63

Value Proposition

Key to the sustainability of a sukuk market’s development is the establishment of an LCY sukuk

market where the private sector participates frequently. To attract the private sector is to

build a strong value proposition for sukuk that is embedded in the country’s roadmap or

financial masterplan. The stability of macroeconomic factors plays a significant role in

determining the stage of the sukuk market’s progress. The amalgamation of all these factors is

a prerequisite for the growth of a country’s ICM.

3.5

COMPREHENSIVE ASSESSMENT OF SUKUK INVESTMENTS – DEMAND

(BUY SIDE)

3.5.1

ARAB REGION

According to the World Bank, the financial industry in the GCC is generally dominated by the

banking sector. NBFIs have a limited presence in the GCC. Investment funds have been

increasing rapidly in several countries, although largely focused on domestic equities and real

estate. The insurance sector remains small and targets property/casualty risks. Contractual

savings are underdeveloped and dominated by public pension systems, which are mainly

defined as “pay as you go” schemes (World Bank Group, 2015). They contribute little to the

accumulation of long-term resources for investment. Since most investment funds are owned

by banks, it is not surprising that domestic investors of GCC sukuk largely comprise local

financial institutions. Table 3.14 shows the compositions of financial markets as a percentage

to GDP while Table 3.15 highlights the key indicators of financial intermediation by NBFIs as a

percentage of GDP in the GCC countries.

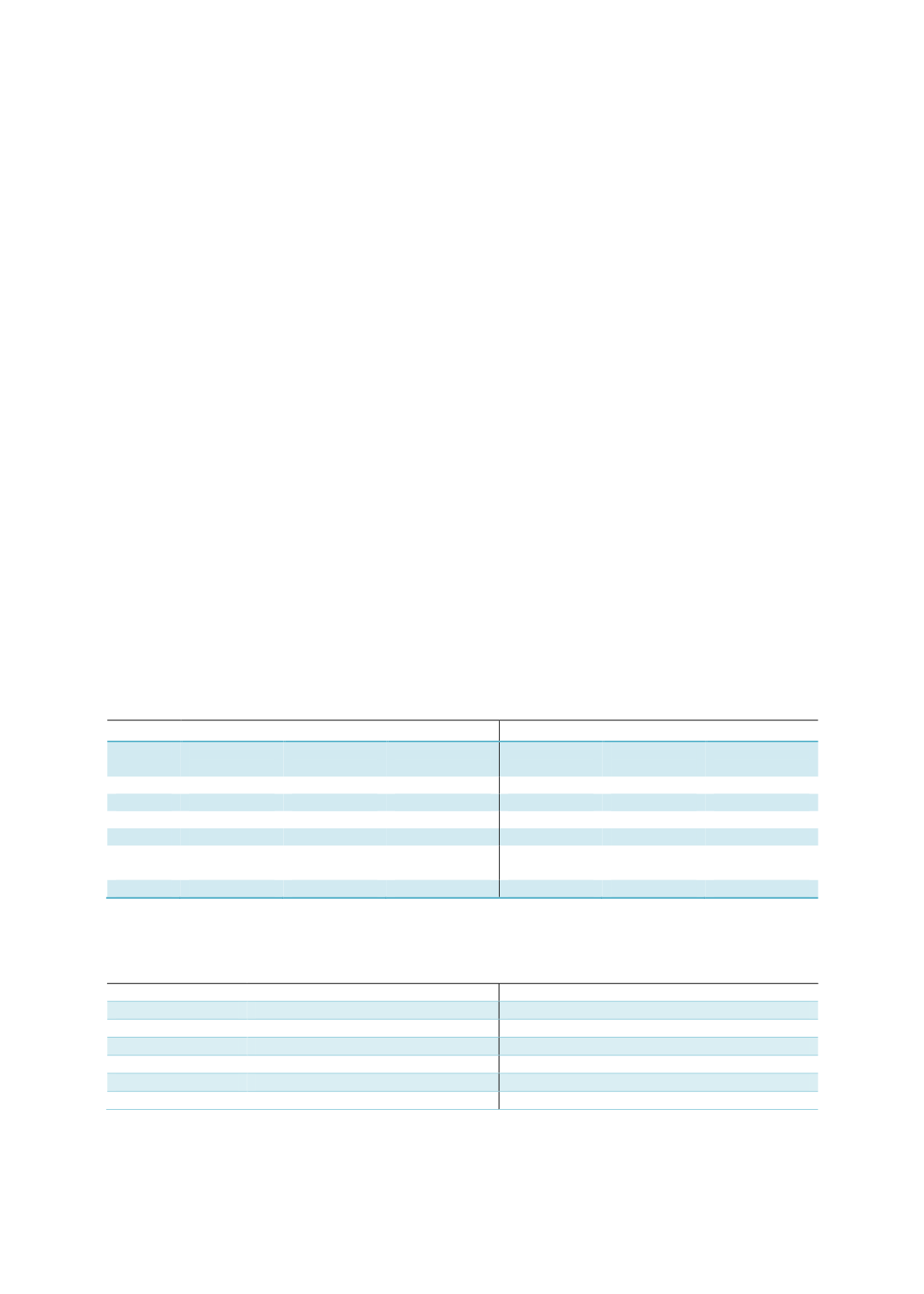

Table 3.14: Composition of Financial Markets by Country as a Percentage of GDP

Historical data

Data based on latest available date

Country

Outstanding

bond

Outstanding

loan

Market

Capitalization

Outstanding

bond

Outstanding

loan

Market

Capitalization

Bahrain

25.7%(2012) 40.0%(1990)

77.2% (1996) 94.5%(2016) 91.1%(2014)

60.9% (2016)

Kuwait

0.4% (2012) 96.5%(1995)

43.9% (1993)

6.2%(2016) 70.8%(2014)

105.4%(2006)

Oman

0.8% (2012) 13.9%(1980)

12.9% (1993) 22.8%(2016) 49.0%(2014)

35.1%(2016)

Qatar

23.3%(2012) 77.6%(1993)

119.8%(

2007) 49.3%(2016) 67

.7%(2014)

101.5%(2016)

Saudi

Arabia

1.7% (2012) 24.7%(1988)

74.2% (2009) 10.8%(2016) 55.8%(2014)

69.4% (2016)

UAE

9.7% (2012) 18.4%(1980)

20.4% (2003) 29.6%(2016) 90.3%(2014)

61.1% (2016)

Sources: World Bank, Bloomberg, The Global Economy

Note: Outstanding loans is defined as bank credit to the public and private sectors.

Table 3.15:

Key Indicators of Financial Intermediation by NBFIs as a Percentage of GDP

Country

NBFIs assets as % to GDP

Pension fund assets as % to GDP

Bahrain

31.5% (2014)

20.5% (2006)

Kuwait

2.44% (2014)

n/a

Oman

n/a

n/a

Qatar

n/a

n/a

Saudi Arabia

14.4% (2014)

26.0% (2016)

UAE

n/a

2.7% (2007)

Source: The Global Economy