows the composition of financial markets as a percentage of

GDP.

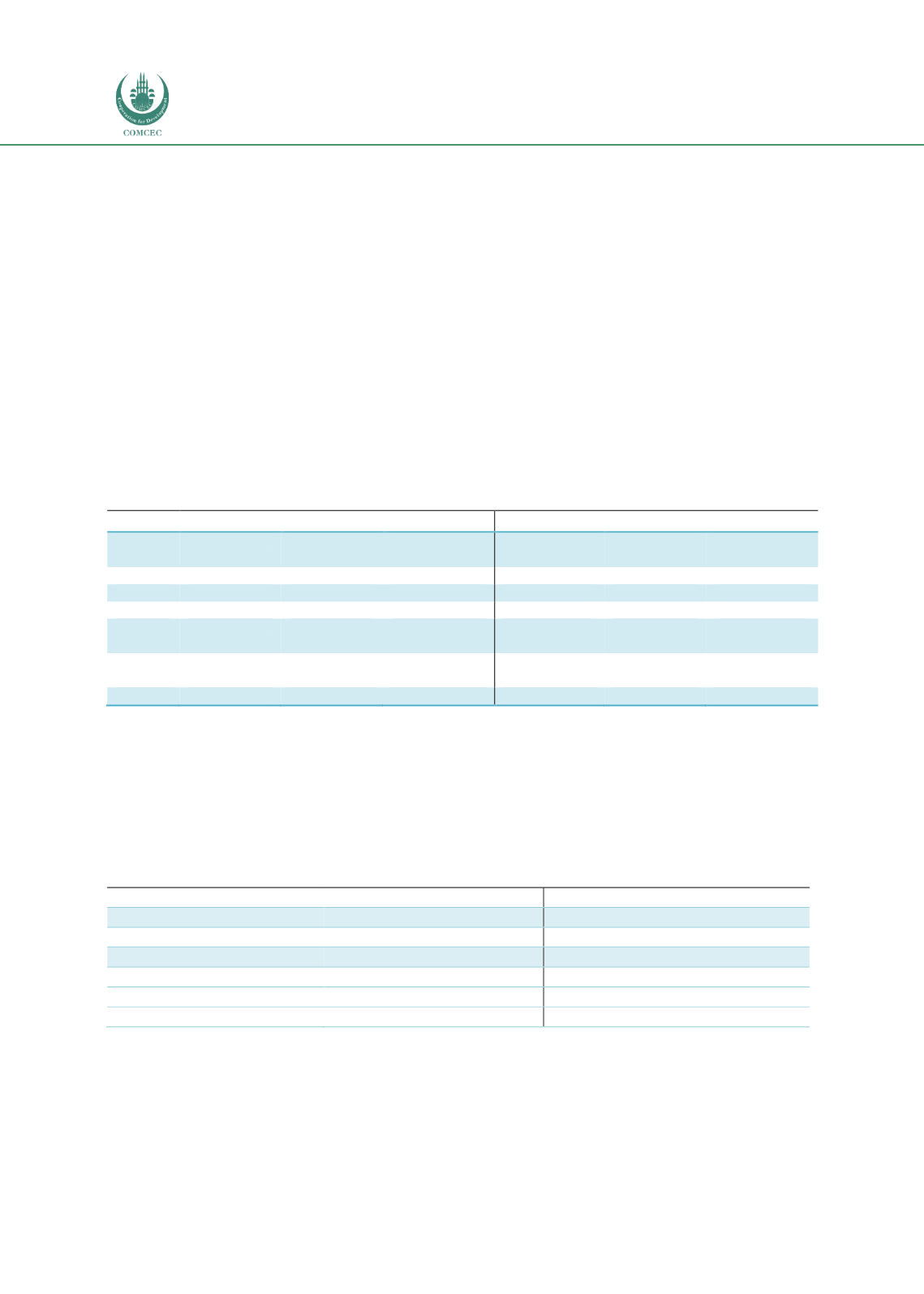

Table 3.18: Composition of Selected African Financial Markets as a Percentage of GDP

Historical data

Data based on latest available date

Country Outstanding

bond

Outstanding

loan

Market

Capitalization

Outstanding

bond

Outstanding

loan

Market

Capitalization

Gambia

0% (2012) 42.4%(1980)

17.0% (2003)

0.2% (2016) 40.4%(2014)

n/a

Nigeria

5.5% (2012) 18.2%(1980)

14.0% (2003)

12.4% (2016) 18.3%(2014)

7.4% (2016)

Senegal

8.4% (2012) 38.4%(1980)

n/a

30.0% (2016) 38.8%(2014)

n/a

Ivory

Coast

50.9%(2012) 40.8%(1980)

12.0% (2003) 120.4%(2016) 26.3%(2014)

34.2% (2016)

South

Africa

34.0%(2012) 49.6%(1980)

161.6%(2003)

82.7%(2016) 77.2%(2014) 322.7%(2016)

Sudan

n/a 17.0%(1980)

n/a

n/a

9.8% (2014)

n/a

Source: The Global Economy

*n/a. – not available

Based on the composite mix of investors, Africa’s debt securities are mainly held by foreign

holders. Although African governments have implemented measures to heighten the

development of NBFIs, challenges such as financial inclusion and a low savings rate have been

hampering progress, as depicted in Table 13.9.

Table 3.19: Key Indicators of Financial Intermediation by NBFIs as a Percentage of GDP

Country

NBFIs assets as % to GDP

Pension fund assets as % to GDP

The Gambia

n/a

n/a

Nigeria

n/a

4.4% (2012)

Senegal

n/a

n/a

Ivory Coast

n/a

n/a

South Africa

120.3% (2014)

40.8% (2014)

Sudan

n/a

n/a

Source: The Global Economy

*n/a. – not available