94

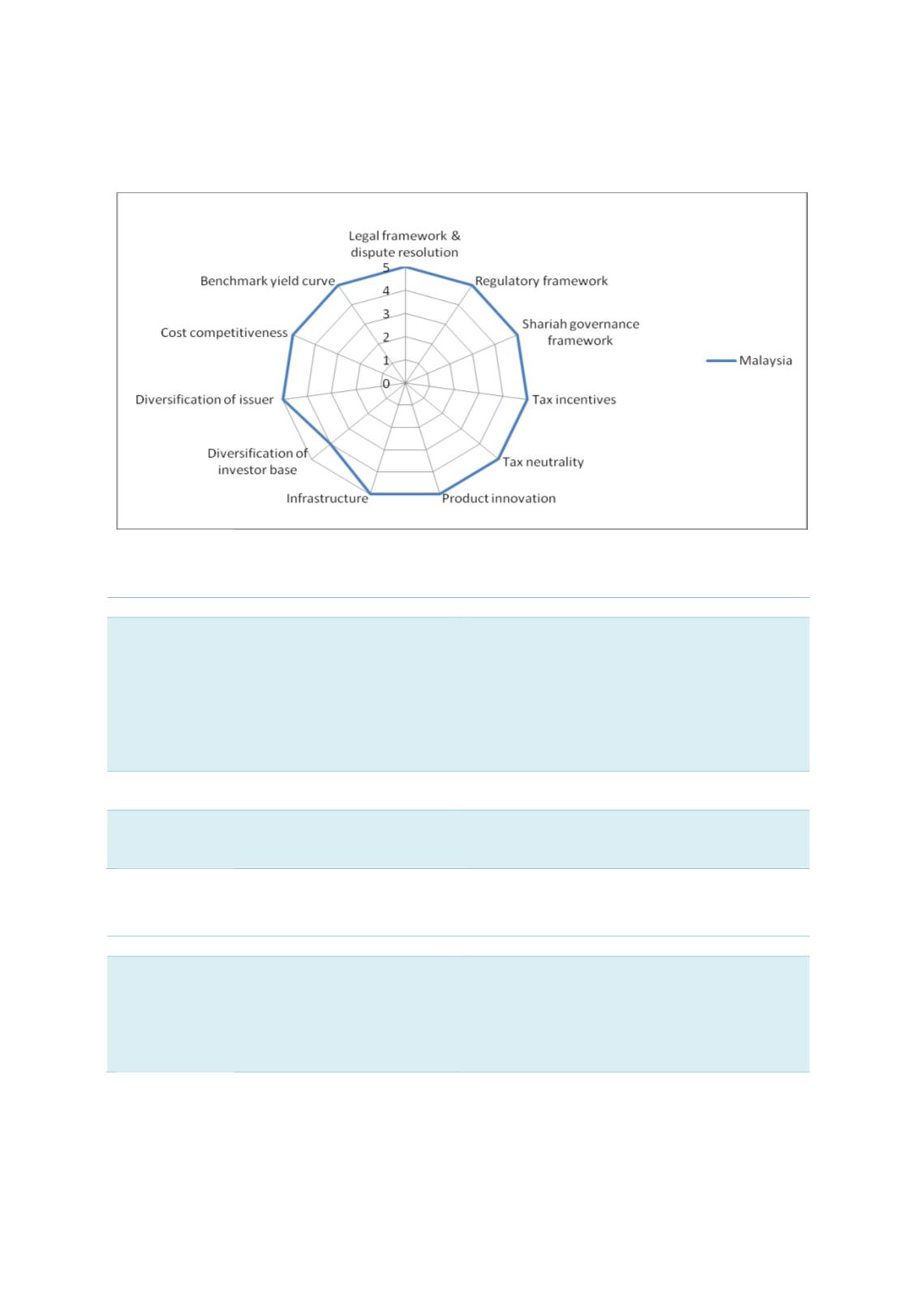

Chart 4.14: Factors Influencing the Development of Malaysia’s Sukuk Market

Sources: RAM, ISRA

Table 4.6: Recommendations to Improve Demand (Buy Side) – Medium-Term Solutions

Issues and challenges

Demand (buy side) opportunities

Greater awareness of impact investing (e.g.

achieving social objectives without

compromising commercial returns) is

required.

SRI is a USD60.0 trillion industry that is still

expanding. The common shared values

between sukuk and SRI can foster greater

linkages between Islamic finance and

conventional SRI investors. Ongoing efforts by

the Islamic finance community to build

awareness and promote a shift in mindset to

consider social impact objectives.

Lack of participation by retail investors

despite a few retail issues under GLCs.

Increase awareness among members of the

public to invest in retail sukuk.

Shortage of liquidity-management

instruments for Islamic banks.

Develop new products or promote innovation

to enable Islamic banks to compete effectively

against their conventional counterparts.

Sources: RAM, ISRA

Table 4.7: Recommendations to Improve Demand (Sell Side) – Medium-Term Solutions

Issues and challenges

Supply (sell side) Opportunities

Strengthen value-based intermediation

(VBI) – In July 2017, BNM released

guidelines on Value-based Intermediation:

Strengthening the Roles and Impact of

Islamic Finance

VBI has been identified as the next market

mover for Islamic finance. Similar initiatives

(e.g. peer-to-peer crowd funding) devoted to

achieving social justice will heighten Malaysia’s

appeal in light of the United Nations’

Sustainable Development Goals (SDGs).

Sources: RAM, ISRA