89

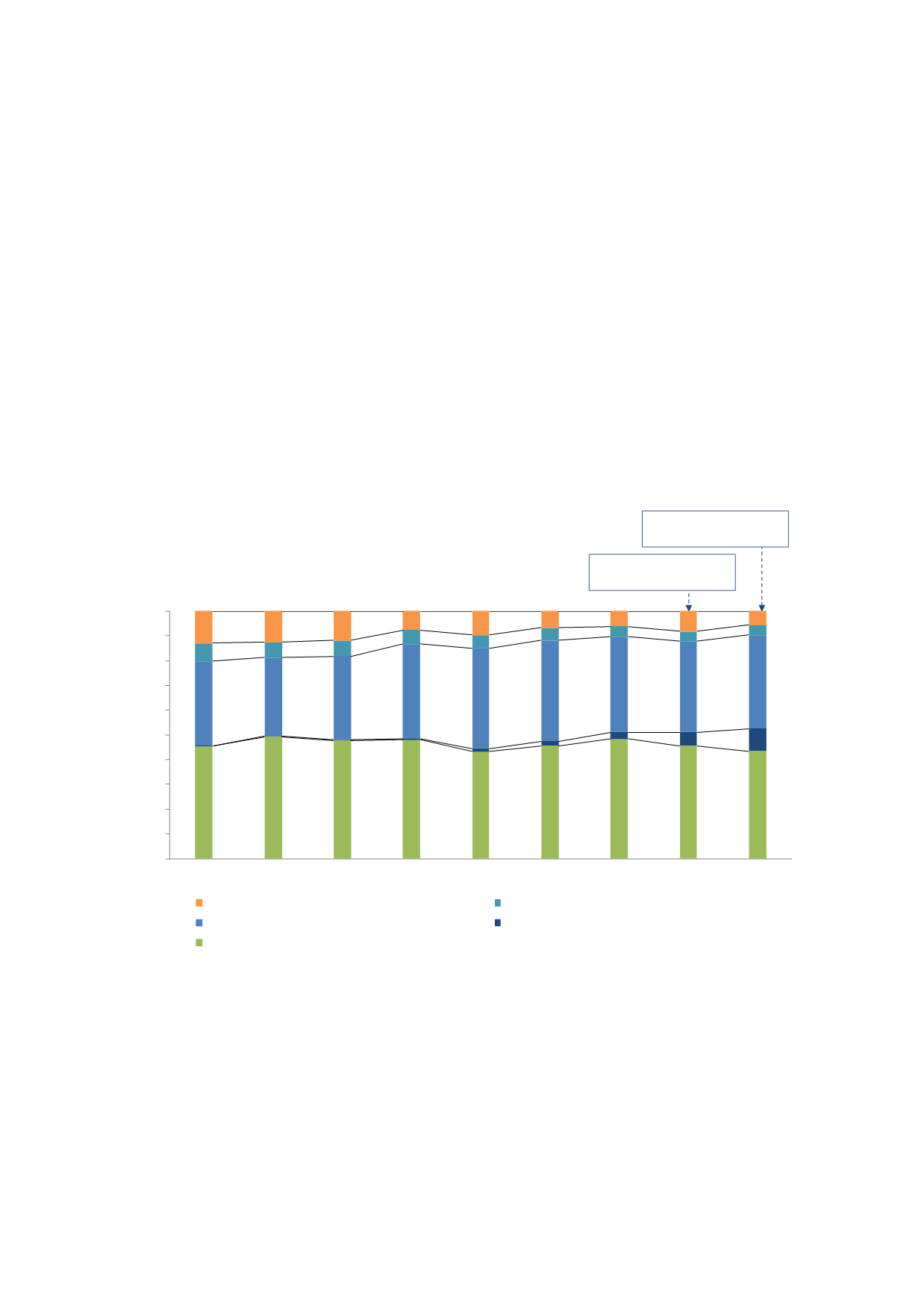

Since the GoM’s inaugural GII issuance in July 1983, the paper has been predominantly held by

domestic investors. As at end-June 2017, approximately 43% of GII was held by banking and

development financial institutions, 38% by institutional funds and another 9% by foreign

investors (refer to Chart 4.11).

As at end-2016, the bulk of MGS issues were held by foreign investors (47%), followed by

institutional investors (22%) and banking and development financial institutions (17%) (refer

to Chart 4.12). Since credit is agnostic as to whether it is Islamic or conventional, the disparity

between holders of GII and MGS points to foreign investors’ familiarity with conventional

documentation for MGS. In the last 2 years, the visibility arising from the incorporation of

Malaysia’s GII into the Barclays Global Aggregate Index in March 2015 and the inclusion of the

USD-denominated Malaysian sukuk in the EMBI Global Diversified Index in October 2016 have

helped enhance the marketability of the GoM’s Islamic debt securities to foreign investors. In

hindsight, the GoM should have included GII in recognised indexes much earlier, to promote its

marketability among international investors.

Chart 4.11: GII Issued Domestically – Classification by Holder (2008-2016)

2015– IncorporationofGII into

Barclay’s Global AggregateIndex

43

%

38

%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2008

2009

2010

2011

2012

2013

2014

2015

2016

Other

Insurance companies

Employees Provident Fund + KWAP

Foreign holders

Banking institutions + Development financial institutions

2015– IncorporationofGII into

Barclay’s Global AggregateIndex

9

%

Source: BNM