155

Issues and challenges

Demand (buy side) opportunities

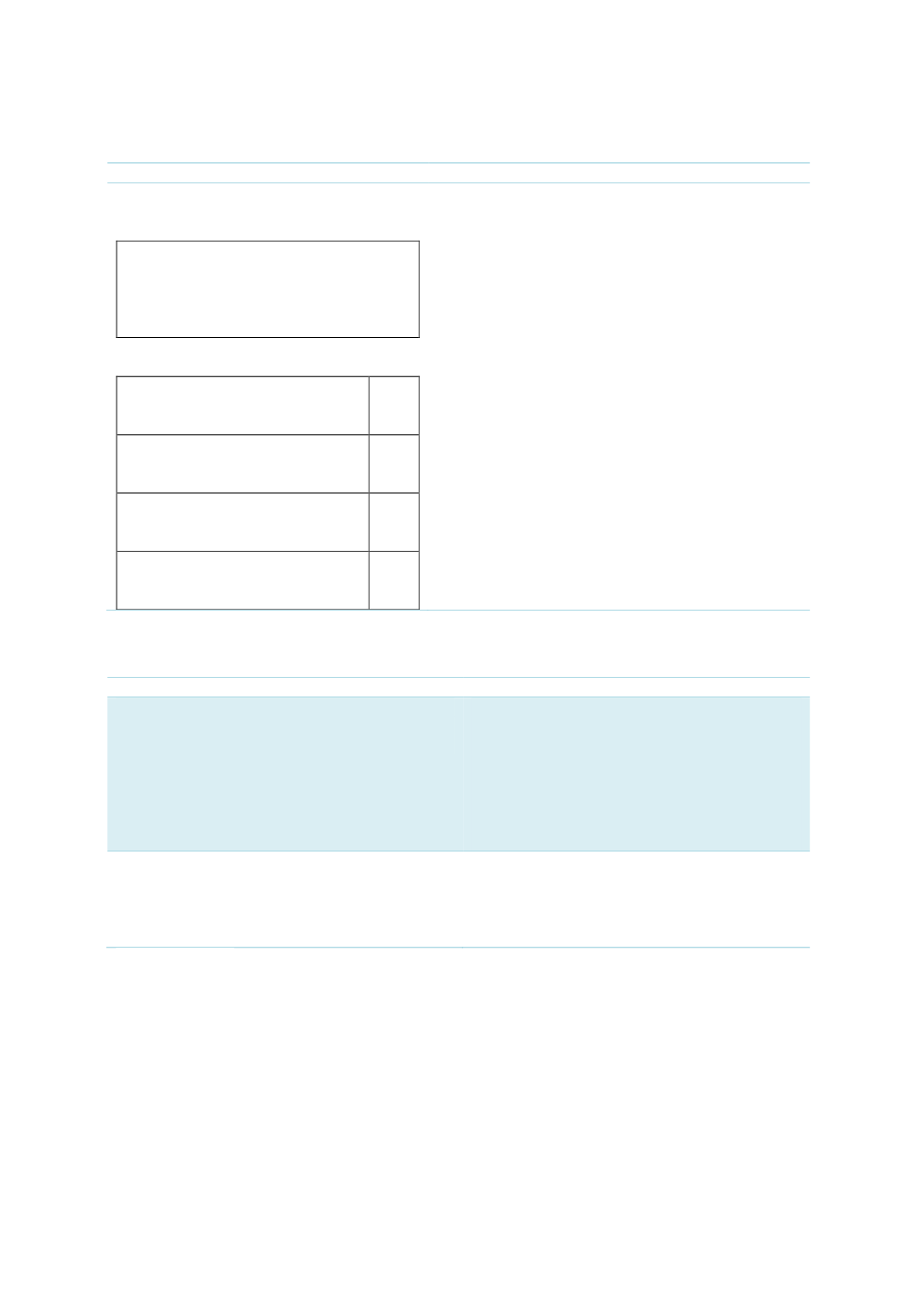

Withholding tax

LCY issuance

Revenues that real person resident and

non-resident taxpayers generate from

lease certificate trading and coupon

payments are subject to a withholding of

10% on income tax

FCY issuance

Earnings from offshore lease

certificate issued with a maturity

of one year

10%

Earnings from offshore lease

certificate issued with a maturity

of one and three years

7%

Earnings from offshore lease

certificate issued with a maturity

of three to five year

3%

Earnings from offshore lease

certificate issued with a maturity

of up to five year

0%

Under the Tax Amnesty Law 2011, ALCs are

exempted from value-added tax on transfers of

assets backing the lease certificates, stamp duty on

the conveyancing of assets, duties/fees arising from

title-deed transfers and corporate tax. This includes

the waiver of withholding tax for longer-dated debt

securities with maturities of not less than 5 years.

Removal of withholding taxes on lease certificates

will facilitate a greater flow of investments into

Turkey’s capital markets and improve

intermediation by NBFIs.

Sources: RAM, ISRA

Table 4.26: Recommendations to Improve Supply (Sell Side) – Medium-Term Solutions

Issues and challenges

Supply (sell side) opportunities

The dearth of investment instruments for

participation banks’ liquidity management

has resulted in an uneven playing field.

Growing demand from participation banks can

be met by public and corporate issuances.

Efforts should be made to promote SOEs, GLCs

and blue-chip corporates. Specific focus on

utilities-backed companies (e.g.

telecommunication, electricity, water, power)

or corporates with infrastructure projects (e.g.

municipality company).

Limitations and/or restrictions on the

capital markets.

Revision of regulations to allow:

Multinationals operating in Turkey to issue TL

bonds. Issuance of FCY bonds in the domestic

bond market since Turkish financial

institutions are allowed to lend in FCY.

Sources: RAM, ISRA