114

4.4

INDONESIA

4.4.1 OVERVIEW OF INDONESIA’S CAPITAL MARKETS

Since the early 1990s, through reformation led by the government of Indonesia, the country’s

capital markets have developed tremendously, albeit with periods of significant volatility

during the Asian financial crisis and the GFC. Nevertheless, the capital markets in Indonesia are

smaller and less liquid relative to its ASEAN neighbours and other emerging markets. The

government, Bank Indonesia (BI) and corporates have issued a variety of debt securities, both

conventional and sukuk, as well as asset-backed securities in the domestic and international

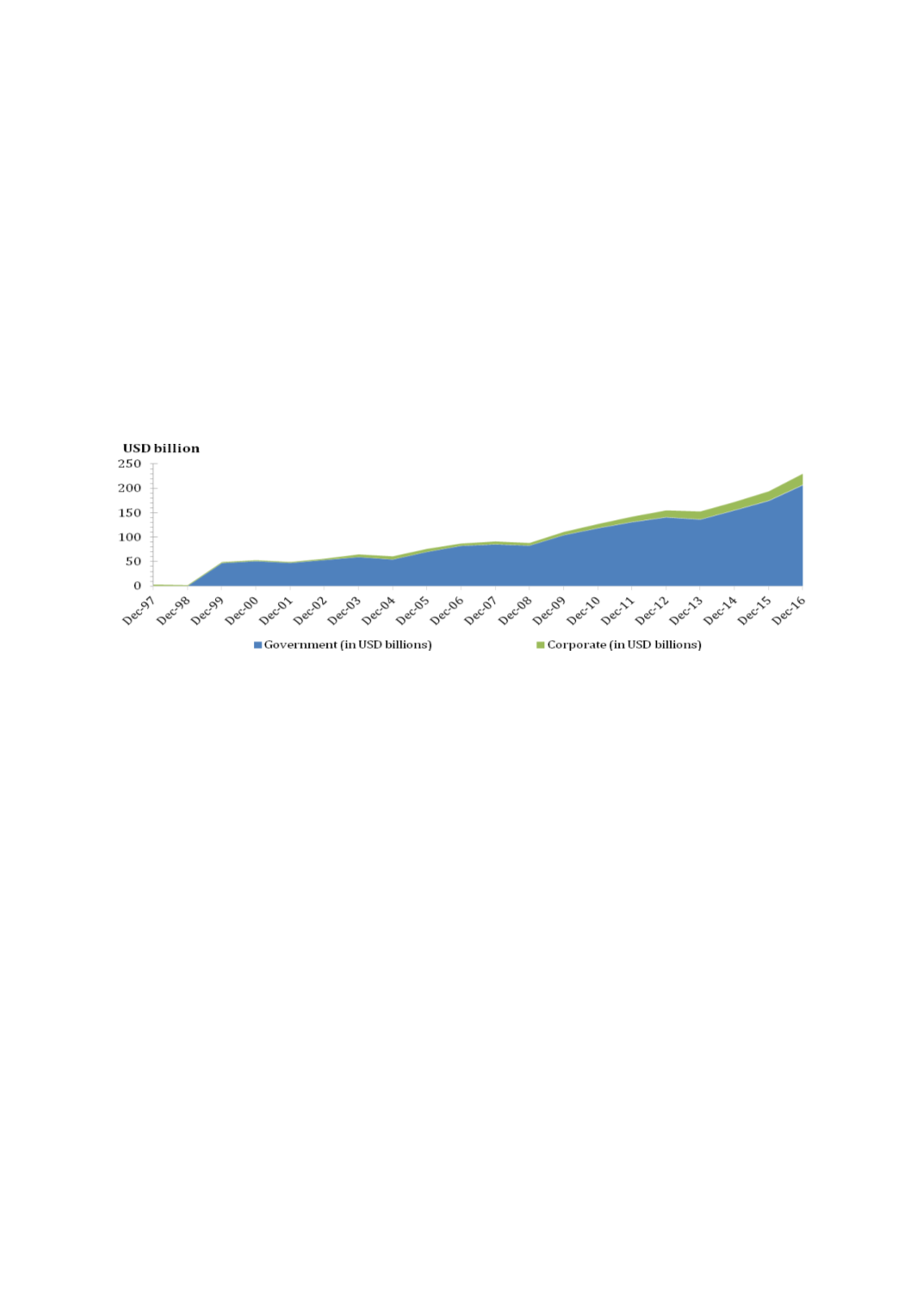

markets. Chart 4.30 depicts the Indonesia’s outstanding LCY bond market from 1997 to 2016.

Chart 4.30: Size of Indonesia’s Outstanding LCY Bond Market in USD (1997-2016)

Sources: Asian Bond Online, Bloomberg

Note: Data indicates the LCY amount equivalent to USD billion.

As at end-June 2017, Indonesia’s outstanding bonds stood at USD250.0 billion, of which 90.6%

comprised government debt securities while the balance originated from the corporate sector.

The crowding out of sovereign issues in the local bond market has had some effect on the

development of corporate bonds. Facilitative guidelines and tax incentives focused on the

development of sovereign bond/sukuk transactions over the last decade (e.g. approval of the

Islamic Shariah debt bill in April 2008 to allow sovereign sukuk issuance, and the removal of

withholding tax on global sovereign bonds) have further constrained the growth of corporate

debt securities. Box 4.6 explains the development of Indonesia’s domestic bond market vis-à-

vis the size of other selected Asian debt markets as at end-2016.