154

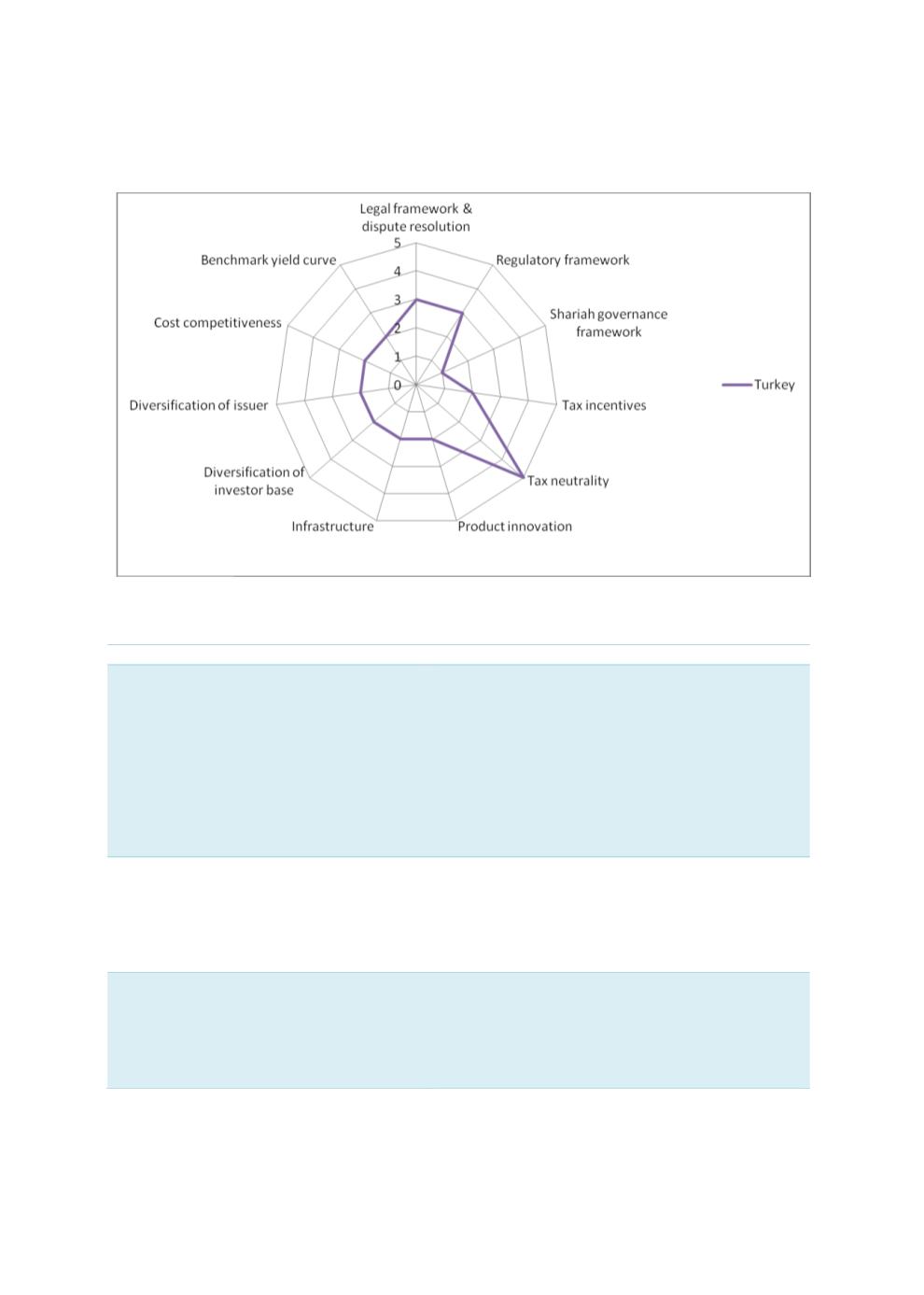

Chart 4.52: Factors Influencing the Development of Turkey’s Sukuk Market

Sources: RAM, ISRA

Table 4.25: Recommendations to Improve Demand (Buy Side) – Medium-Term Solutions

Issues and challenges

Demand (buy side) opportunities

Capital market intermediation remains

insignificant.

Macroeconomic instability (i.e. volatility of local

currency, high inflation rate) have led to households

investing their savings intangible assets (e.g. gold,

real estate) and FCY.

The Government plays a pertinent role in building

institutional funds. Concerted efforts should be

undertaken to develop wealth within the domestic

financial system, which will take time considering

the current market conditions.

Bonds issued have average maturities of

between 3 and 5 years.

Capital markets allow intermediation of long-term

funds to match the need for long-term financing.

Identifying suitable candidates from among SOEs or

GLCs to finance project-based sukuk can provide

the necessary benchmark yield curves to support

other corporate issues.

Retail investors prefer to invest in gold

and real estate.

Encourage the government, SOEs and corporates to

issue retail sukuk linked to infrastructure projects.

Establish new products to tap Turkey’s religious

funds (hajj fund, zakat, waqf) with financing linked

to direct financing of the government’s

infrastructure projects.