186

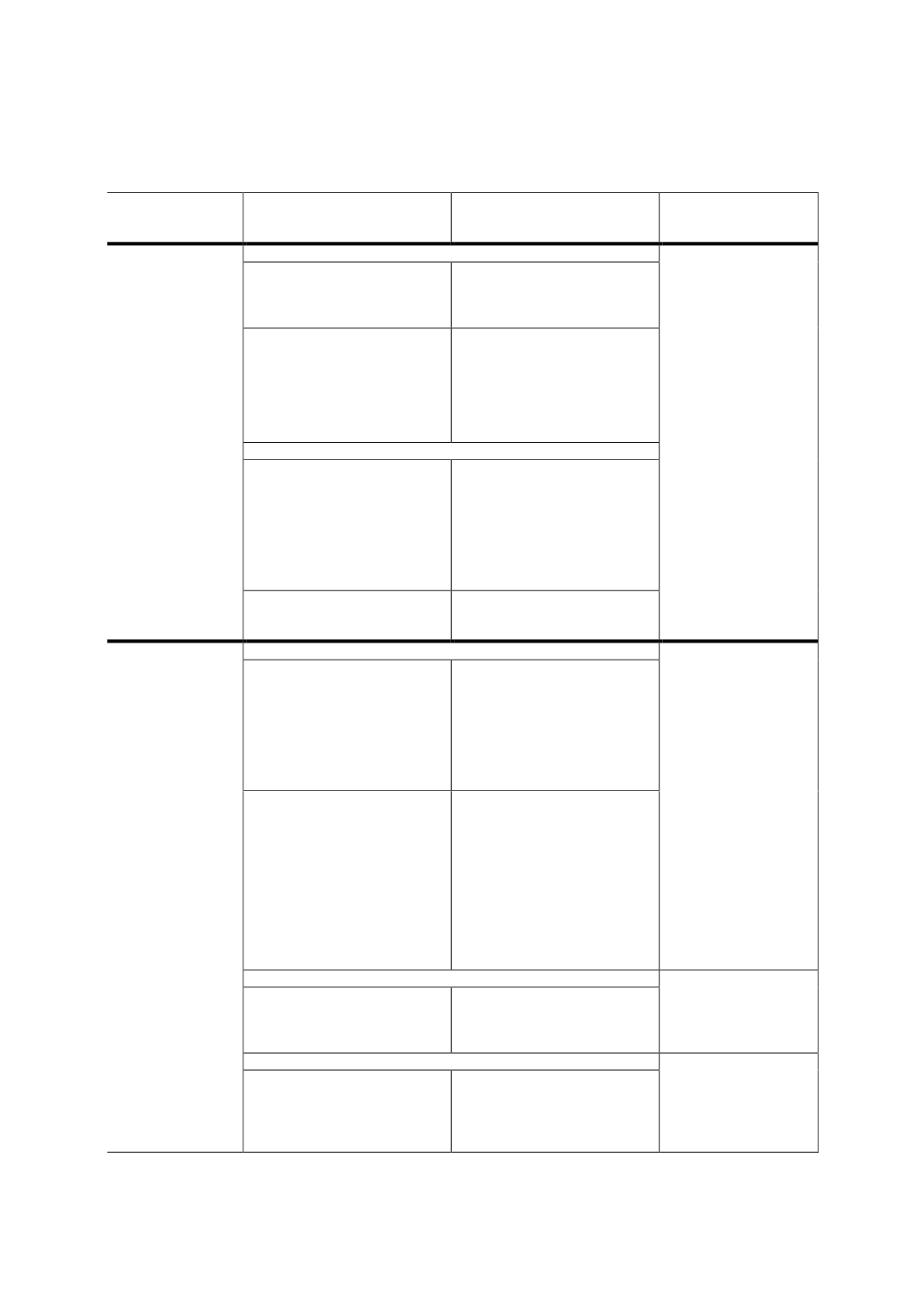

Table 5.2: Key Issues and Recommendations by Stage of Sukuk Market Development

Stage of sukuk

market

development

Issues and challenges

Key recommendations

Rationale

Matured

(example of OIC

countries includes

Malaysia)

Market and infrastructure development

To build a sukuk

market that champions

the UN’s SDGs, thereby

heightening its appeal

and positioning within

the mainstream

financial markets.

Shortage of short-term

investments for the

Islamic money market.

To deepen the Islamic

money market and improve

liquidity in secondary

trading.

Lack of innovative sukuk

structures that truly

adhere to the spirit of

maqasid al-Shariah,

which

emphasises substance and

legal form.

To increase issues that

embrace the VBI concept

and SRI, which looks at

elements of ESG.

Diversified market players on supply and demand sides

Lack of investors that can

strike a balance between

social responsibility and

profit maximisation.

To create greater

awareness among the

Islamic finance community

on impact investing, which

emphasises social

objectives without

compromising commercial

returns.

Lack of participation by

retail investors.

To increase awareness

among the public on

investment in retail sukuk.

Developing

(Advanced)

(examples of OIC

countries include

the UAE and Saudi

Arabia)

Legal and regulatory framework

To provide greater

certainty and

protection to sukuk

holders in the event of

defaults and/or

disputes.

Lack of a comprehensive

legal framework and

plagued by regulatory

uncertainties, especially in

civil law jurisdictions that

do not have a separate

trust law to facilitate

sukuk structuring.

To improve clarity on

investor protection and

enforcement of charge

over securities, to avoid

defaults and/or disputes

(e.g. Investment Dar and

Dana Gas).

Decentralised Shariah

governance has led to

more uncertainties and

ambiguities in Shariah

compliance, which adds to

complexity and negatively

affects both primary

issuance and secondary

trading of broader Islamic

capital-market

instruments.

To establish a centralized

Shariah authority to

oversee the

standardisation of legal

documentation, sukuk

structures and Shariah

rulings. This will create

more certainty among

investors, hence lifting

demand for sukuk.

Market and infrastructure development

To offer more

instruments so that

Islamic banks can

manage their liquidity.

Shallow Islamic money

market and dearth of

short-term instruments

for liquidity management

To issue short-term sukuk

or subscribe to IILM sukuk.

Diversified market players on supply and demand sides

To provide a

sustainable supply

of government and

corporate sukuk

with different

maturities, and

Lack of benchmark

sovereign sukuk issues by

federal and state

governments

To increase more

domestic issuance in

addition to international

issuance. Federal and

state governments should