61

3.4.4

SUKUK ISSUANCES IN NON-OIC COUNTRIES

To allow sovereigns to issue sukuk, changes have been made to the countries’ tax and legal

frameworks. For example, the UK’s Finance Act 2009, which received royal assent on 21 July

2009, removed the tax barriers that had rendered Shariah-compliant financial products less

tax-efficient than their conventional counterparts. The enactment of the legislation had been

envisaged to promote the UK’s ambition of becoming a leading international centre for Islamic

finance. A key component adopted by the UK in enabling Islamic finance is the embedding of

the ability to allow future adjustments by way of statutory instruments (or other forms of

guidance), without necessarily requiring primary legislation (SEDCO Capital, 2014). This

approach demonstrates the government’s willingness to make any adjustment to facilitate

other types of issues, showing that it has both the legislative authority and the tools available

to do so. Unfortunately, there has been no further development to date in the UK’s sukuk

market.

France and Luxembourg have also enacted tax regulations that specifically show how Islamic

financial products are treated according to their tax codes. Elsewhere, Singapore has made

additional amendments to its income tax regulations to clarify in detail how Islamic banking is

handled. Although there have been efforts by governments and regulators to develop the

necessary infrastructure, the number of issues has been rather few. Table 3.12 indicates the

total number of domestic sukuk issuances while Table 3.13 shows the number of international

sukuk issuances by non-OIC countries (outside the Arab, Asian and African regions).

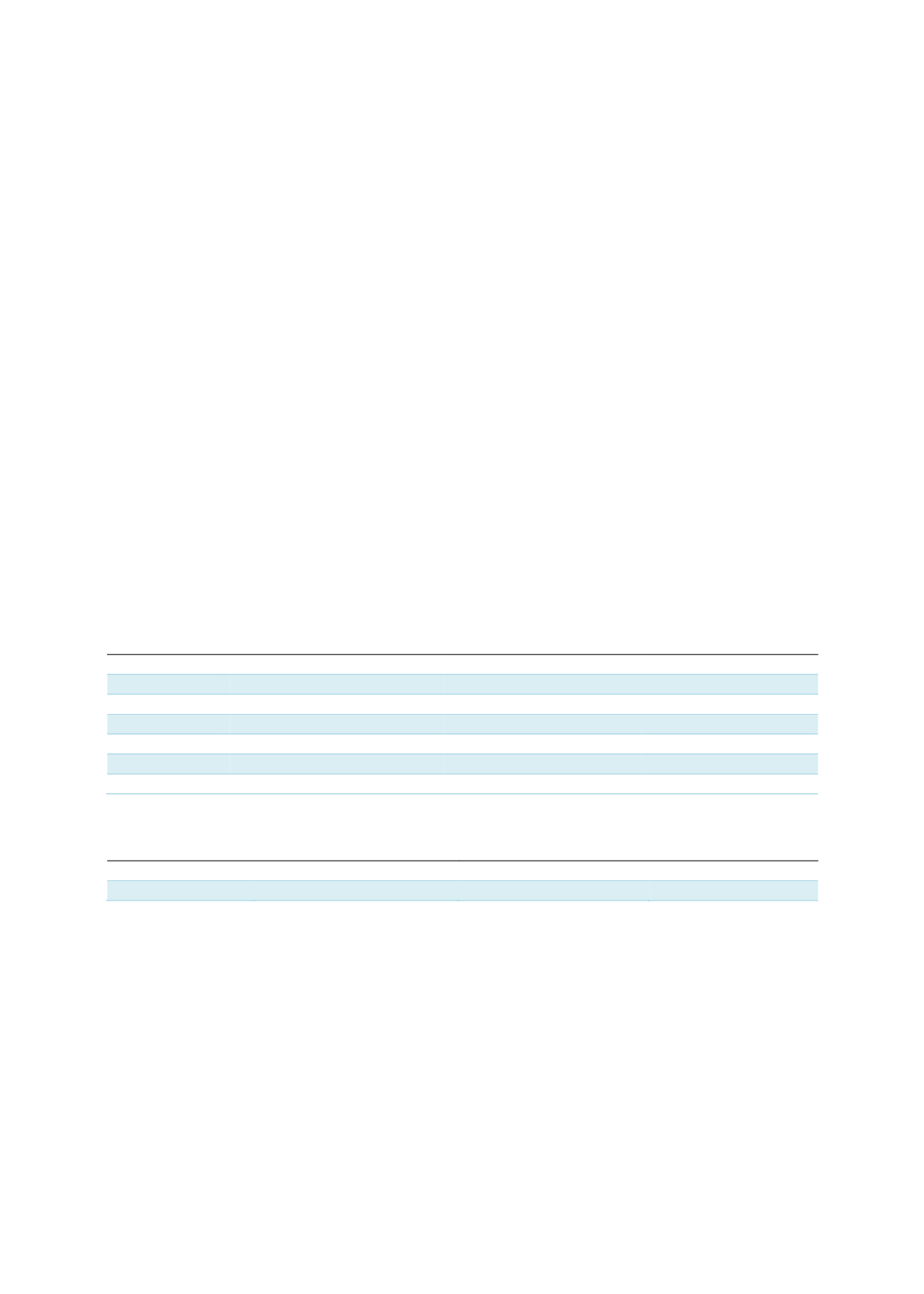

Table 3.12: Number of Domestic Sukuk Issuances by Country (2001-2016)

Europe

Number of sukuk issues

Amount (USD million)

% of the total value

France

1

1

0.0

Germany

2

83

2.8

Luxembourg

3

280

9.0

UK

9

1,368

44.1

US

5

1,367

44.1

Total

20

3,099

100.0

Source: IIFM (2017, July)

Table 3.13: Number of International Sukuk Issuances by Country (2001-2016)

Europe & Others

Number of sukuk issues

Amount (USD million)

% of the total value

Germany

1

123

100.0

Source: IIFM (2017, July)