90

Chart 4.12: MGS Issued Domestically – Classification by Holder (2008-2016)

17

%

22

%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2008

2009

2010

2011

2012

2013

2014

2015

2016

Other

Insurance companies

Employees Provident Fund + KWAP

Foreign holders

Banking institutions + Development financial institutions

47

%

Source: BNM

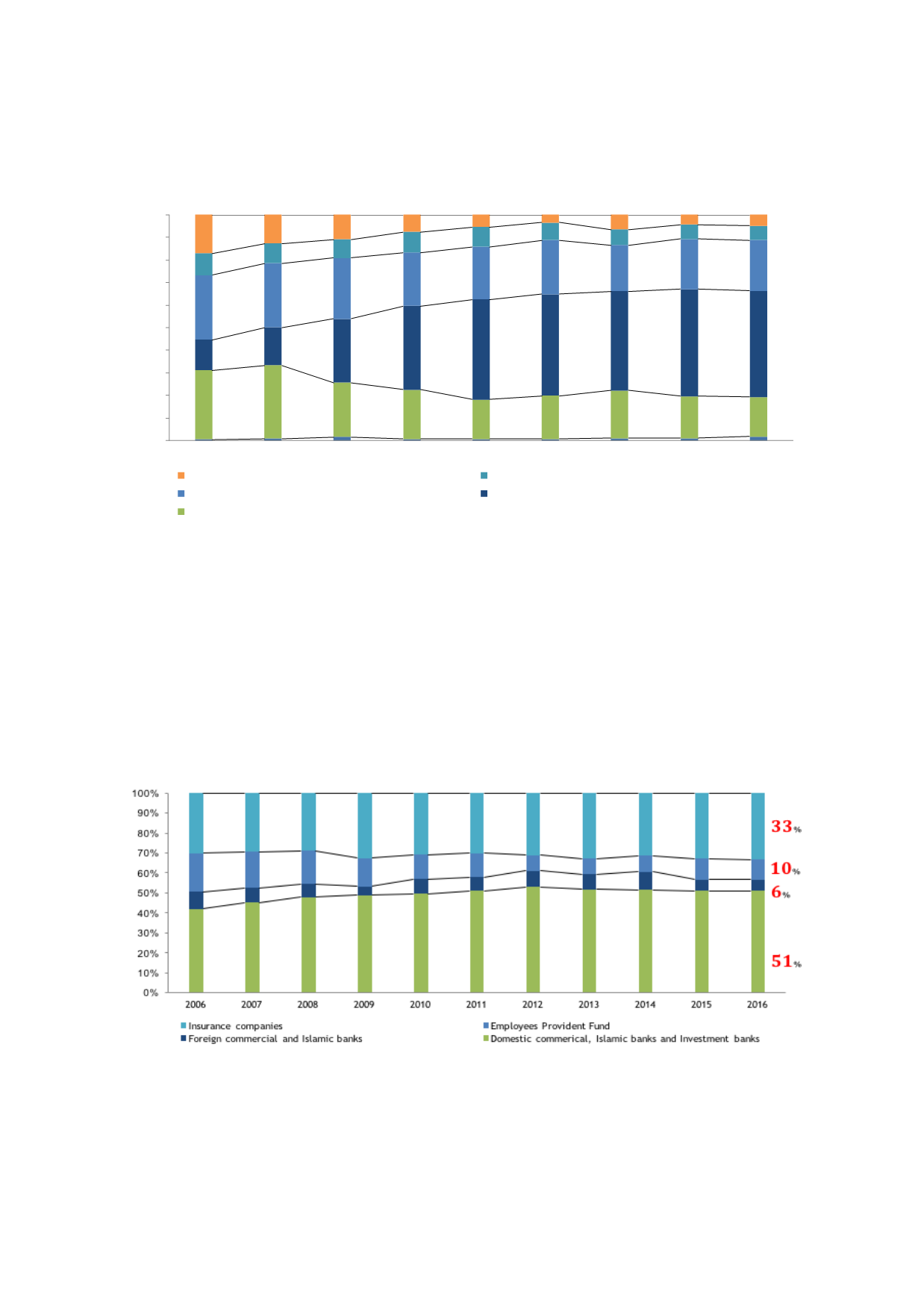

As at end-2016, the investor base for LCY corporate bonds (i.e. Islamic and conventional

bonds) is dominated by local investors, mainly domestic commercial banks, Islamic banks and

investment banks (51%), insurance companies (33%) and the EPF (10%), with foreign

investors making up another 6% (refer to Chart 4.13). Since the liquidity of Malaysia’s

domestic corporate bond market is significantly derived from local institutions, this provides

some cushion against external shocks and, in turn, accords some degree of stability to the

performance of Malaysia’s bond market. Nevertheless, it remains susceptible to volatility

stemming from global developments.

Chart 4.13: Investor Profile of Malaysia’s LCY Corporate Bonds

Sources: BNM, EPF